Lennar Corp (LEN) Reports Robust First Quarter 2024 Earnings with Significant Gains in Net ...

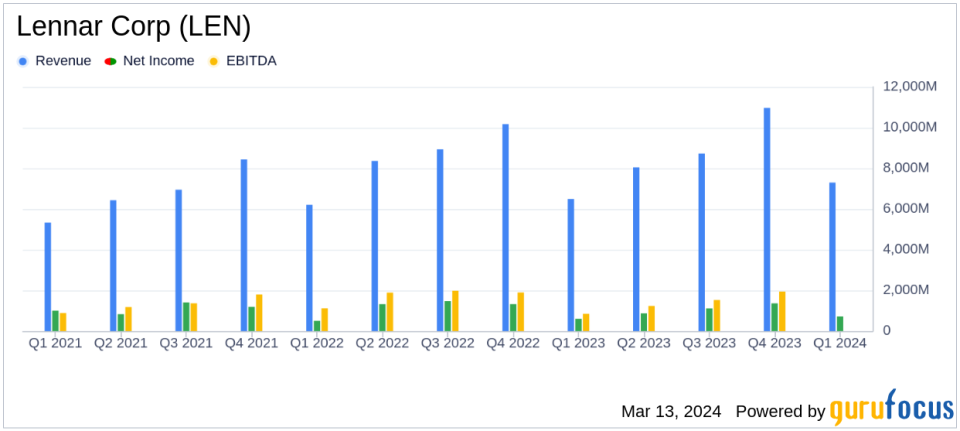

Net Earnings: Increased by 21% to $719 million.

Earnings Per Share: Rose 25% to $2.57 per diluted share.

New Orders: Jumped 28% to 18,176 homes.

Deliveries: Grew by 23% to 16,798 homes.

Total Revenues: Increased by 13% to $7.3 billion.

Gross Margin on Home Sales: Improved to 21.8%.

Balance Sheet Strength: Homebuilding cash and cash equivalents of $5.0 billion, with no outstanding borrowings.

Lennar Corp (NYSE:LEN), the second-largest public homebuilder in the United States, released its 8-K filing on March 13, 2024, detailing a strong performance for the first quarter of 2024. The company, known for its targeted homebuilding operations and financial services, reported a substantial increase in net earnings and earnings per share, alongside a significant rise in new orders and home deliveries. Lennar's financial-services segment continues to support its homebuyers with mortgage financing and related services, while its multifamily construction and investment in housing-related technology startups remain integral components of its diversified business model.

Performance Highlights and Strategic Focus

Lennar's impressive earnings growth is a testament to its strategic focus on maintaining a consistent production pace, which has driven a robust sales pace. Despite challenges posed by fluctuating interest rates and affordability concerns, Lennar's dynamic pricing and incentive strategies have effectively stimulated demand, as evidenced by a 28% increase in new orders and a 23% increase in deliveries year over year.

Executive Chairman and Co-Chief Executive Officer Stuart Miller highlighted the company's ability to navigate a complex macroeconomic environment, marked by strong employment, a chronic shortage of housing supply, and robust demand driven by household formation. Lennar's operational strategy prioritized production and sales pace over price, contributing to market share growth and a solid gross margin improvement to 21.8%.

"We are pleased to report another strong quarter as we remained focused on consistent production pace driving sales pace, while using pricing, incentives, marketing spend, and margin informed by dynamic pricing to enable consistent sales volume in a fluctuating interest rate environment," said Stuart Miller.

Financial Achievements and Capital Allocation

Lennar's financial achievements in the first quarter of 2024 underscore the importance of prudent capital allocation and balance sheet management in the homebuilding industry. The company's repurchase of $506 million of common stock and the bolstering of its stock repurchase program by an additional $5.0 billion reflect confidence in its financial health. Moreover, the increase in the annual dividend from $1.50 per share to $2.00 per share rewards shareholders and signals the company's strong cash flow position.

With homebuilding debt to total capital at 9.6%, and significant liquidity, Lennar's balance sheet remains robust. The company's "land light" strategy has led to a year's supply of owned homesites of 1.3 years and controlled homesites of 77%, positioning Lennar for sustained execution and growth.

Outlook and Forward Guidance

Looking ahead to the second quarter of 2024, Lennar expects to deliver between 19,000 and 19,500 homes with a gross margin of approximately 22.5%. The company remains focused on delivering 80,000 homes for the full year, with a margin consistent with the previous year's. Lennar's strategic initiatives and strong balance sheet are poised to drive continued cash flow and higher returns, even amidst the complexities of an election year.

For investors and potential GuruFocus.com members, Lennar Corp's (NYSE:LEN) latest earnings report reflects a company that is effectively navigating market challenges and leveraging its operational strengths to deliver value. The company's focus on maintaining a robust balance sheet, coupled with strategic capital allocation, positions it well for continued success in the homebuilding and construction industry.

For a more detailed analysis of Lennar Corp's (NYSE:LEN) financials and strategic outlook, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Lennar Corp for further details.

This article first appeared on GuruFocus.