Lennox International Inc. Reports Record Earnings, Boosts Long-Term Targets

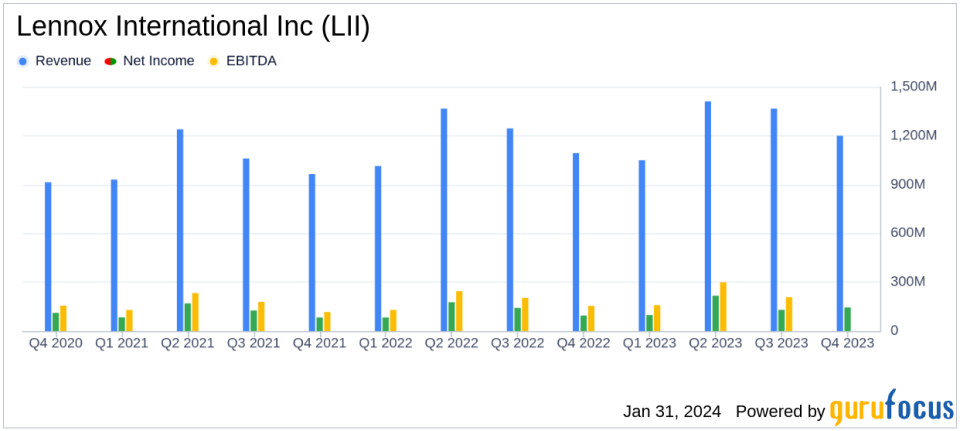

Revenue Growth: Q4 revenue increased by 6% to $1.2 billion, with full-year revenue also up 6% to $5 billion.

Earnings Per Share: GAAP diluted EPS surged 52% to $4.04 in Q4, with full-year EPS up 19% to $16.54.

Operating Cash Flow: Q4 operating cash flow climbed 132% to $306 million, contributing to a 144% increase for the full year to $736 million.

Adjusted Diluted EPS: Q4 adjusted diluted EPS rose 41% to $3.63, with a 27% increase to $17.96 for the full year.

2024 Guidance: Lennox International projects a 7% increase in core revenue and an adjusted EPS range of $18.50 to $20.00.

On January 31, 2024, Lennox International Inc (NYSE:LII), a leader in energy-efficient climate-control solutions, released its 8-K filing, announcing record fourth quarter and full-year results for 2023. The Texas-based company, which specializes in heating, ventilating, air conditioning, and refrigeration products, has shown remarkable financial resilience and growth, particularly in its core markets in North America.

Financial Performance and Challenges

Lennox International's financial performance in Q4 and throughout 2023 has been impressive, with significant increases in revenue, operating income, and earnings per share. The company's strategic focus on pricing excellence and supply chain resiliency has paid off, leading to a robust increase in operating cash flow. Despite facing challenges in the residential end-markets and navigating through inventory destocking in the distribution channels, Lennox has managed to achieve growth through disciplined execution and a favorable mix of higher-efficiency products.

CEO Alok Maskara commented on the company's strategic execution, stating,

In 2023, relentless execution of our Lennox transformation strategy yielded significant financial successes even as we navigated challenging residential end-markets."

This approach has been pivotal in overcoming market uncertainties and positions the company well for continued success in 2024.

Segment Performance

The Home Comfort Solutions segment saw a modest revenue growth of 1%, while the Building Climate Solutions segment experienced a remarkable 19% increase, driven by pricing and volume gains. The divestiture of European operations late in the quarter has allowed the company to streamline its focus on its core markets.

Lennox's financial achievements are particularly noteworthy in the context of the construction industry, where efficient production and supply chain management are critical for maintaining profitability and competitiveness. The company's ability to improve factory output and adapt to regulatory changes while maintaining strong margins is a testament to its operational excellence.

Key Financial Metrics

Important metrics from Lennox's financial statements include a 41% increase in operating income to $185 million for Q4, with a 400 basis point improvement in operating profit margin to 16%. Adjusted segment profit rose 34% to $175 million, with a 320 basis point increase in adjusted segment profit margin to 15.9%. Net income for Q4 was $145 million, translating to $4.04 per share, a significant increase from the prior year's $94 million, or $2.65 per share.

For the full year, net income reached $590 million, or $16.54 per share, up from $497 million, or $13.88 per share, in the previous year. The company's balance sheet remains strong, with total assets of $2.8 billion as of December 31, 2023, and a healthy cash flow that supports strategic investments and shareholder returns.

Looking Ahead

Lennox International's performance in 2023 sets a positive tone for its 2024 outlook. The company anticipates core revenue to increase by approximately 7%, with adjusted earnings per share expected to be in the range of $18.50 to $20.00. Capital expenditures are projected to be around $175 million, and free cash flow is estimated to be between $500 million to $600 million.

Lennox's strategic focus on innovation, energy efficiency, and market leadership in climate-control solutions continues to drive its financial success. With a clear vision for the future and a commitment to operational excellence, Lennox International Inc (NYSE:LII) is well-positioned to navigate the challenges and opportunities that lie ahead.

Explore the complete 8-K earnings release (here) from Lennox International Inc for further details.

This article first appeared on GuruFocus.