Lenovo Jumps After Top Global PC Maker Arrests Sales Declines

(Bloomberg) -- Lenovo Group Ltd.’s shares gained more than 3% after the world’s largest PC maker reported a return to growth, reflecting a gradual pickup in demand after a prolonged slump.

Most Read from Bloomberg

BYD’s New $233,450 EV Supercar to Rival Ferrari, Lamborghini

Stock Rally Stalls at Start of Data-Packed Week: Markets Wrap

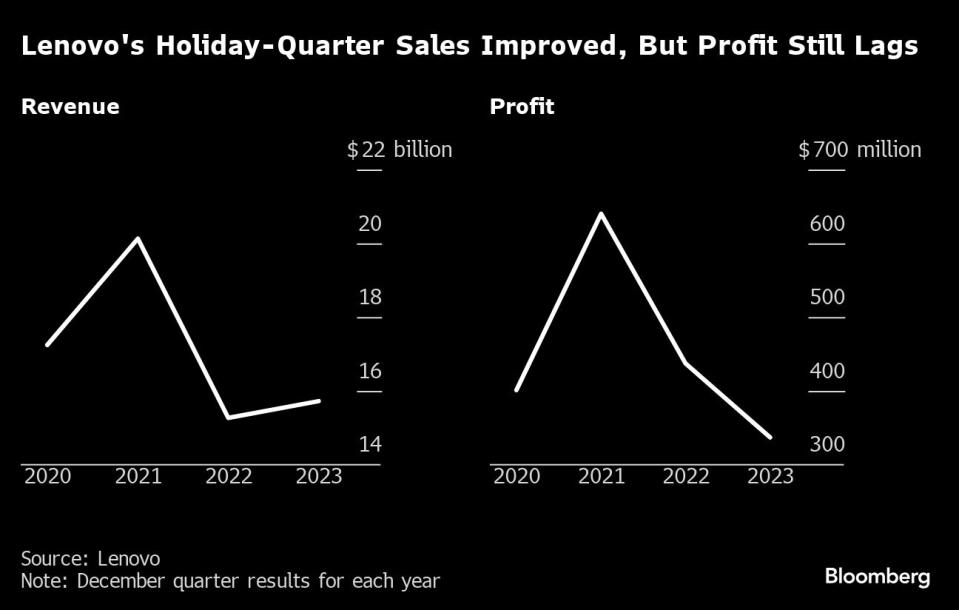

It reported a better-than-projected 3% rise in revenue to $15.7 billion, the first quarterly sales growth for Lenovo since late 2022, when Covid-era demand evaporated. Net income slid a less-than-expected 23% to $337 million in the three months ended December.

The results show PC demand, while coming back only slowly, is returning to a more positive trajectory, Chief Executive Officer Yang Yuanqing told Bloomberg News. The business should improve, though a migration away from traditional servers toward higher-end setups for training and developing AI may pressure profitability in the short term, Yang said in an interview.

Lenovo is betting on artificial intelligence to propel hardware sales this year. Its executives have been bullish about the prospects for AI-empowered devices and the company is slated to introduce products with such functions. Roughly 170 million so-called AI phones will be produced worldwide this year, almost 15% of total shipments, IDC estimates.

But Lenovo’s Infrastructure Solutions Group, which sells servers and yields about 15% of sales, is scrambling to buy Nvidia Corp. graphics processors to build AI-training farms, which are in hot demand.

“Very unfortunately we don’t have enough supply on GPU-based servers. That impacted on not just our revenue but also profitability,” the CEO said.

Lenovo’s shares have slid more than 20% this year after hitting a two-year-high in late 2023, tracking market routs in Hong Kong and mainland China.

Roughly 75% of Lenovo’s sales come from the Intelligent Devices Group — a unit that sells electronics from PCs to smartphones — while the server and services units contribute the rest.

It grew PC shipments about 3.9% in the December quarter, maintaining its lead over long-time rivals HP Inc. and Dell Technologies Inc., according to IDC. The Beijing-based company managed to grow market share even as overall PC shipments dipped 2.7%, suggesting a full recovery was a ways off.

A rebound in the hardware business and more sales of higher-margin services should help Lenovo improve its profitability, Bloomberg Intelligence analyst Steven Tseng wrote in a note ahead of the results.

“Strong adoption of ‘as-a-service’ offerings and robust growth of customized solutions for select sectors should support a double-digit increase in its services revenue over the next two to three years,” he wrote.

Read More: Nvidia Surges After AI Boom Shows No Signs of Letting Up

(Updates with share price reaction)

Most Read from Bloomberg Businessweek

Elon Musk’s Vegas Tunnel Project Has Been Racking Up Safety Violations

Can the Masters of Hipster Cringe Conquer Hollywood With Wall Street Cash?

How Capital One’s $35 Billion Discover Merger Could Affect Consumers

©2024 Bloomberg L.P.