Leon Cooperman Leans Out Ocwen Financial Holding

- By Graham Griffin

Leon Cooperman (Trades, Portfolio), founder of Omega Advisors, has revealed a reduction in his Ocwen Financial Corp. (NYSE:OCN) position according to GuruFocus' Real-Time Picks, a Premium feature.

Cooperman, who now heads a family office, combines his macro view and fundamental valuation in his investing strategy. He does try to predict the market direction, but pays close attention to valuations, too.

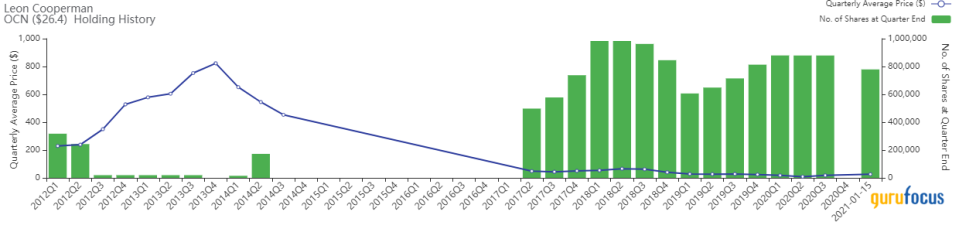

On Jan. 15, Cooperman sold 100,000 shares of Ocwen Financial to reduce the holding by 11.38%. On the day of the sale, the shares traded at an average price of $26.28. Overall, the sale had an impact of -0.26% on the equity portfolio and GuruFocus estimates Cooperman's total gain on the holding at 1.10%.

Ocwen Financial (NYSE:OCN) is a financial service company that services and originates loans. Its business segment includes servicing and lending. The servicing segment provides residential and commercial mortgage loan servicing, special servicing and asset management services. The lending segment originates and purchases conventional and government-insured residential forward and reverse mortgage loans. This is done mainly through correspondent lending arrangements, broker relationships and directly with mortgage customers. The company generates a majority of its revenue from the servicing segment. Geographically, it generates a majority of its revenue from the United States.

On Jan. 22, the stock was trading at $26.40 per share with a market cap of $229.26 million. The stock is trading at fair value according to the GF Value Line.

GuruFocus gives the company a financial strength rating of 2 out of 10, a profitability rank of 5 out of 10 and a valuation rank of 7 out of 10. There are currently five severe warning signs issued, including declining revenue per share, new long-term debt and an Altman Z-Score of 0.2 placing the company well into the distress column. Debt has risen steadily while cash flows have tapered off since 2014.

Cooperman is the second-largest shareholder with 8.98% of shares outstanding. Other top shareholders include Deer Park Road Corp. (Trades, Portfolio), Fortress Investment Group LLC (Trades, Portfolio), Vanguard Group Inc. (Trades, Portfolio) and Bank of America Corp. /DE/ (Trades, Portfolio).

Portfolio overview

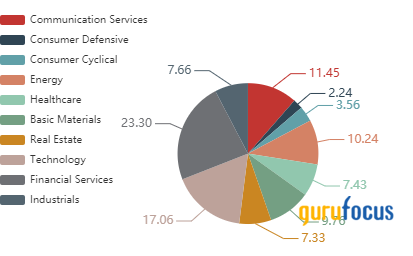

At the end of the third quarter, Cooperman's portfolio contained 41 stocks, with seven new holdings. It was valued at $1.02 billion and has seen a turnover rate of 21%. Top holdings at the end of the quarter included Fiserv Inc. (NASDAQ:FISV), Mr. Cooper Group Inc. (NASDAQ:COOP), Alphabet Inc. (NASDAQ:GOOGL), Cigna Corp. (NYSE:CI) and Trinity Industries Inc. (NYSE:TRN).

By weight, the top three sectors represented were financial services (23.30%), technology (17.06%) and communication services (11.45%).

Disclosure: Author owns no stocks mentioned.

Read more here:

United Airlines Suffering Losses Through the 4th Quarter

Value Investing Live Recap: Matthew McLennan

Goldman Sachs Boasts Strong Earnings for the 4th Quarter

Not a Premium Member of GuruFocus? Sign up for a free 7-day trial here.

This article first appeared on GuruFocus.