Leonardo DRS Inc (DRS) Reports Record Backlog and Solid Revenue Growth in Q4 and Full Year 2023

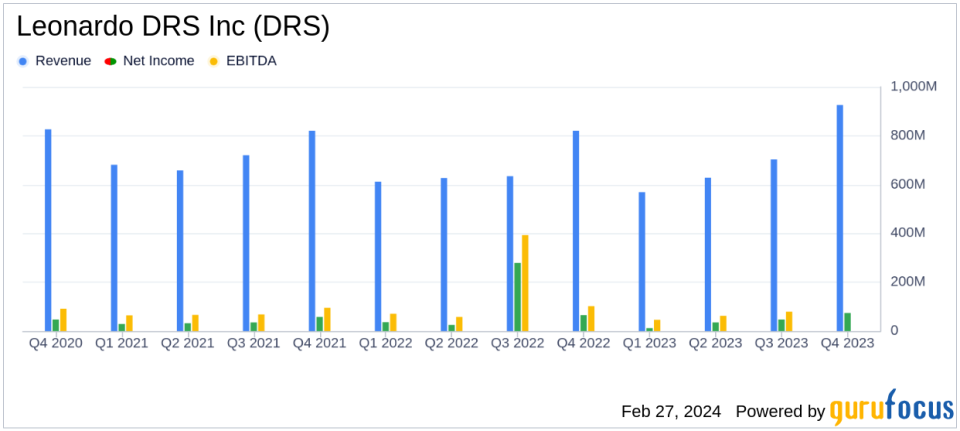

Revenue: $926 million in Q4, a 13% increase; $2.8 billion for the full year, up 5%.

Net Earnings: $74 million in Q4, rising 14%; $168 million for the full year, down 59% due to one-time gains in 2022.

Adjusted EBITDA: $131 million in Q4, up 9%; $324 million for the full year, a 2% increase.

Diluted EPS: $0.28 for Q4; $0.64 for the full year, impacted by increased share count.

Bookings and Backlog: $1.0 billion in Q4 bookings; record backlog of $7.8 billion, an 82% increase.

Capital Investment: Initiates a $120 million investment for a new naval propulsion facility in South Carolina.

2024 Guidance: Revenue projected between $2.925 billion and $3.025 billion; Adjusted EBITDA between $365 million and $390 million.

On February 27, 2024, Leonardo DRS Inc (NASDAQ:DRS), a leading provider of advanced defense technologies, released its 8-K filing, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, which delivers a wide range of defense systems and solutions to military, aerospace, and government customers, announced a significant increase in its backlog and solid revenue growth, underscoring the strong demand for its products and services.

Financial Performance and Challenges

Leonardo DRS Inc (NASDAQ:DRS) reported a 13% increase in fourth-quarter revenue to $926 million, driven by contributions from multi-mission advanced sensing and naval and ground network computing programs. Full-year revenue saw a 5% increase to $2.8 billion, despite divestiture headwinds. The company's net earnings for the fourth quarter grew by 14% to $74 million, while the full-year net earnings decreased by 59% to $168 million, primarily due to a one-time net gain in 2022 related to divestitures.

The company's adjusted EBITDA for the fourth quarter was $131 million, a 9% increase, with a slight contraction in adjusted EBITDA margin due to higher general and administrative expenses and investments in research and development. Full-year adjusted EBITDA grew by 2% to $324 million, despite inflationary impacts and increased expenses.

Leonardo DRS Inc (NASDAQ:DRS) faced challenges including a higher tax burden and increased interest expenses, which affected adjusted net earnings growth. The company's diluted EPS and adjusted diluted EPS were impacted by the increased share count resulting from the all-stock merger with RADA.

Financial Achievements and Importance

The company's financial achievements, particularly the record backlog of $7.8 billion, up 82% from the previous year, highlight the enduring demand for Leonardo DRS Inc (NASDAQ:DRS)'s defense technologies. This backlog provides visibility into future revenues and underscores the company's strong market position in the Aerospace & Defense industry. The solid bookings of $1.0 billion in the fourth quarter and $3.5 billion for the year, with a book-to-bill ratio of 1.2, demonstrate the company's ability to secure new business and grow its order book.

Leonardo DRS Inc (NASDAQ:DRS) also announced the commencement of a significant capital investment, allocating approximately $120 million to build a state-of-the-art naval propulsion manufacturing and test facility. This investment reflects the company's commitment to maintaining its competitive edge and expanding its manufacturing capabilities.

Key Financial Metrics and Commentary

Leonardo DRS Inc (NASDAQ:DRS)'s CEO, Bill Lynn, commented on the company's performance, stating:

"We delivered solid 2023 financial results, which continue to demonstrate the strength of our portfolio and the clear customer demand for our technologies. I am incredibly proud of the tremendous effort from the entire team to execute for our customers, drive innovation and deliver excellent financial performance for shareholders. In 2024, we are maintaining steadfast focus on increasing long-term shareholder value by delivering consistent revenue growth, margin expansion and solid free cash generation."

The company's strong operating performance and cash generation capabilities were evident in the net cash flow from operating activities, which amounted to $515 million for the fourth quarter and $205 million for the full year. The exceptional free cash flow in the fourth quarter was $494 million, and the full year free cash flow was $159 million.

With $467 million of cash and $214 million of outstanding borrowings at year-end, Leonardo DRS Inc (NASDAQ:DRS) maintains a healthy balance sheet, providing financial flexibility to support growth and shareholder value creation.

2024 Outlook and Investor Engagement

Looking ahead, Leonardo DRS Inc (NASDAQ:DRS) has initiated guidance for 2024, projecting revenue between $2.925 billion and $3.025 billion, and adjusted EBITDA between $365 million and $390 million. The company expects the new facility investment to increase capital expenditures for 2024 and reduce free cash flow conversion of adjusted net earnings to approximately 80% for the year.

The company also confirmed its Investor Day on March 14, 2024, at the Nasdaq MarketSite in New York City, where management will discuss the company's portfolio, strategic priorities, and growth outlook.

Leonardo DRS Inc (NASDAQ:DRS) continues to navigate the complex defense market with agility and innovation, positioning itself for sustained growth and value creation for its shareholders. The company's full financial statements and additional details can be found in its 8-K filing.

Explore the complete 8-K earnings release (here) from Leonardo DRS Inc for further details.

This article first appeared on GuruFocus.