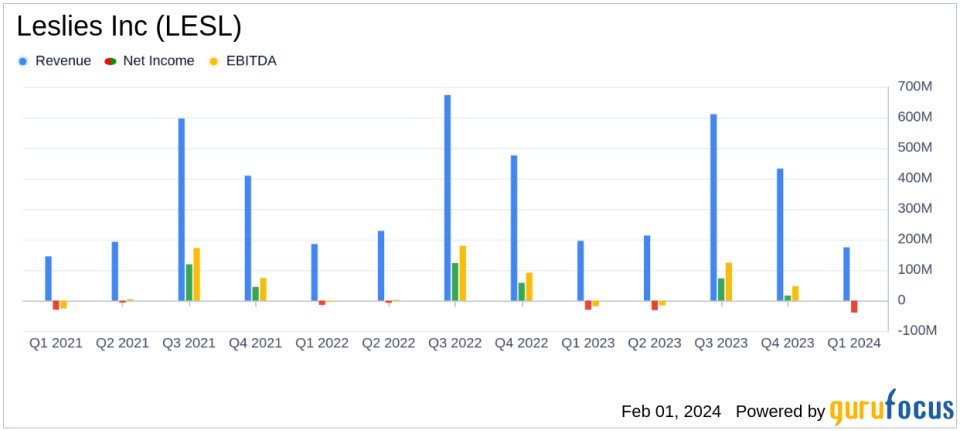

Leslies Inc (LESL) Faces Headwinds: Sales Dip and Net Losses Widen in Q1 Fiscal 2024

Sales: Decreased by 10.8% to $174.0 million from the prior year period.

Net Loss: Widened to $39.6 million compared to a net loss of $30.3 million in the prior year period.

Adjusted EBITDA: Dropped to $(24.4) million from $(11.9) million year-over-year.

Diluted EPS: Declined to $(0.21), with adjusted diluted EPS at $(0.20).

Gross Margin: Fell to 29.0% from 33.5% in the prior year period.

Debt Reduction: Funded debt decreased to $825.7 million, down from $886.8 million at the end of the prior year.

Inventory Levels: Decreased by 22.2% to $334.0 million, reflecting improved inventory management.

On February 1, 2024, Leslies Inc (NASDAQ:LESL), the leading direct-to-consumer pool and spa care brand in the U.S., released its financial results for the first quarter of fiscal 2024 through an 8-K filing. The company, which operates exclusively in the United States, reported a sales decline and an increase in net losses, attributing the downturn to pricing actions taken in the previous year and the need to enhance marketing and merchandising tactics ahead of the peak pool season.

Financial Performance and Challenges

Leslies Inc (NASDAQ:LESL) reported a 10.8% decrease in sales to $174.0 million, with comparable sales down by 11.7%. The net loss for the quarter widened to $39.6 million from $30.3 million in the prior year period. The company's gross margin also saw a significant reduction, dropping from 33.5% to 29.0%. These figures reflect the challenges Leslies Inc faces, including the impact of pricing actions and the need for strategic marketing improvements.

CEO Mike Egeck commented on the results, stating,

Our first quarter results were in line with or ahead of our expectations and topline performance showed sequential improvement each month throughout the quarter, supported by more normalized weather."

He also emphasized the company's focus on strategic initiatives to drive growth and shareholder value.

Financial Achievements and Industry Significance

Despite the setbacks, Leslies Inc (NASDAQ:LESL) achieved a reduction in funded debt, decreasing it to $825.7 million from $886.8 million at the end of the prior year. This debt reduction is a positive step for the company, particularly within the cyclical retail industry where managing leverage is crucial for sustaining operations during fluctuating market conditions.

The company also managed to decrease its inventory levels by 22.2% to $334.0 million, showcasing effective inventory managementa critical aspect for retailers to avoid excess stock and maintain cash flow.

Outlook and Analyst Perspective

Leslies Inc (NASDAQ:LESL) reaffirmed its fiscal 2024 outlook, projecting sales between $1,410 to $1,470 million and adjusted EBITDA of $170 to $190 million. The company's ability to maintain its full-year guidance despite a challenging quarter signals management's confidence in their strategic plans and the underlying strength of the business.

For value investors, the company's commitment to reducing debt and managing inventory levels, coupled with the reaffirmed outlook, may present a case for potential long-term value creation. However, the current performance underscores the importance of closely monitoring Leslies Inc's execution of its strategic initiatives and the effectiveness of its marketing and merchandising efforts.

Investors and analysts interested in further details are invited to review the conference call held on February 1, 2024, and access the webcast on the company's investor relations website.

For a comprehensive analysis of Leslies Inc's financials and strategic direction, stay tuned to GuruFocus.com for continued coverage and expert insights.

Explore the complete 8-K earnings release (here) from Leslies Inc for further details.

This article first appeared on GuruFocus.