Levi Strauss & Co. (LEVI) Posts Q4 Revenue Growth and Margin Expansion Amidst Productivity ...

Net Revenues: Q4 net revenues increased by 3% to $1.6 billion.

Gross Margin: Improved to 57.8%, a 200 basis point increase over the prior year.

Adjusted Diluted EPS: Rose to $0.44, up 29% compared to the previous year.

Inventory: Down 17% on a comparable basis.

Global Productivity Initiative: Expected to generate net cost savings of $100 million in fiscal 2024.

Fiscal Year 2024 Guidance: Anticipates reported net revenues growth of 1% to 3% year-over-year.

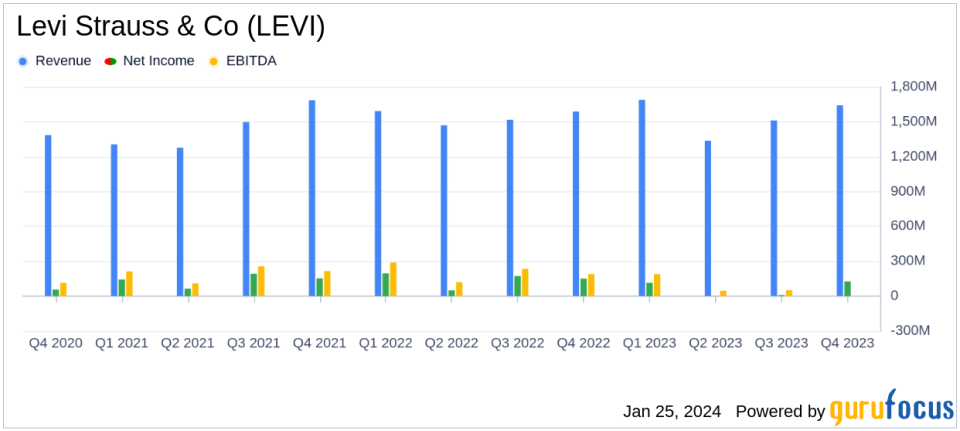

On January 25, 2024, Levi Strauss & Co (NYSE:LEVI) released its 8-K filing, detailing its financial results for the fourth quarter and fiscal year ended November 26, 2023. The company, a global leader in jeanswear, reported a 3% increase in net revenues for the quarter, reaching $1.6 billion. This growth was driven by an 11% increase in Direct to Consumer (DTC) net revenues, reflecting robust performance in both physical stores and e-commerce.

Levi Strauss & Co is renowned for its iconic Levi's brand and operates under a diversified portfolio that includes Dockers, Signature by Levi Strauss & Co., Denizen, and Beyond Yoga. The company's business is segmented into three regions: the Americas, Europe, and Asia, with the Americas being the largest revenue contributor.

Financial Performance and Challenges

The company's gross margin for the quarter improved significantly, up 200 basis points to 57.8%, primarily due to lower product costs and a favorable channel mix. Adjusted diluted earnings per share (EPS) increased by 29% to $0.44, reflecting the company's ability to manage costs and drive efficiency. However, the company also announced a global productivity initiative, which includes a workforce reduction of 10% to 15%, expected to generate net cost savings of $100 million in fiscal 2024 but will incur restructuring charges of $110 to $120 million in the first quarter.

Levi Strauss & Co's performance is particularly important as it demonstrates resilience in a challenging retail environment. The company's focus on direct-to-consumer sales and e-commerce growth is a strategic response to the evolving consumer shopping behaviors. However, the announced workforce reduction and associated restructuring charges highlight the ongoing pressures to optimize operations and manage costs.

Financial Achievements and Industry Significance

The company's achievements in improving gross margin and reducing inventory levels are critical in the Manufacturing - Apparel & Accessories industry, where managing production costs and supply chain efficiency are key to maintaining profitability. The growth in DTC sales is also a significant achievement, as it aligns with broader industry trends towards online retail and brand-controlled distribution channels.

Income Statement and Balance Sheet Highlights

For the fourth quarter, operating margin increased to 9.2%, and adjusted EBIT margin rose by 320 basis points to 12.2%. The company's effective tax rate was 7.2%, and net income for the quarter was $127 million, a decrease from $151 million in the prior year. For the full fiscal year, net revenues were flat at $6.2 billion, with a gross margin of 56.9%. Net income for the year was $250 million, down from $569 million in the previous fiscal year.

The balance sheet reflects a strong liquidity position, with cash and cash equivalents of $399 million and total liquidity of approximately $1.3 billion. The company's leverage ratio stood at 1.4, compared to 1.1 at the end of the previous fiscal year. Total inventories decreased by 9% on a reported basis and 17% on a comparable basis.

Analysis and Outlook

Levi Strauss & Co's fourth-quarter results indicate a strategic pivot towards productivity and cost savings, which may position the company for sustainable long-term growth. The company's guidance for fiscal 2024 suggests modest revenue growth, with adjusted diluted EPS projected between $1.15 and $1.25. This outlook assumes no significant worsening of macro-economic pressures, inflationary pressures, supply chain disruptions, or currency impacts.

The company's focus on expanding its direct-to-consumer footprint and e-commerce capabilities, along with its global productivity initiative, underscores its commitment to adapting to market changes and improving shareholder value. However, the planned workforce reduction and the associated costs highlight the ongoing challenges in the apparel industry and the need for continued operational efficiency.

Value investors and potential GuruFocus.com members may find Levi Strauss & Co's strategic initiatives and financial discipline to be of interest, particularly as the company navigates a dynamic retail landscape and works to capitalize on its iconic brand and global presence.

Explore the complete 8-K earnings release (here) from Levi Strauss & Co for further details.

This article first appeared on GuruFocus.