Levi Strauss' (LEVI) Q3 Earnings Beat Mark, Revenues Flat Y/Y

Levi Strauss & Co. LEVI reported third-quarter fiscal 2023 results wherein earnings beat the Zacks Consensus Estimate while revenues missed the same. LEVI’s adjusted earnings of 28 cents a share outpaced the consensus estimate by a penny. However, quarterly earnings decreased 30% on a reported basis from the year-ago fiscal quarter’s level.

Shares of this San Francisco, CA-based player have increased 2.4% in the past three months compared with the industry’s 1.4% rise.

Q3 Metrics

Net revenues of $1,511 million came below the Zacks Consensus Estimate of $1,546 million. However, the metric was consistent year over year on a reported basis and 2% lower on a constant-currency basis.

This current Zacks Rank #2 (Buy) company’s direct-to-consumer (DTC) net revenues jumped 14% year over year and 13% on a constant-currency basis, buoyed by robust growth across the company-operated mainline as well as stores and e-commerce. E-commerce revenues rose 19% on a reported basis and 18% on a constant-currency basis including double-digit growth at all the brands. As a rate of third-quarter net revenues, DTC accounted for 40% of the overall net revenues.

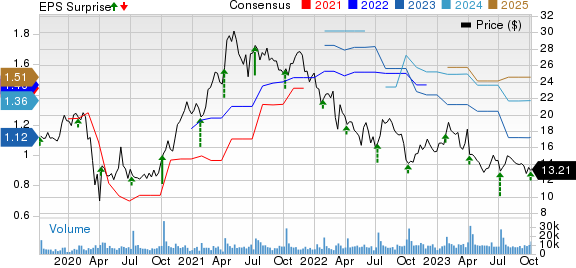

Levi Strauss & Co. Price, Consensus and EPS Surprise

Levi Strauss & Co. price-consensus-eps-surprise-chart | Levi Strauss & Co. Quote

Wholesale revenues fell 8% on a reported basis and 10% on a constant-currency basis as growth in Asia and Latin America was offset by lower sales in North America and Europe. Other Brands’ revenues climbed 12% on a reported basis and 9% on a constant-currency basis. Dockers revenues rose 9% on a reported basis and 5% on a constant-currency basis as solid growth internationally and in DTC was somewhat offset by U.S. wholesale. Beyond Yoga revenues grew 25% on reported and at constant currency.

In the Americas, revenues slipped 5% on a reported basis and 7% on a constant-currency basis. DTC revenues climbed 12% on a reported basis and 11% on a constant-currency basis, thanks to the company-operated mainline, and stores and e-commerce. Wholesale revenues declined 12% on a reported basis and 14% on a constant-currency basis as sluggishness in North America was somewhat offset by growth in Latin America.

In Europe, revenues dipped 2% on a reported basis and 6% on a constant-currency basis, and excluding Russia, the metric dropped 3% on a constant-currency basis. DTC net revenues jumped 10% on a reported basis and 6% on a constant-currency basis, and 11% excluding Russia, due to the company-operated mainline, and outlets and e-commerce. Wholesale revenues fell 10% on a reported basis and 14% on a constant-currency basis, indicating the cautious order backdrop among wholesale partners.

In Asia, revenues rose 12% on a reported basis and 18% on a constant-currency basis, buoyed by growth across almost all the markets with strong growth in China. DTC revenues grew 15% on a reported basis and 23% on a constant-currency basis, due to strength in the company-operated mainline, and outlet stores and e-commerce. Wholesale revenues jumped 8% on a reported basis and 13% on a constant-currency basis.

Margins & Costs

Adjusted gross margin of 55.6% contracted 130 basis points (bps) year over year, thanks to reduced full-price sales, pricing actions and increased product costs. These were somewhat offset by favorable channel and geographic mix, along with a fall in air freight expenses and the positive impacts of currency exchange.

Adjusted SG&A was $702 million, up from $675 million recorded in the year-earlier quarter, on elevated planned expenses to aid DTC expansion. Adjusted EBIT came in at $138 million, down 27% from $188 million seen in the year-earlier fiscal quarter.

Other Financials

Levi Strauss ended the quarter with cash and cash equivalents of $295 million and total liquidity of $1.1 billion.

As of Aug 27, 2023, long-term debt and total shareholders’ equity were $1,004.6 million and $1,941.4 million, respectively. During the nine months of fiscal 2023, cash from operations was $176.6 million and adjusted free cash flow was a negative $82.4 million.

The company returned nearly $48 million to shareholders in the fiscal third quarter, as dividends were 12 cents a share, in line with the prior-year quarter. Management declared a dividend of 12 cents per share, totaling nearly $48 million, payable in cash on Nov 9, 2023, to the holders of record as on Oct 26, 2023.

It did not repurchase any shares during the reported quarter. At the end of the quarter, the company had $680 million remaining under its existing share repurchase authorization with no expiration date.

Outlook

For fiscal 2023, net revenues are expected to be flat to up 1% year over year. Adjusted diluted earnings per share are likely to be on the low-end of the earlier guided range of $1.10-$1.20. The outlook assumes no major worsening of the macro-economic issues, inflationary pressures, supply-chain bottlenecks or currency impacts.

Eye These Solid Picks Too

We have highlighted three other top-ranked stocks, namely American Eagle Outfitters AEO, Abercrombie & Fitch ANF and Boot Barn BOOT.

American Eagle Outfitters, a retailer of casual apparel, accessories and footwear, currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for American Eagle Outfitters’ current financial-year earnings per share suggests growth of 33% from the year-ago reported figure. AEO delivered an average trailing four-quarter earnings surprise of 43.2%.

Abercrombie & Fitch, a leading casual apparel retailer, currently sports a Zacks Rank of 1. ANF has delivered an earnings surprise of 724.8% in the last four quarters.

The Zacks Consensus Estimate for Abercrombie & Fitch’s current financial-year sales suggests growth of 10% from the year-ago reported figures.

Boot Barn, a leading apparel and footwear retailer, currently carries a Zacks Rank of 2. BOOT delivered an average trailing four-quarter earnings surprise of 13.5%.

The Zacks Consensus Estimate for Boot Barn’s current financial-year sales suggests growth of 7.8% from the year-ago reported figure.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Abercrombie & Fitch Company (ANF) : Free Stock Analysis Report

American Eagle Outfitters, Inc. (AEO) : Free Stock Analysis Report

Boot Barn Holdings, Inc. (BOOT) : Free Stock Analysis Report

Levi Strauss & Co. (LEVI) : Free Stock Analysis Report