Lexicon's (LXRX) Heart Failure Drug Inpefa Gets FDA Approval

Lexicon’s LXRX shares were up almost 18% on May 26, after market hours. The rise was due to the FDA approval of a broad label for Inpefa (sotagliflozin) — a once-daily oral tablet that can be used across full range of left ventricular ejection fraction, including HFpEF and HFrEF, and for patients with or without diabetes.

The drug has been approved to reduce the risk of death and hospitalization in adults with heart failure, type II diabetes mellitus, chronic kidney disease and other cardiovascular risk factors.

This broad approval highlights the potential of Inpefa to address the diverse needs of patients with heart failure.

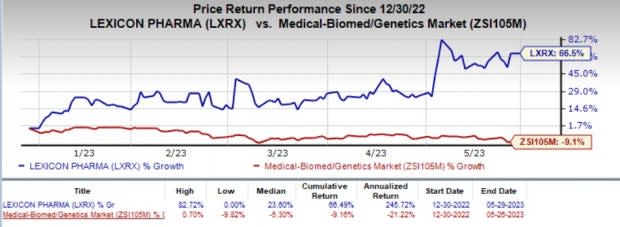

In the year so far, shares of Lexicon have rallied 66.5% against the industry’s 9.1% decline.

Image Source: Zacks Investment Research

Inpefa is a dual inhibitor of sodium-glucose co-transporter type II (SGLT2) and type I (SGLT1). Heart failure affects around 6.7 million Americans and this number is expected to increase to 8.0 million by 2030. It is the primary cause of hospitalization among individuals aged 65 and older, leading to approximately 1.3 million hospitalizations annually.

Cardiovascular patients face the highest risk of experiencing a heart failure event within 30 days of discharge, with a 7% mortality and 25% hospital readmission rate.

Approval of the drug was based on the positive results from two phase III cardiovascular outcome studies, SOLOIST-WHF and SCORED. The studies, which enrolled nearly 12,000 patients, demonstrated that Inpefa reduced the risk of hospitalizations and urgent visits due to heart failure.

The investigations also established that the drug could lower the risk of cardiovascular death by 33% compared to a placebo in those who were recently hospitalized for worsening heart failure.

The new drug application (NDA) for Inpefa was accepted by the food and drug administration (FDA) in June 2022. Lexicon expects to make Inpefa commercially available in the U.S. market by the end of June 2023.

The company has also developed sotagliflozin for type I diabetes. A separate NDA for this indication has been submitted, supported by positive results from three phase III clinical studies. The first, second and third study involved approximately 800, 800 and 1,400 patients, respectively.

The FDA issued a complete response letter regarding the NDA for sotagliflozin in type I diabetes. In response, Lexicon requested a public notice of opportunity for hearing from the FDA to determine if there are grounds for denying their NDA approval. The hearing process on the same is currently under way.

LXRX also has mid-stage clinical studies ongoing for another candidate LX9211 for treating neuropathic pain.

Lexicon Pharmaceuticals, Inc. Price and Consensus

Lexicon Pharmaceuticals, Inc. price-consensus-chart | Lexicon Pharmaceuticals, Inc. Quote

Zacks Rank and Stocks to Consider

Currently, Lexicon carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the biotech sector are Allogene Therapeutics ALLO, Akero Therapeutics AKRO and ADMA Biologics, Inc. ADMA, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The bottom line estimate for Allogene Therapeutics has narrowed from a loss of $2.83 to $2.31 per share for 2023 in the past 90 days. In the year so far, shares of the company have nosedived 12.1%.

ALLO’s earnings beat estimates in three of the trailing four quarters and missed the mark in one, delivering an average surprise of 5.08%.

The bottom line estimate for Akero Therapeutics has narrowed from a loss of $3.46 to $2.78 per share for 2023 in the past 90 days. In the year so far, shares of Akero Therapeutics have fallen 18.4%.

AKRO’s earnings beat estimates in three of the trailing four quarters and missed the mark in one, delivering an average surprise of 7.96%.

The bottom line estimate for ADMA Biologics has narrowed from a loss of 19 cents to 9 cents per share for 2023 in the past 90 days. In the year so far, shares of ADMA Biologics have risen 5.2%.

ADMA’s earnings beat estimates in each of the trailing four quarters, delivering an average surprise of 19.13%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lexicon Pharmaceuticals, Inc. (LXRX) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Allogene Therapeutics, Inc. (ALLO) : Free Stock Analysis Report

Akero Therapeutics, Inc. (AKRO) : Free Stock Analysis Report