LGI Homes Inc (LGIH) Reports Growth Amidst Economic Challenges

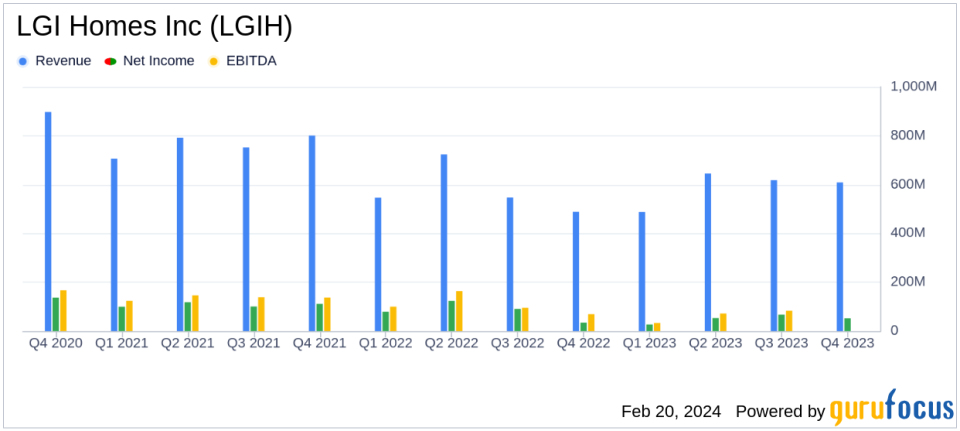

Revenue: Home sales revenues increased by 2.3% year-over-year to $2.4 billion.

Net Income: Despite a challenging economic environment, net income rose to $199.2 million.

Earnings Per Share: Basic EPS was reported at $8.48, with diluted EPS at $8.42.

Gross Margin: Full year gross margin reached 23.0%, with adjusted gross margin at 24.7%.

Community Growth: Active selling communities grew by 18.2% to 117.

Lots Owned and Controlled: LGIH ended the year with a total of 71,081 owned and controlled lots.

2024 Outlook: The company anticipates home closings between 7,000 and 8,000 with an average sales price per home closed between $350,000 and $360,000.

LGI Homes Inc (NASDAQ:LGIH) released its 8-K filing on February 20, 2024, detailing its financial results for the fourth quarter and full year ended December 31, 2023. The company, known for its design, construction, and sale of new homes under the LGI Homes and Terrata Homes brands, has reported a year of growth despite economic headwinds.

Financial Performance and Challenges

In the face of inflation and uncertain interest rates, LGI Homes Inc (NASDAQ:LGIH) has managed to increase its home sales revenues by 2.3% to $2.4 billion for the full year. The number of homes closed also saw a modest increase of 1.6% to 6,729 homes. However, the company faced a decrease in net income before income taxes by 37.4% to $261.8 million and a net income decrease of 39.0% to $199.2 million. These figures reflect the challenges of increased costs and a competitive market environment.

The company's financial achievements, particularly the growth in active selling communities and the control of a significant number of lots, are critical in the homebuilding industry. These metrics indicate the company's ability to expand its operations and secure future revenue streams. The increase in average sales price per home closed, albeit slight, suggests the company's ability to navigate market pricing pressures effectively.

Key Financial Metrics

Key metrics from the income statement show that the gross margin as a percentage of home sales revenues decreased to 23.0%, with an adjusted gross margin of 24.7%. The balance sheet reflects a strong liquidity position with total liquidity of $403.8 million, including cash and cash equivalents of $49.0 million. The net debt to capitalization stood at 39.3% at the end of the year.

Chairman and CEO Eric Lipar commented on the results:

We delivered a strong performance in the fourth quarter and successfully achieved all of our guidance targets for 2023. Our strong execution in the fourth quarter resulted in full year closings of 6,729 homes and revenue of $2.4 billion. We believe these results make us one of just a few homebuilders to have delivered growth in both of these metrics in 2023.

Despite the challenges, LGI Homes Inc (NASDAQ:LGIH) has provided a positive outlook for 2024, with expectations of increased home closings and community count, as well as improvements in profitability.

Analysis of Company Performance

LGI Homes Inc (NASDAQ:LGIH) has demonstrated resilience in a tough economic climate, achieving growth in key areas while navigating cost pressures and market uncertainty. The company's strategic focus on increasing leads through targeted marketing, controlling costs, and maintaining a strong balance sheet has positioned it well for the future. The expansion of active communities and the management of a substantial lot inventory are indicative of LGI Homes' commitment to long-term growth and profitability.

For more detailed information, investors and interested parties can access the archived earnings call webcast on the company's website, which will be available for one year from the date of the call.

As LGI Homes Inc (NASDAQ:LGIH) moves into 2024, the company's focus on operational efficiency and market responsiveness will be crucial in sustaining its growth trajectory and delivering value to shareholders.

For further details on LGI Homes Inc (NASDAQ:LGIH)'s financial performance and strategic outlook, please visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from LGI Homes Inc for further details.

This article first appeared on GuruFocus.