Li Lu's Firm Exits Micron, Boosts East West Bancorp

Renowned investor Li Lu recently disclosed his firm's Q2 2023 portfolio through the 13F filing. Li Lu (Trades, Portfolio), a disciple of value investing, is known for his meticulous stock selection and long-term investment approach. His investment philosophy is deeply influenced by Warren Buffet and Charlie Munger (Trades, Portfolio), focusing on buying undervalued companies with strong fundamentals and holding them for the long term.

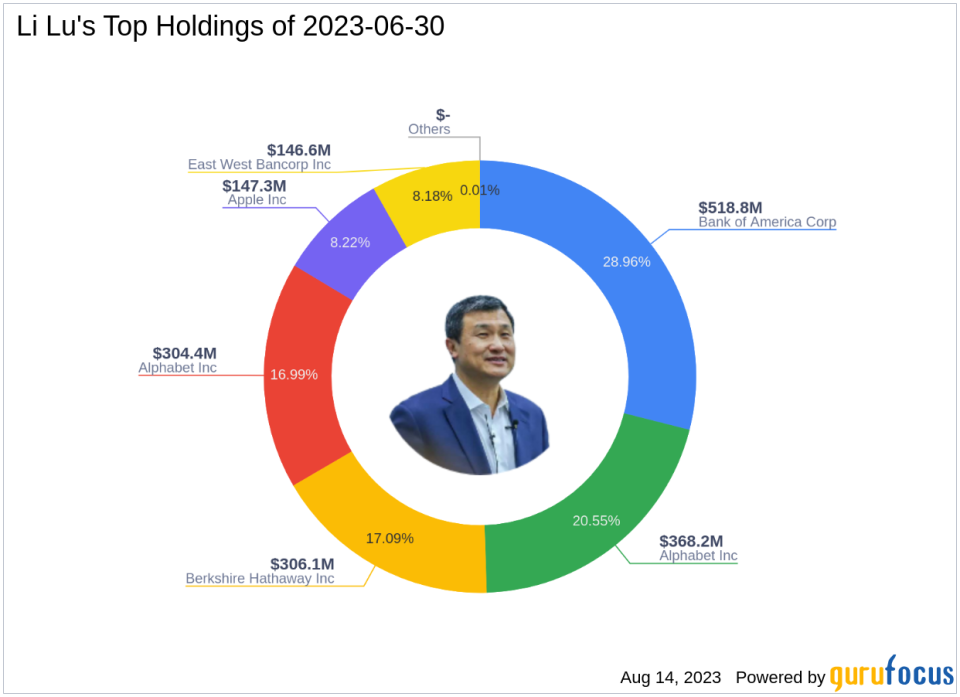

The firm's portfolio for the quarter ending on June 30, 2023, comprised six stocks with a total value of $1.79 billion. The top holdings were Bank of America Corp (NYSE:BAC) with 28.96% of the portfolio, Alphabet Inc (GOOG) with 20.55%, and Berkshire Hathaway Inc (BRK.B) with 17.09%.

Top Trades of the Quarter

The most significant transactions of the quarter included a complete sell-off of Micron Technology Inc (NAS:MU) and a substantial purchase of shares in East West Bancorp Inc (NAS:EWBC).

Micron Technology Inc (NAS:MU)

Li Lu (Trades, Portfolio)'s firm sold its entire stake of 6,826,079 shares in Micron Technology Inc. The shares were traded at an average price of $64.22 during the quarter. As of August 14, 2023, the stock was priced at $68.28 with a market cap of $74.79 billion. Over the past year, the stock has returned 5.76%. GuruFocus rates the company's financial strength and profitability at 6/10 and 8/10 respectively. The valuation ratios indicate a price-book ratio of 1.65, an EV-to-Ebitda ratio of 13.81, and a price-sales ratio of 4.13.

East West Bancorp Inc (NAS:EWBC)

During the quarter, the firm acquired an additional 480,051 shares of East West Bancorp Inc, bringing the total holding to 2,776,351 shares. This transaction had a 1.41% impact on the equity portfolio. The stock was traded at an average price of $50.82 during the quarter. As of August 14, 2023, the stock was priced at $56.99 with a market cap of $8.06 billion. Despite a negative return of -22.77% over the past year, the firm increased its stake. The company's financial strength and profitability are rated 4/10 and 7/10 respectively by GuruFocus. The valuation ratios show a price-earnings ratio of 6.39, a price-book ratio of 1.25, a PEG ratio of 0.65, and a price-sales ratio of 3.18.

In conclusion, Li Lu (Trades, Portfolio)'s Q2 2023 portfolio shows a strategic mix of sell-offs and acquisitions, reflecting the firm's value investing philosophy. The firm's decisions to increase stakes in certain stocks despite negative returns suggest a long-term investment approach based on strong fundamentals rather than short-term market fluctuations.

This article first appeared on GuruFocus.