Liberty Broadband Corp Reports Mixed Results Amidst Strategic Expansions

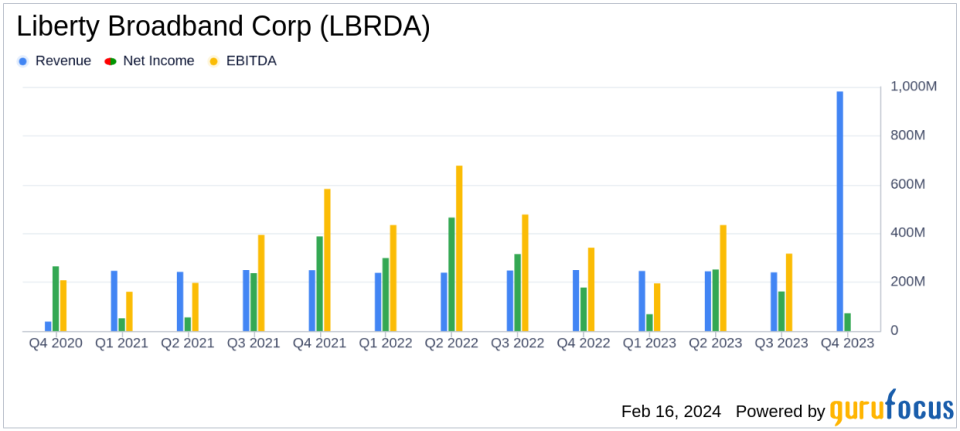

Revenue: Liberty Broadband Corp (NASDAQ:LBRDA) maintains steady revenue at $981 million in 2023, matching the previous year's performance.

Operating Income: Operating income sees a significant rise from a loss of $39 million in 2022 to a gain of $73 million in 2023.

Adjusted OIBDA: Adjusted OIBDA marginally increases to $337 million in 2023 from $327 million in 2022.

Share Repurchases: The company repurchased 3.2 million shares for $255 million, with a remaining authorization of $1.7 billion as of February 2024.

Debt Reduction: Total Liberty Broadband debt decreases by $69 million in Q4, primarily due to repayment under the Charter margin loan.

GCI Holdings Performance: GCI Holdings, a segment of Liberty Broadband, reports a 117% increase in operating income and a 1% rise in adjusted OIBDA for the year.

On February 16, 2024, Liberty Broadband Corp (NASDAQ:LBRDA) released its 8-K filing, detailing its financial results for the fourth quarter and year end of 2023. The telecommunications giant, known for providing a range of services including video, internet, voice, and mobile services to residential and small to medium businesses, faced a challenging environment but managed to maintain its revenue stream while strategically expanding its mobile and rural services.

Strategic Initiatives and Financial Performance

Liberty Broadband's President & CEO, Greg Maffei, highlighted the company's strategic initiatives, stating,

Despite a challenging environment, Charter deployed significant capital and made progress on its attractive mobile and rural expansion initiatives in 2023."

He emphasized the growth in the mobile sector and the success of rural footprint expansion, which are surpassing penetration and return targets. The company's subsidiary, GCI Holdings, also contributed to the financial stability with solid results and continued network upgrades across Alaska.

Financial Highlights and Shareholder Returns

The company's share repurchase program remained active, with 3.2 million shares bought back at an average price of $79.69 per share. Liberty Broadband's cash position improved by $70 million in the fourth quarter, primarily due to proceeds from Charter share sales. The company's total debt decreased, reflecting prudent financial management and commitment to maintaining a strong balance sheet.

Operational Metrics and Future Outlook

GCI Holdings, the major revenue contributor for Liberty Broadband, reported flat revenue for the fourth quarter but a 1% increase for the full year. This was driven by strong demand for business data services, despite declines in other segments. Operating income for GCI Holdings rose significantly, benefiting from lower depreciation expenses and the absence of a legal settlement accrual that impacted the previous year's figures.

Looking ahead, Liberty Broadband is poised to continue its investment in high-return connectivity projects, particularly in rural Alaska. The company expects GCI's net capital expenditures for 2024 to be around $200 million, focusing on network expansion in key markets.

Balance Sheet and Cash Flow Analysis

The balance sheet reflects a healthy liquidity position, with an increase in cash and cash equivalents and a reduction in total debt. The company's investment in Charter, accounted for using the equity method, remains a significant asset on the balance sheet. The statement of cash flows indicates effective cash management, with an increase in cash from operations offsetting capital expenditures.

In conclusion, Liberty Broadband Corp (NASDAQ:LBRDA) navigated a challenging year with strategic focus and financial discipline. The company's investments in mobile growth and rural expansion are expected to enhance its competitive positioning and drive future growth, thereby increasing shareholder value. Investors and potential GuruFocus.com members can find further details and analysis of Liberty Broadband's financial performance on the GuruFocus website.

Explore the complete 8-K earnings release (here) from Liberty Broadband Corp for further details.

This article first appeared on GuruFocus.