Liberty Energy Inc's Meteoric Rise: Unpacking the 26% Surge in Just 3 Months

Liberty Energy Inc (NYSE:LBRT), a leading oilfield services company, has seen a significant uptick in its stock performance recently. With a current market cap of $3.48 billion and a stock price of $20.4, the company has witnessed a 5.55% gain over the past week and a substantial 25.57% gain over the past three months. The company's GF Value, a measure of intrinsic value defined by GuruFocus.com, has also risen from $23.14 to $23.65 over the same period. This indicates that the stock is currently considered modestly undervalued, a significant improvement from being significantly undervalued three months ago.

Company Overview: Liberty Energy Inc

Liberty Energy Inc operates in major basins throughout North America, providing hydraulic fracturing services, primarily pressure pumping. The company's 2020 acquisition of Schlumberger's OneStim business segment has positioned Liberty as one of the largest pressure pumpers in North America. This acquisition also added wireline operations, two Permian frac sand mines, and an expanded technological portfolio to the company's business.

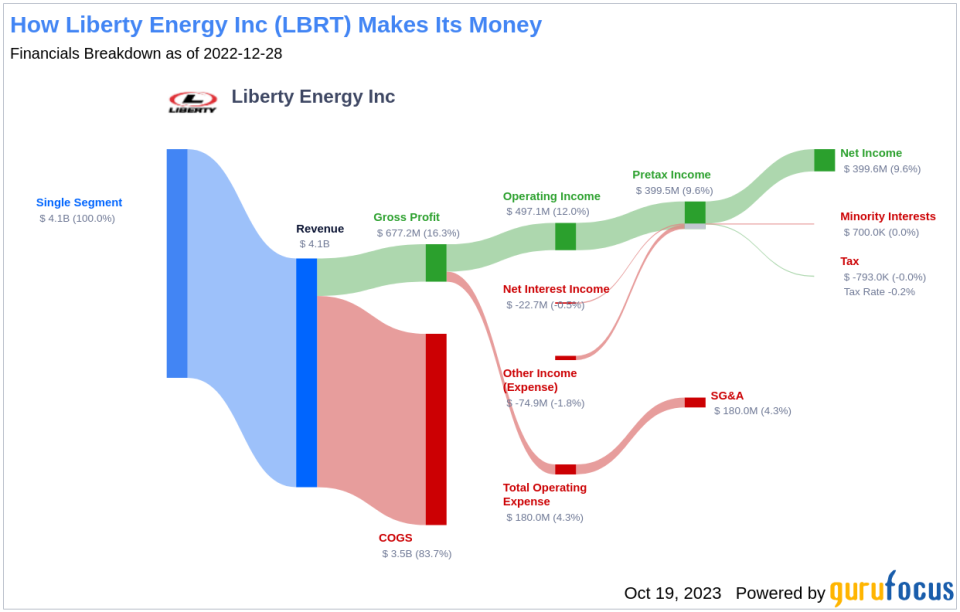

Profitability Analysis

Liberty Energy Inc's profitability rank stands at 5/10, indicating moderate profitability. The company's operating margin of 16.59% is better than 63.18% of 986 companies in the same industry. Furthermore, the company's ROE, ROA, and ROIC, which are calculated as Net Income divided by its average Total Stockholders Equity, Total Assets, and capital invested in its business respectively, are all higher than the majority of companies in the same industry. Over the past 10 years, the company's profitability has been better than 32.81% of 957 companies.

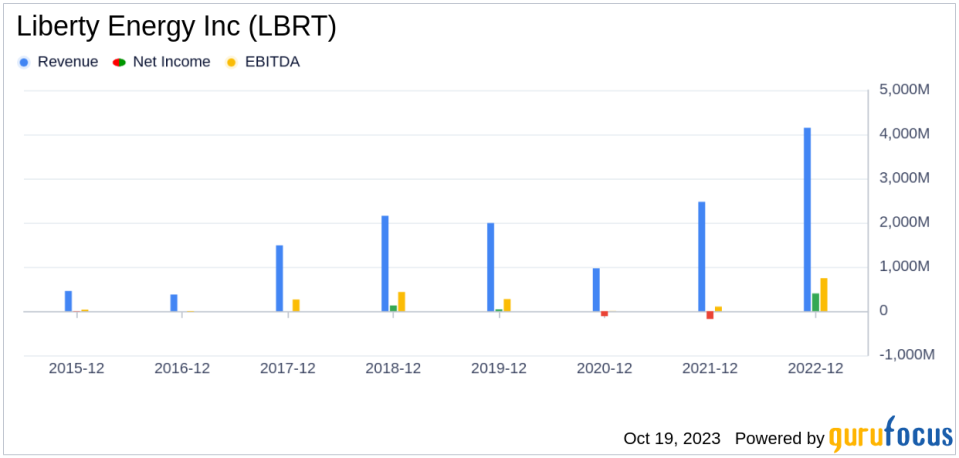

Growth Prospects

The company's growth rank is 3/10, indicating moderate growth. The 3-year and 5-year revenue growth rates per share are better than 39.07% and 27.43% of companies in the same industry, respectively. The company's future total revenue growth rate estimate of 3.49% is better than 51.35% of 259 companies. Furthermore, the company's 3-year EPS without NRI growth rate and future EPS without NRI growth rate are better than 80.72% and 11.11% of companies in the same industry, respectively.

Major Stock Holders

The top three holders of Liberty Energy Inc's stock are Jim Simons (Trades, Portfolio), HOTCHKIS & WILEY, and First Eagle Investment (Trades, Portfolio), who hold 0.95%, 0.3%, and 0.12% of the stock, respectively.

Competitive Landscape

Liberty Energy Inc operates in a competitive industry with major players such as NexTier Oilfield Solutions Inc (NEX) with a market cap of $2.42 billion, Weatherford International PLC (NASDAQ:WFRD) with a market cap of $6.74 billion, and TechnipFMC PLC (NYSE:FTI) with a market cap of $8.97 billion.

Conclusion

In conclusion, Liberty Energy Inc's stock performance, profitability, and growth prospects have shown significant improvement over the past three months. Despite facing stiff competition, the company's strategic acquisitions and robust business model have positioned it well for future growth. Investors should keep a close eye on this stock as it continues to gain momentum in the market.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.