Liberty Energy (LBRT): A Modestly Undervalued Gem in the Oil & Gas Industry?

Liberty Energy Inc (NYSE:LBRT) experienced a daily gain of 7.96%, and a 3-month gain of 38.6%. With an Earnings Per Share (EPS) (EPS) of 3.37, the question arises: is the stock modestly undervalued? This article delves into an in-depth valuation analysis to answer this question.

Company Overview

Liberty Energy is an oilfield services company providing hydraulic fracturing services, primarily pressure pumping, across major basins in North America. Its 2020 acquisition of Schlumberger's OneStim business segment propelled Liberty to become one of North America's largest pressure pumpers. This acquisition also added wireline operations, two Permian frac sand mines, and an expanded technological portfolio to Liberty's assets. The company's stock price currently stands at $17.77, while its GF Value, an estimate of fair value, is $23.68. This comparison sets the stage for a deeper exploration of Liberty Energy's value, ingeniously integrating financial assessment with essential company details.

Understanding GF Value

The GF Value represents a stock's current intrinsic value derived from our unique method. The GF Value Line on our summary page provides an overview of the stock's fair trading value. This value is calculated based on historical trading multiples, a GuruFocus adjustment factor based on the company's past performance and growth, and future business performance estimates.

Liberty Energy (NYSE:LBRT) stock is estimated to be modestly undervalued based on the GuruFocus Value calculation. At its current price of $17.77 per share, Liberty Energy has a market cap of $3 billion, suggesting that the stock is modestly undervalued. As a result, the long-term return of its stock is likely to be higher than its business growth.

Link: These companies may deliever higher future returns at reduced risk.

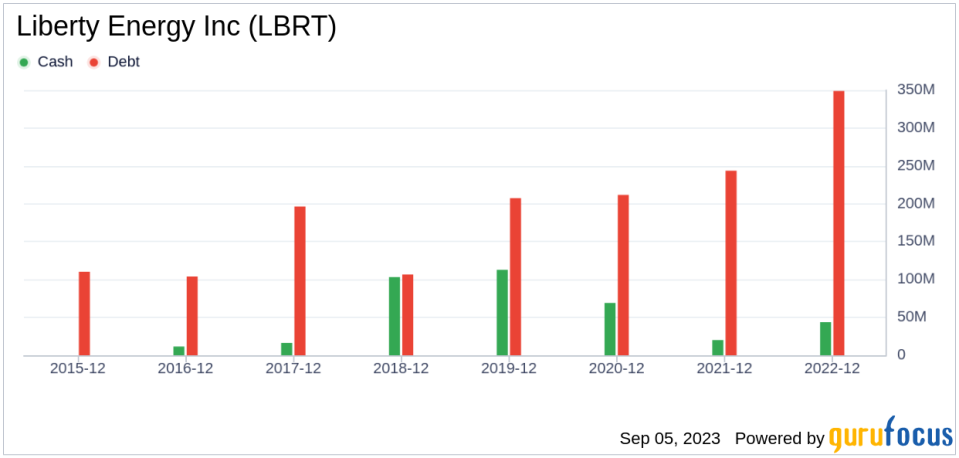

Financial Strength

Investing in companies with poor financial strength carries a higher risk of permanent capital loss. Hence, it's crucial to carefully review a company's financial strength before deciding to buy its stock. A good starting point for understanding a company's financial strength is looking at the cash-to-debt ratio and interest coverage. Liberty Energy's cash-to-debt ratio stands at 0.07, which is worse than 83.55% of 1021 companies in the Oil & Gas industry. Despite this, GuruFocus ranks the overall financial strength of Liberty Energy at 7 out of 10, indicating that the company's financial strength is fair.

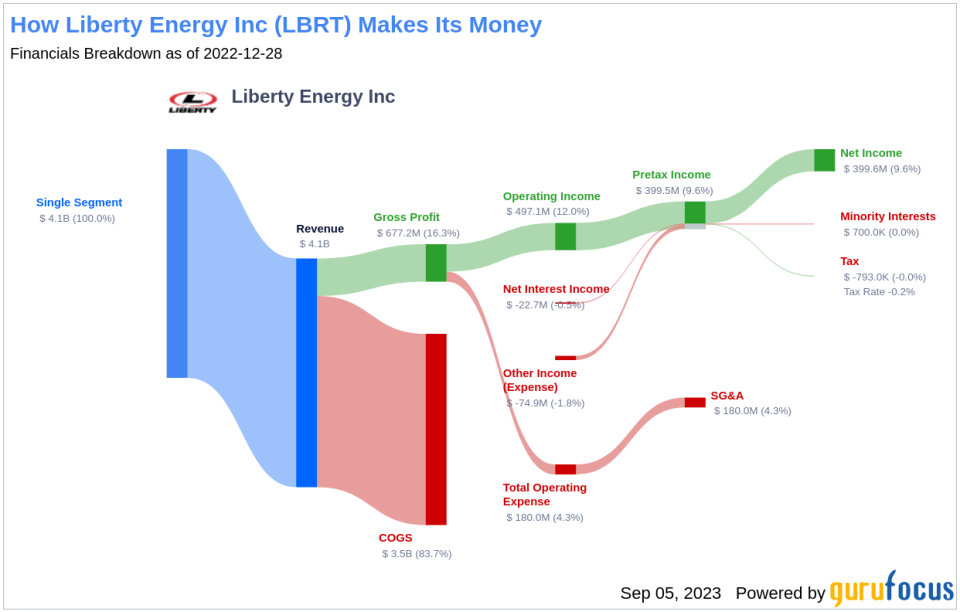

Profitability and Growth

Investing in profitable companies carries less risk, especially those demonstrating consistent profitability over the long term. Liberty Energy has been profitable for 3 years over the past 10 years. In the past 12 months, the company recorded revenues of $4.90 billion and an EPS of $3.37. Its operating margin of 16.59% is better than 62.73% of 966 companies in the Oil & Gas industry. Overall, GuruFocus ranks Liberty Energy's profitability as fair.

One of the most important factors in a company's valuation is its growth. Companies that grow faster create more value for shareholders, especially if that growth is profitable. Liberty Energy's average annual revenue growth is 5%, ranking worse than 60.4% of 851 companies in the Oil & Gas industry. However, its 3-year average EBITDA growth is 15.1%, ranking better than 51.46% of 822 companies in the Oil & Gas industry.

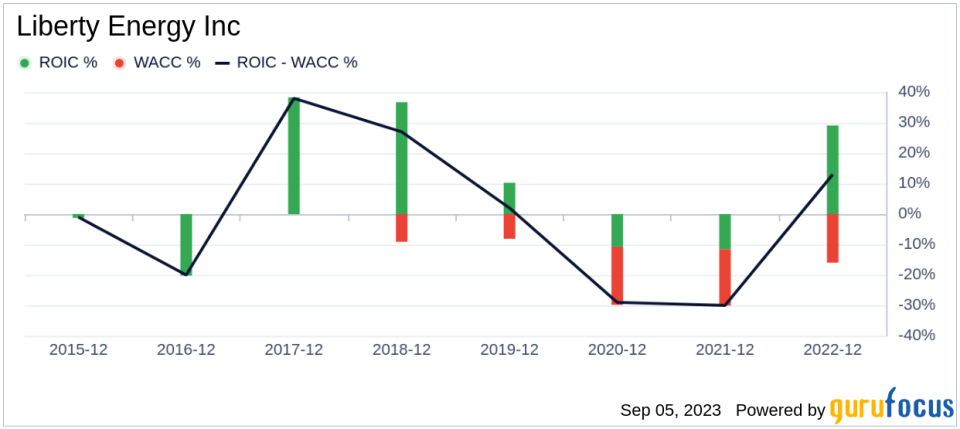

ROIC vs WACC

Another method to evaluate a company's profitability is to compare its return on invested capital (ROIC) with its weighted average cost of capital (WACC). If the ROIC is higher than the WACC, it indicates that the company is creating value for shareholders. Over the past 12 months, Liberty Energy's ROIC was 35.81, while its WACC came in at 9.64.

Conclusion

Overall, Liberty Energy (NYSE:LBRT) stock is estimated to be modestly undervalued. The company's financial condition is fair, and its profitability is fair. Its growth ranks better than 51.46% of 822 companies in the Oil & Gas industry. To learn more about Liberty Energy stock, you can check out its 30-Year Financials here.

To discover high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.