Liberty Global PLC (LBTYA): An Undervalued Gem in the Telecommunication Services Industry?

Liberty Global PLC (NASDAQ:LBTYA) has experienced a daily loss of -3.96% and a three-month gain of 5.79%, with a Loss Per Share of 7.2. The stock's valuation raises the question: is it modestly undervalued? This article provides a comprehensive analysis of the company's valuation and encourages readers to delve into the detailed analysis that follows.

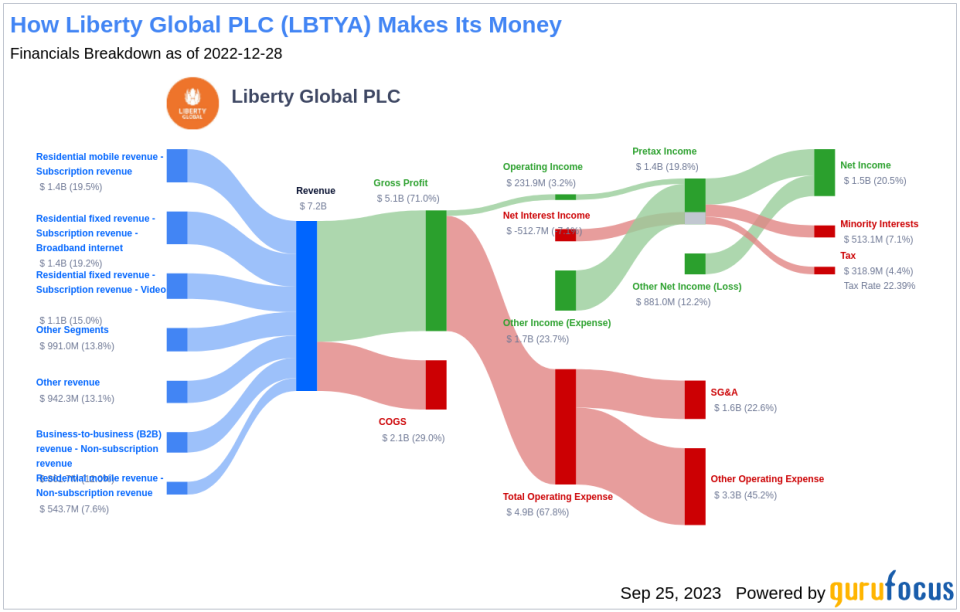

Company Introduction

Liberty Global PLC (NASDAQ:LBTYA) is a holding company with interests in several telecom companies in the U.K., Netherlands, Belgium, Switzerland, Ireland, and Slovakia. The company owns the primary cable network in each of these regions and has pursued a strategy since 2016 to merge or partner with mobile-network-operators to offer converged services. Its current stock price is $17.34, while the GF Value, an estimation of fair value, stands at $22.03. This discrepancy paves the way for a deeper exploration into the company's value.

GF Value Summary

The GF Value is a proprietary measure of a stock's intrinsic value. It is based on historical trading multiples, a GuruFocus adjustment factor based on past performance and growth, and future business performance estimates. If the stock price is significantly above the GF Value Line, it is overvalued, and its future return is likely to be poor. On the other hand, if it is significantly below the GF Value Line, its future return will likely be higher.

According to the GuruFocus Value calculation, the stock of Liberty Global PLC (NASDAQ:LBTYA) is estimated to be modestly undervalued. The current price of $17.34 per share and the market cap of $7.70 billion suggest that Liberty Global PLC stock is likely to offer higher long-term returns than its business growth due to its relative undervaluation.

Link: These companies may deliver higher future returns at reduced risk.

Financial Strength

Investing in companies with low financial strength could result in permanent capital loss. Liberty Global PLC has a cash-to-debt ratio of 0.22, ranking worse than 57.69% of 390 companies in the Telecommunication Services industry. This suggests a poor balance sheet, earning Liberty Global PLC's financial strength a rank of 4 out of 10 by GuruFocus.

Profitability and Growth

Companies with high profitability and consistent profitability over the long term are generally safer investments. Liberty Global PLC has been profitable 5 out of the past 10 years. Its operating margin is 1.22%, ranking worse than 74.17% of 391 companies in the Telecommunication Services industry. Overall, Liberty Global PLC's profitability is ranked 5 out of 10 by GuruFocus, indicating fair profitability.

Company growth is a crucial factor in valuation. Liberty Global PLC's 3-year average annual revenue growth rate is -2.8%, which ranks worse than 73.54% of 378 companies in the Telecommunication Services industry. However, its 3-year average EBITDA growth rate is 17.2%, ranking better than 74.25% of companies in the industry.

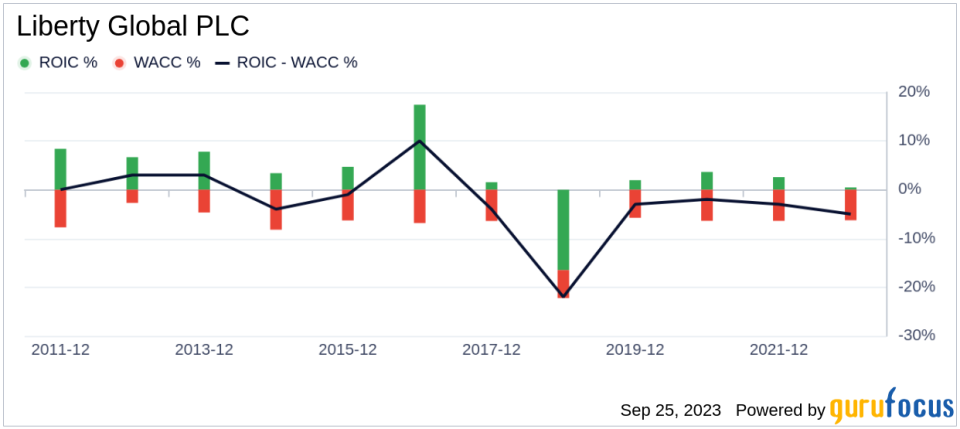

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) can provide insights into its profitability. Over the past 12 months, Liberty Global PLC's ROIC was 0.25, while its WACC came in at 6.34.

Conclusion

In conclusion, the stock of Liberty Global PLC (NASDAQ:LBTYA) is estimated to be modestly undervalued. The company's financial condition is poor, and its profitability is fair. Its growth ranks better than 74.25% of 334 companies in the Telecommunication Services industry. To learn more about Liberty Global PLC stock, you can check out its 30-Year Financials here.

To find out the high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.