Liberty Latin America Ltd's Meteoric Rise: Unpacking the 23% Surge in Just 3 Months

Liberty Latin America Ltd (NASDAQ:LILA), a leading telecommunications company, has seen a significant surge in its stock price over the past three months. The company's market cap stands at $1.93 billion, with the current stock price at $9.25, marking a 23.09% increase from the past price of $8.61 three months ago. Over the past week, the stock price has seen a gain of 5.77%. The current GF Value is $9.99, slightly down from the past GF Value of $10.67. Despite this, the stock is considered fairly valued, an improvement from being modestly undervalued three months ago. The GF Value, defined by GuruFocus.com, calculates a stock's intrinsic value using historical multiples, past performance adjustments, and future business estimates.

Unveiling Liberty Latin America Ltd

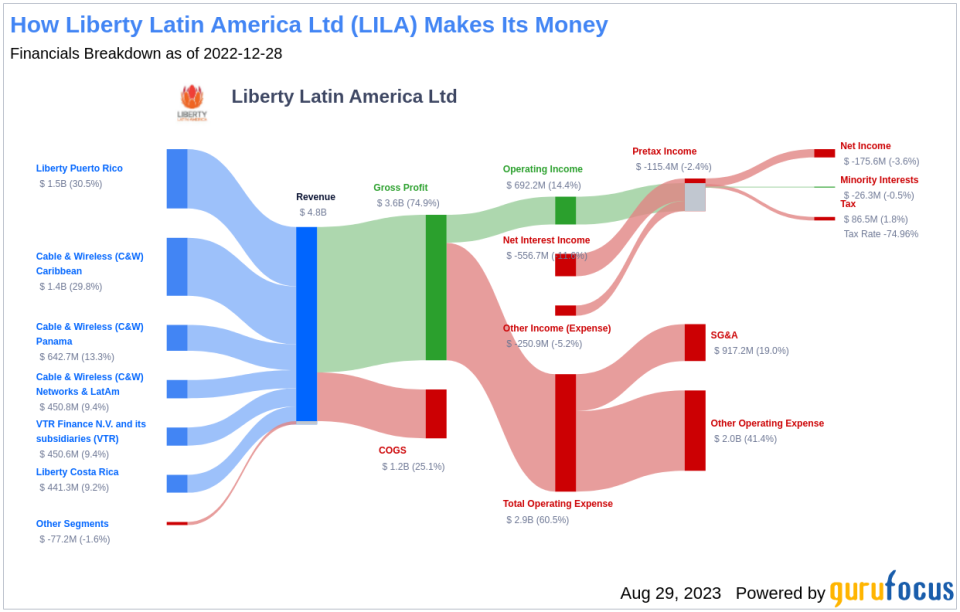

Liberty Latin America Ltd operates in the Telecommunication Services industry, providing video, broadband internet, fixed-line telephony, and mobile services to residential and business customers. The company's reportable segments include C&W Caribbean and Networks, C&W Panama, VTR, Liberty Puerto Rico, and Costa Rica.

Profitability Analysis of LILA

Liberty Latin America Ltd's Profitability Rank stands at 5/10, indicating a moderate level of profitability. The company's operating margin is 13.54%, better than 62.02% of 387 companies in the same industry. This ratio, calculated as Operating Income divided by its Revenue, is a key indicator of the company's profitability. The company's ROE, ROA, and ROIC are 11.10%, 1.47%, and 3.60% respectively, outperforming a significant portion of industry peers. Over the past decade, the company has had 2 years of profitability, better than 13% of 377 companies.

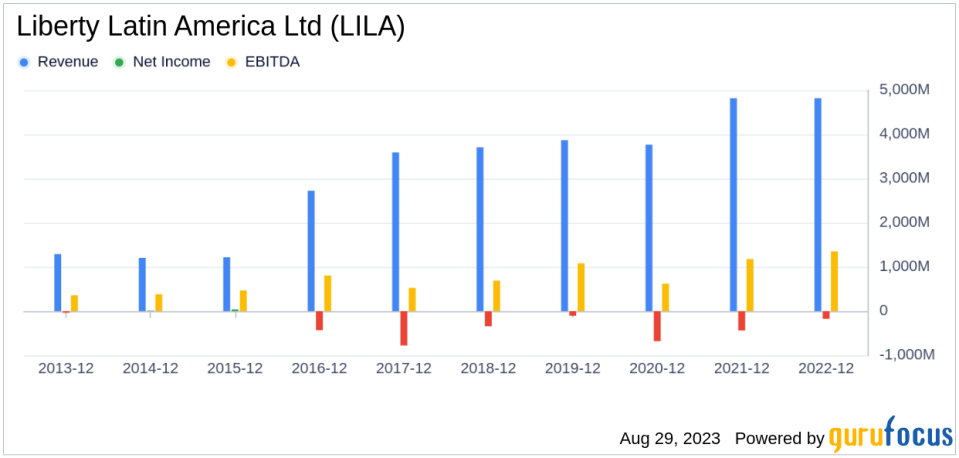

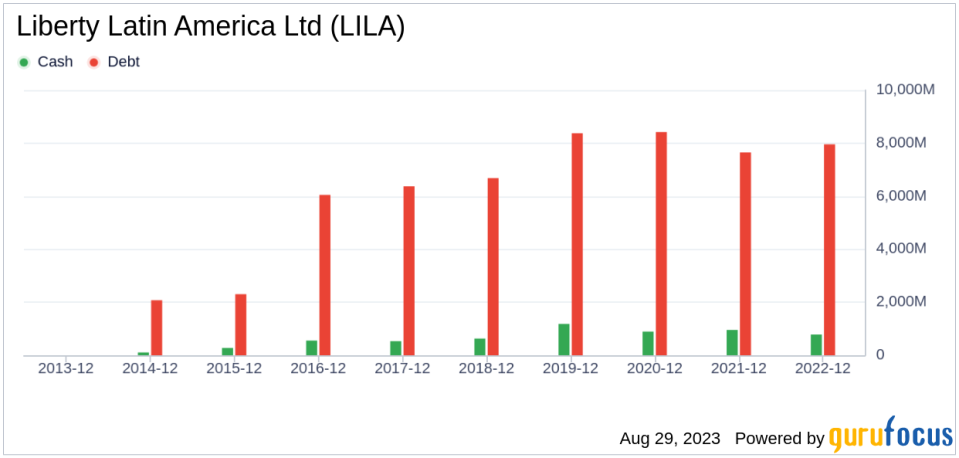

Growth Analysis of LILA

Liberty Latin America Ltd's Growth Rank is 5/10, indicating a moderate growth rate. The company's 3-year and 5-year revenue growth rate per share are 1.00% and 0.90% respectively. However, the 3-year EPS without NRI growth rate is -10.80%, which is better than 23.03% of 304 companies. The 5-year EPS without NRI growth rate is 17.60%, outperforming 71.56% of 211 companies.

Major Holders of LILA Stock

Warren Buffett (Trades, Portfolio), Mario Gabelli (Trades, Portfolio), and Jim Simons (Trades, Portfolio) are the top three holders of LILA stock, holding 1.27%, 0.16%, and 0.1% of the shares respectively.

Competitor Analysis

Liberty Latin America Ltd faces competition from Globalstar Inc(GSAT) with a market cap of $2.37 billion, Telephone and Data Systems Inc(NYSE:TDS) with a market cap of $2.14 billion, and Gogo Inc(NASDAQ:GOGO) with a market cap of $1.42 billion.

Conclusion

In conclusion, Liberty Latin America Ltd has shown a significant surge in its stock price over the past three months. The company's profitability and growth ranks indicate a moderate level of profitability and growth. Despite facing competition from industry peers, the company has managed to maintain a competitive edge. The future performance of LILA will depend on its ability to sustain its growth and profitability while navigating the competitive landscape of the Telecommunication Services industry.

This article first appeared on GuruFocus.