Liberty Latin America Reports Robust Subscriber Growth and Strong Adjusted OIBDA in Q4 & FY 2023

Operating Income: Increased to $518 million for FY 2023.

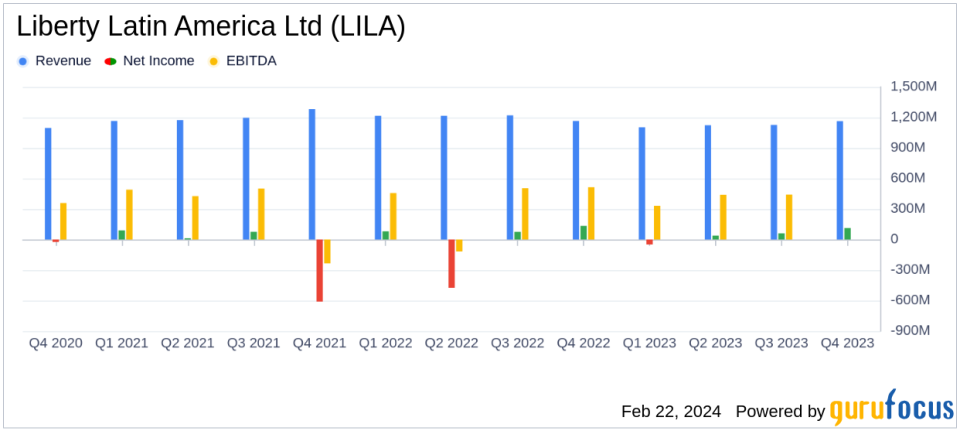

Adjusted OIBDA: Rebased growth of 6% to $1.7 billion for FY 2023.

Subscriber Growth: 186,000 organic broadband and postpaid mobile subscriber net adds in 2023.

Cash Flow: Cash provided by operating activities reached $897 million, with Adjusted Free Cash Flow before distributions to noncontrolling interests at $273 million.

Equity Repurchase: $300 million in equity and convertible notes repurchased during the year.

Integration Milestones: Over 800,000 mobile subscribers migrated in Puerto Rico, integration over 80% complete.

On February 22, 2024, Liberty Latin America Ltd (NASDAQ:LILA), a leading telecommunications company, released its 8-K filing, detailing its financial and operating results for the fourth quarter (Q4) and full year (FY) ended December 31, 2023. The company, which provides video, broadband internet, fixed-line telephony, and mobile services across its segments, including C&W Caribbean and Networks, C&W Panama, VTR, Liberty Puerto Rico, and Costa Rica, reported significant subscriber growth and a strong increase in operating income.

Performance and Challenges

Liberty Latin America's performance in 2023 was marked by a robust addition of broadband and postpaid mobile subscribers, contributing to the company's growth. The Adjusted OIBDA rebased growth of 6% to $1.7 billion underscores the company's ability to increase its operational efficiency and profitability. However, the company faces challenges, including the completion of the mobile customer migration in Puerto Rico and the USVI, which is crucial for future growth and cost savings.

Financial Achievements

The company's financial achievements, particularly the operating income of $518 million, reflect its strong market position and operational effectiveness in the telecommunications industry. These achievements are significant because they demonstrate LILA's ability to navigate a competitive market while investing in infrastructure and integrating acquisitions, such as Claro Panama.

Key Financial Metrics

Liberty Latin America's financial health can be assessed through several key metrics:

"We ended the year well, generating healthy subscriber and Adjusted OIBDA growth and delivering Adjusted FCF before distributions to noncontrolling interests of $273 million, 43% higher than the prior year," said CEO Balan Nair.

Revenue for FY 2023 was $4,511 million, a decrease from $4,809 million in FY 2022, primarily due to the deconsolidation of VTR. Excluding VTR, revenue increased by 4%. The company's cash provided by operating activities was a solid $897 million, and it reported Adjusted Free Cash Flow before distributions to noncontrolling interests of $273 million, a significant increase from the previous year.

Analysis of Performance

The company's strategic investments in infrastructure have paid off, with over 80% of its fixed networks upgraded to enable speeds in excess of 1 Gbps. This has been a key factor in the addition of 81,000 broadband subscribers during the year. The mobile base also saw strong growth, with 105,000 subscribers added, mainly in Liberty Costa Rica and C&W Caribbean.

The tower monetization transaction completed in Q4 2023 brought in $244 million of proceeds, strengthening the company's financial position. Looking ahead, LILA anticipates a mid to high single digit Adjusted OIBDA rebased CAGR and aggregate Adjusted FCF of more than $1 billion over the next three years, signaling confidence in continued growth and value creation for stakeholders.

For a detailed view of Liberty Latin America's financials and strategic outlook, investors and interested parties can access the full 8-K filing.

Explore the complete 8-K earnings release (here) from Liberty Latin America Ltd for further details.

This article first appeared on GuruFocus.