Lifecore (LFCR) Down 30% on Ending Strategic Review With No Deal

Shares of Lifecore Biomedical LFCR plummeted 30.3% on Mar 20 after the company announced that it concluded its year-long extensive strategic review. The board of directors unanimously opted to continue executing its standalone strategic plan rather than pursuing a sale or merger.

In addition to the above decision, Lifecore has also determined to increase its investment in aseptic production capacity. Over the last three years, management claims to have strategically invested in its aseptic production capacity to meet the pharmaceutical industry's growing demand for injectable fill/finish capabilities.

With the installation of its new high-speed multi-purpose isolator fillers, Lifecore expects to more than triple its current theoretical capacity, from 22 million units to around 70 million units, by fiscal year 2027. Management intends to share more details about their plans at the company’s Investor Day event scheduled to be held later this year.

Per management, the strategic review involved outreach to over 75 potential buyers and financial sponsors. Management expects the significant investments in the injectable fill/finish capacity will help Lifecore return to growth in the second half of fiscal 2024.

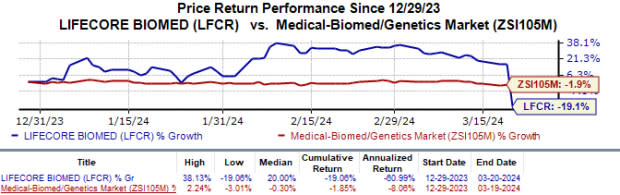

Shares of Lifecore have lost 19.1% year to date compared with the industry’s 1.9% fall.

Image Source: Zacks Investment Research

Alongside the strategic review decision, Lifecore also announced changes in its top-level leadership. The board of directors named Paul Josephs as the company’s new President and chief executive officer (CEO). Mr. Josephs will also join the company’s board of directors.

Josephs will succeed current CEO Jim Hall, effective May 20, when Hall retires. Mr. Hall will step down from the company’s board but will remain with Lifecore in an advisory capacity for a year.

In the same press release, Lifecore announced that its board of directors named current independent director Katrina Houde as the company’s new Chairperson, effective at the upcoming annual shareholders meeting. This decision comes after the board’s current chair, Craig Barbarosh, decided that he won’t seek re-election at this upcoming meeting.

Lifecore Biomedical, Inc. Price

Lifecore Biomedical, Inc. price | Lifecore Biomedical, Inc. Quote

Zacks Rank & Key Picks

Lifecore currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include ADMA Biologics ADMA, ANI Pharmaceuticals ANIP and Galapagos GLPG, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

In the past 60 days, estimates for ADMA Biologics’ 2024 earnings per share (EPS) have risen from 22 cents to 30 cents. During the same period, EPS estimates for 2025 have improved from 32 cents to 50 cents. Year to date, shares of ADMA have risen 39.8%.

Earnings of ADMA Biologics beat estimates in three of the last four quarters while meeting the same on one occasion. ADMA delivered a four-quarter average earnings surprise of 85.00%.

In the past 60 days, estimates for ANI Pharmaceuticals’ 2024 EPS have risen from $4.06 to $4.43. Meanwhile, during the same period, EPS estimates for 2025 have improved from $4.80 to $5.04. Year to date, shares of ANIP have risen 23.6%.

Earnings of ANI Pharmaceuticals beat estimates in each of the last four quarters. ANI delivered a four-quarter average earnings surprise of 109.06%.

In the past 60 days, Galapagos’ loss estimates for 2024 have improved from $1.68 to 39 cents. During the same period, loss estimates for 2025 have improved from 60 cents to 14 cents. Year to date, shares of Galapagoshave lost 16.5%.

Galapagos’ earnings beat estimates in three of the trailing four quarters while missing the mark on one occasion. On average, GLPG’s four-quarter earnings surprise was 91.97%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ANI Pharmaceuticals, Inc. (ANIP) : Free Stock Analysis Report

ADMA Biologics Inc (ADMA) : Free Stock Analysis Report

Galapagos NV (GLPG) : Free Stock Analysis Report

Lifecore Biomedical, Inc. (LFCR) : Free Stock Analysis Report