Lifetime Brands Inc (LCUT) Reports Mixed Financial Outcomes for Q4 and Full Year 2023

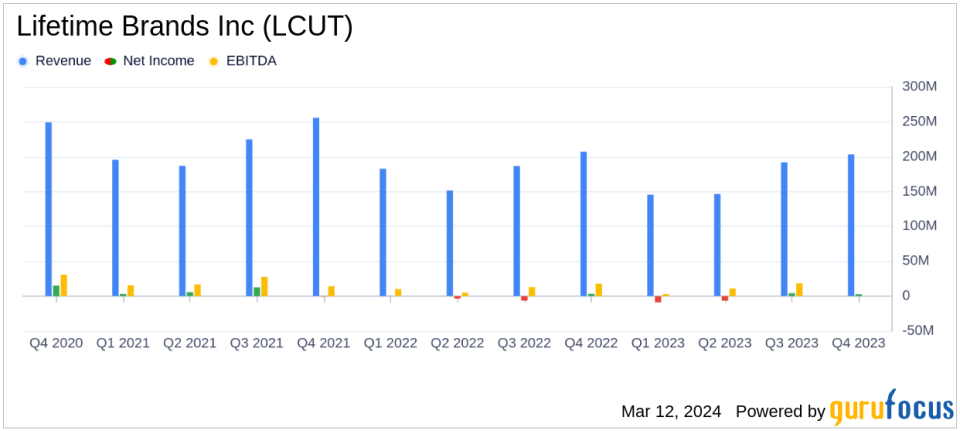

Net Sales: Q4 net sales decreased by 1.9% year-over-year to $203.1 million; full-year sales down 5.6% to $686.7 million.

Gross Margin: Improved to 36.4% in Q4 2023 from 35.9% in Q4 2022; annual gross margin increased to 37.1% from 35.8%.

Net Income: Q4 net income declined to $2.7 million from $3.3 million in the prior year; full-year net loss widened to $(8.4) million from $(6.2) million.

Adjusted EBITDA: Reached $57.3 million for the full year 2023.

Dividend: A quarterly dividend of $0.0425 per share declared, payable on May 15, 2024.

Lifetime Brands Inc (NASDAQ:LCUT), a global leader in branded consumer products for the home, announced its financial results for the fourth quarter and full year ended December 31, 2023. The company released its 8-K filing on March 12, 2024, revealing a slight decrease in net sales but an improvement in gross margin. Lifetime Brands is known for its extensive portfolio of kitchenware, tableware, and home solutions, with a significant presence in the U.S. market.

Rob Kay, CEO of Lifetime Brands, highlighted the company's strong quarter in line with expectations and emphasized growth in the U.S. Kitchenware category and e-commerce channel. Despite a decrease in net sales for both the quarter and the full year, the company managed to improve its gross margin and income from operations. However, net income for the quarter and the full year experienced a decline, with the full year showing a net loss.

The company's focus on managing expenses and identifying efficiencies has translated into a more agile company structure, contributing to bottom line growth. The anticipation of channel expansion and market share growth positions Lifetime Brands to potentially enhance performance and value generation in 2024.

Financial Performance Analysis

Lifetime Brands' financial performance in the fourth quarter showed resilience despite a slight decrease in net sales. The company's gross margin improvement from 35.9% to 36.4% in the fourth quarter indicates better cost management and pricing strategies. The adjusted income from operations for the quarter increased to $19.4 million from $18.2 million in the previous year, reflecting operational efficiencies.

For the full year, the company faced a 5.6% decrease in net sales, which was consistent in constant currency terms. The net loss for the year widened, which may raise concerns among investors about the company's profitability. However, the adjusted net income provides a different perspective, excluding certain non-recurring items and showing a more stable financial condition.

The declaration of a quarterly dividend suggests confidence in the company's cash flow and commitment to shareholder returns. The focus on e-commerce growth is particularly noteworthy as consumer shopping behaviors continue to shift online, which could be a significant driver of future sales.

Challenges and Opportunities

Despite the mixed financial outcomes, Lifetime Brands has demonstrated an ability to navigate through market challenges, including foreign exchange fluctuations and competitive pressures. The company's strategic focus on e-commerce and operational efficiency may offer a pathway to improved performance in the coming year.

Investors and potential GuruFocus.com members should consider the company's efforts to adapt to changing market conditions and its strategies for growth when evaluating Lifetime Brands as an investment opportunity. The company's commitment to maintaining a strong brand portfolio and expanding its market presence could yield positive results in the long term.

For a detailed understanding of Lifetime Brands Inc's financial results and strategic direction, interested parties are encouraged to review the full 8-K filing.

Explore the complete 8-K earnings release (here) from Lifetime Brands Inc for further details.

This article first appeared on GuruFocus.