Lifeway Foods (LWAY) Q2 Earnings Beat Estimates, Rise Y/Y

Lifeway Foods, Inc. LWAY reported second-quarter 2023 results, wherein the top and bottom lines beat the Zacks Consensus Estimate and improved year over year. This marked the company’s 15th straight quarter of year-over-year net sales growth.

A proactive approach to managing operations, combined with the alleviation of inflationary pressures, has enabled the company to continue capitalizing on consistent revenue expansion. This growth signifies not only higher product volumes but also a widespread acceptance of price adjustments justified by inflation.

Leveraging customer loyalty, strategic retail and branding investments attract new, quality-conscious buyers. The company's commitment to growth involves marketing, distribution and promising prospects in core products like kefir and Farmer Cheese, benefiting from popular social media recipes.

Lifeway Foods, Inc. Price, Consensus and EPS Surprise

Lifeway Foods, Inc. price-consensus-eps-surprise-chart | Lifeway Foods, Inc. Quote

Q2 Performance in Detail

Lifeway posted earnings of 21 cents a share in the second quarter, beating the Zacks Consensus Estimate of 6 cents. This compares to earnings of 1 cent per share reported a year ago.

Net revenues were $39.2 million, up 17.1% year over year. The top line beat the Zacks Consensus Estimate of $38 million. The increase was primarily driven by higher volumes of its branded drinkable kefir and, to a lesser extent, the impacts of price increases implemented in the fourth quarter of 2022.

The gross profit amounted to $11.3 million, up from the $5.7 million reported in the year-ago quarter. The upside can be attributed to higher revenues. The gross margin expanded 1,170 basis points (bps) to 28.7%. The metric benefited from higher volumes of its branded products and the favorable impacts of milk pricing, and, to a lesser extent, the price increases implemented in the fourth quarter of 2022 and decreased transportation costs.

Selling, general and administrative expenses rose 19.9% to $6.4 million. As a percentage of net revenues, selling, general and administrative expenses increased 40 bps to 16.3%.

The company reported net income of $3.2 million for the second quarter ended Jun 30, 2023, compared with $0.1 million reported for the same period in 2022.

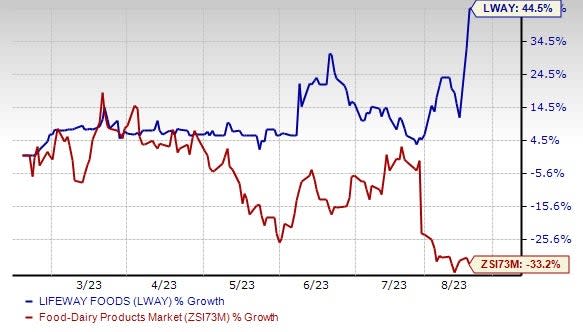

Image Source: Zacks Investment Research

Other Financial Details

Lifeway ended the quarter with cash and cash equivalents totaling $7.4 million as of Jun 30, 2023, compared with $6.5 million for the six months ended Jun 30, 2022. The company has no long-term debt. Net cash provided by operating activities was $5.5 million for the six months ended Jun 30, 2023.

Shares of this Zacks Rank #3 (Hold) company have gained 44.5% in the past six months against the industry's decline of 33.2%.

3 Stocks to Consider

Here we have highlighted three better-ranked stocks, namely BJ’s Restaurants BJRI, Post Holdings POST and AmBev ABEV.

BJ’s Restaurants owns and operates a chain of high-end casual dining restaurants in the United States. It currently sports a Zacks Rank #1 (Strong Buy). BJRI’s expected EPS growth rate for three to five years is 15%. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for BJ’s Restaurants’ current quarter’s sales and earnings suggests growth of 5.6% and 108%, respectively, from the year-ago reported numbers. BJRI has a trailing four-quarter earnings surprise of 121.2%, on average.

Post Holdings is a consumer-packaged goods holding company. It currently flaunts a Zacks Rank #1. POST has a trailing four-quarter earnings surprise of 59.6%, on average.

The Zacks Consensus Estimate for Post Holdings’ current-quarter sales and earnings suggests growth of 24% and 40%, respectively, from the year-ago reported numbers.

AmBev is engaged in producing, distributing and selling beer, carbonated soft drinks and other non-alcoholic and non-carbonated products. It currently has a Zacks Rank #2 (Buy). ABEV’s expected EPS growth rate for three to five years is 7%.

The Zacks Consensus Estimate for AmBev’s current-quarter sales suggests growth of 5.6% from the year-ago reported number. ABEV has a trailing four-quarter earnings surprise of 20.8%, on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

BJ's Restaurants, Inc. (BJRI) : Free Stock Analysis Report

Lifeway Foods, Inc. (LWAY) : Free Stock Analysis Report

Post Holdings, Inc. (POST) : Free Stock Analysis Report

Ambev S.A. (ABEV) : Free Stock Analysis Report