Lilly (LLY) Up on NVO's Ozempic Early Success in Kidney Study

Shares of Eli Lilly and Company LLY were up almost 5% on Wednesday after rival Novo Nordisk NVO announced that a kidney outcomes study on its diabetes medicine Ozempic (semaglutide) was being stopped earlier than planned due to efficacy.

An independent data monitoring committee (DMC) recommended that a kidney outcomes study, called FLOW, evaluating once-weekly injectable Ozempic, be stopped early, based on an interim analysis. The data from the interim analysis showed that certain pre-specified criteria for stopping the study early for efficacy were met.

Once-weekly subcutaneous Ozempic is currently approved in the United States in 0.5 mg, 1.0 mg and 2.0 mg doses for the treatment of type II diabetes as well as for reducing the risk of major adverse cardiovascular events in adults with type II diabetes mellitus and established cardiovascular disease. The company’s FLOW study is evaluating the efficacy of Ozempic for the prevention of the progression of renal impairment in people with type II diabetes and chronic kidney disease (CKD), compared to placebo.

Ozempic is a GLP-1 receptor agonist. Lilly also has a dual GIP and GLP-1 receptor agonist (GIP/GLP-1 RA) in its portfolio called Mounjaro (tirzepatide), which is already approved for treating type II diabetes. Mounjaro is also being evaluated in a phase II study for patients who are obese/overweight and have CKD. Investors are probably expecting similar success for Mounjaro’s CKD study as well.

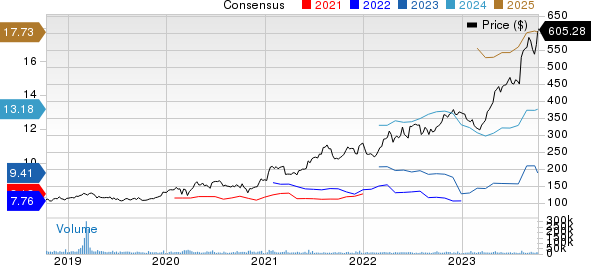

Lilly’s stock has risen 65.4% year to date compared with an increase of 6.3% for the industry.

Image Source: Zacks Investment Research

The FDA approved Mounjaro in 2022 and it is already generating impressive sales, driven by strong demand trends. Mounjaro sales totaled $1.55 billion in the first half of 2023. It is expected to be a key long-term top-line driver for Lilly as it has the potential to be approved for obesity and other diabetes-related diseases.

Mounjaro showed superior weight-loss reduction in clinical studies for the obesity indication. Regulatory applications have already been filed for Mounjaro for the obesity indication in the United States and EU. In the United States, the FDA has assigned priority review to the regulatory filing, with a decision expected by year-end.

Phase III studies are ongoing for obstructive sleep apnea and heart failure with preserved ejection fraction and phase II in NASH.

Zacks Rank & Stocks to Consider

Lilly has a Zacks Rank #3 (Hold) currently.

Eli Lilly and Company Price and Consensus

Eli Lilly and Company price-consensus-chart | Eli Lilly and Company Quote

Some better-ranked drug/biotech companies worth considering are Alpine Immune Sciences ALPN and Aurinia Pharmaceuticals AUPH, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

In the past 90 days, the consensus estimate for Alpine Immune Sciences’ 2023 loss has narrowed from $1.43 per share to $1.18 per share, while the same for 2024 has narrowed from $1.73 per share to $1.47 per share. Year to date, shares of Alpine Immune Sciences have rallied 47.3%.

ALPN’s earnings beat estimates in two of the trailing four quarters and missed the mark in the other two, delivering an average negative earnings surprise of 79.65%.

In the past 90 days, the bottom line estimate for Aurinia Pharmaceuticals for 2023 has narrowed from a loss of 71 cents per share to a loss of 58 cents per share, while the same for 2024 has narrowed from a loss of 43 cents per share to a loss of 27 cents per share. Year to date, shares of Aurinia Pharmaceuticals have gained 75.2%.

Earnings of Aurinia Pharmaceuticals beat estimates in the last four quarters, delivering an earnings surprise of 45.61% on average.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Novo Nordisk A/S (NVO) : Free Stock Analysis Report

Eli Lilly and Company (LLY) : Free Stock Analysis Report

Aurinia Pharmaceuticals Inc (AUPH) : Free Stock Analysis Report

Alpine Immune Sciences, Inc. (ALPN) : Free Stock Analysis Report