Limbach Holdings Inc (LMB) Reports Robust Earnings Growth and Margin Expansion in 2023

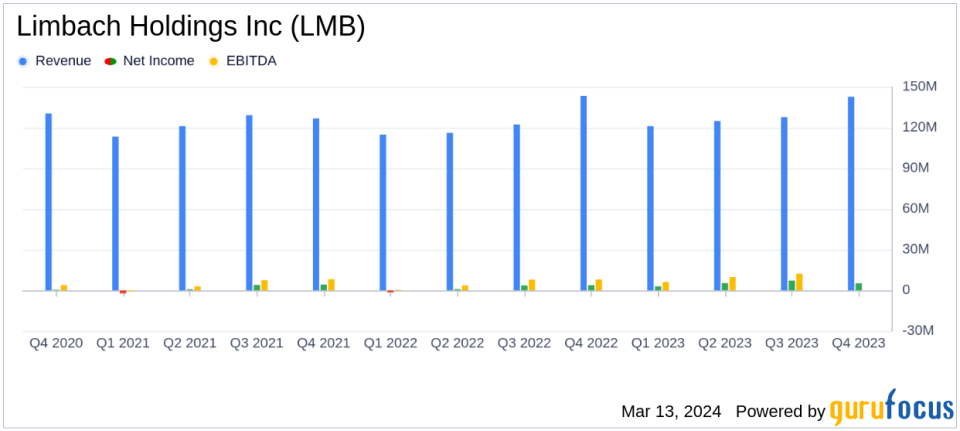

Revenue: Consolidated revenue slightly decreased by 0.6% in Q4, but increased 3.9% for the full year.

Gross Profit: Gross profit rose by 14.0% in Q4 and 27.3% for the year, with gross margin reaching 23.3% for Q4 and 23.1% for the year.

Net Income: Net income improved to $5.2 million in Q4, a 37.7% increase, and $20.8 million for the year, a 205.9% surge.

Earnings Per Share (EPS): Diluted EPS grew to $0.44 in Q4 from $0.35, and to $1.76 for the year from $0.64.

Adjusted EBITDA: Adjusted EBITDA increased by 8.8% to $12.6 million in Q4 and by 47.3% to $46.8 million for the year.

Cash Flow: Net cash provided by operating activities rose to $13.9 million in Q4 and $57.4 million for the year.

Balance Sheet: Year-end cash and cash equivalents stood at $59.8 million, with a current ratio of 1.50x.

Limbach Holdings Inc (NASDAQ:LMB) released its 8-K filing on March 13, 2024, detailing its financial results for the fourth quarter and the full year of 2023. The company, a leading commercial specialty contractor in heating, ventilation, air conditioning, plumbing, electrical, and building controls, operates primarily through its General Contractor Relationships (GCR) and Owner Direct Relationships (ODR) segments, with the latter driving significant growth and profitability.

Performance Highlights and Strategic Focus

The ODR segment's revenue surged by 22.8% year-over-year for Q4 and 21.1% for the full year, accounting for 55.1% of total revenue and 71.1% of consolidated gross profit for the quarter. This strategic shift towards ODR has led to expanded margins and a robust increase in Adjusted EBITDA, outpacing the company's guidance for the year. Limbach's disciplined approach to project selection, particularly within the GCR segment, has resulted in a slight decrease in consolidated revenue for Q4 but is expected to enhance flexibility and drive higher returns moving forward.

Michael McCann, Limbach's President and CEO, emphasized the company's progress in becoming a pure-play provider of building systems solutions and the strategic shift in customer mix driving higher margin opportunities. He noted the company's focus on accelerating the shift to the ODR business, which resulted in a significant increase in full-year diluted EPS and cash flow from operating activities.

"In 2023, we made tremendous progress executing our strategy to become a pure-play provider of buildings systems solutions. We continued to grow our ODR business as an indispensable partner helping our customers provide mission critical services to maintain uninterrupted operations in their facilities. This strategic shift in customer mix is driving higher margin opportunities and creating a stronger, more resilient Limbach," said Michael McCann, Limbachs President and Chief Executive Officer.

Financial Achievements and Future Outlook

Limbach's financial achievements in 2023 reflect the company's successful execution of its strategic initiatives and its ability to adapt to market conditions. The company's strong balance sheet, with year-end cash and cash equivalents of $59.8 million, provides a solid foundation for strategic investments and future growth. For 2024, Limbach provides revenue guidance of $510 million to $530 million and Adjusted EBITDA guidance of $49 million to $53 million, indicating confidence in the company's continued performance.

The company's focus on smaller, higher margin GCR projects and investment in rental equipment for indoor climate control are expected to contribute to future profitability. Limbach's transformation into a higher quality, more predictable business is anticipated to deliver value to customers and higher returns for shareholders in 2024 and beyond.

Key Financial Metrics and Tables

Key financial metrics such as gross margin, net income, and Adjusted EBITDA are critical for understanding Limbach's operational efficiency and profitability. The increase in gross margin reflects the company's ability to manage costs effectively while increasing profitability. The surge in net income and Adjusted EBITDA demonstrates Limbach's success in executing its business strategy and generating value for shareholders.

Below is a summary of key financial data from Limbach's income statement and balance sheet:

Financial Metric | Q4 2023 | Full Year 2023 |

|---|---|---|

Consolidated Revenue | $142.7 million | $516.4 million |

Gross Profit | $33.3 million | $119.3 million |

Net Income | $5.2 million | $20.8 million |

Diluted EPS | $0.44 | $1.76 |

Adjusted EBITDA | $12.6 million | $46.8 million |

Cash and Cash Equivalents | $59.8 million | |

For a more detailed analysis of Limbach Holdings Inc (NASDAQ:LMB)'s financial performance and future prospects, visit GuruFocus.com.

Explore the complete 8-K earnings release (here) from Limbach Holdings Inc for further details.

This article first appeared on GuruFocus.