Is Limbach Holdings (LMB) Significantly Overvalued?

With a daily loss of 10.96%, a three-month gain of 71.37%, and an Earnings Per Share (EPS) of 1.42, Limbach Holdings Inc (NASDAQ:LMB) presents a complex investment scenario. The question arises: is this stock significantly overvalued? Let's delve into the valuation analysis to unravel the true intrinsic value of Limbach Holdings.

Company Introduction

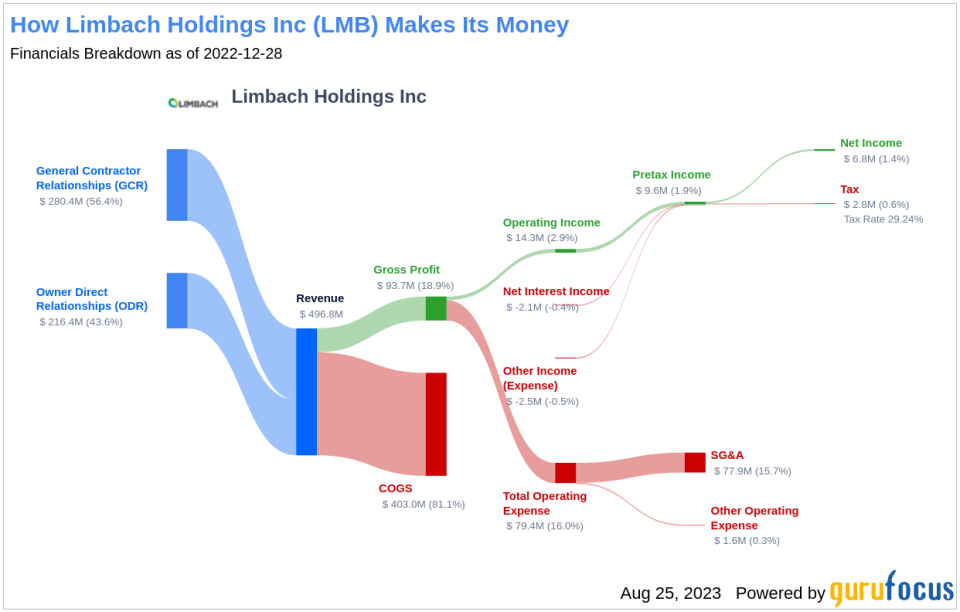

Limbach Holdings Inc is a commercial specialty contractor renowned in the fields of heating, ventilation, air conditioning, plumbing, electrical, and building controls. The company's expertise lies in the design and construction of new and renovated buildings, maintenance services, energy retrofits, and equipment upgrades. It operates through two segments: General Contractor Relationships (GCR) and Owner Direct Relationships (ODR), with the GCR segment generating the maximum revenue.

Despite its current stock price of $32.09, the GF Value, an exclusive GuruFocus estimate of the stock's fair value, stands at a mere $7.15. This stark contrast invites a deeper investigation into the company's valuation.

Understanding GF Value

The GF Value is a unique measure of a stock's intrinsic value, calculated based on historical trading multiples, a GuruFocus adjustment factor, and future business performance estimates. The GF Value Line provides an overview of the stock's fair value. If the stock price significantly surpasses the GF Value Line, it is considered overvalued, indicating poor future returns. Conversely, if the stock price is significantly below the GF Value Line, it suggests higher future returns.

Currently, Limbach Holdings (NASDAQ:LMB) is deemed significantly overvalued based on the GuruFocus Value calculation. With a market cap of $353.10 million, the stock's future return is expected to be much lower than its future business growth due to its overvaluation.

Link: These companies may deliver higher future returns at reduced risk.

Assessing Financial Strength

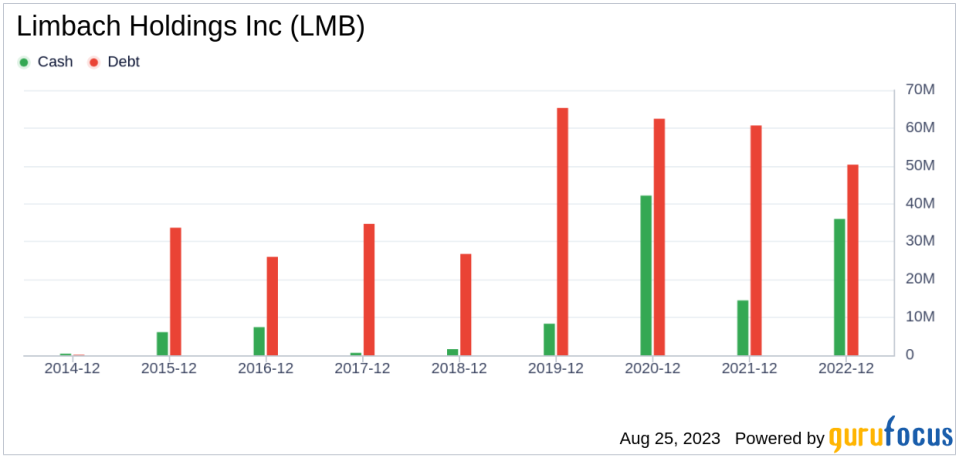

Investing in companies with low financial strength could lead to permanent capital loss. It's crucial to review a company's financial strength before investing. Limbach Holdings has a cash-to-debt ratio of 1.15, ranking better than 62.08% of 1590 companies in the Construction industry. This strong balance sheet earns Limbach Holdings a GuruFocus financial strength rank of 8 out of 10.

Evaluating Profitability and Growth

Investing in profitable companies typically carries less risk. Limbach Holdings has been profitable for 5 years over the past 10 years. With revenues of $511.70 million and Earnings Per Share (EPS) of $1.42 in the past 12 months, its operating margin of 4.96% is better than 50.75% of 1604 companies in the Construction industry. However, the 3-year average annual revenue growth rate of Limbach Holdings is -13.6%, ranking worse than 83.44% of 1546 companies in the Construction industry.

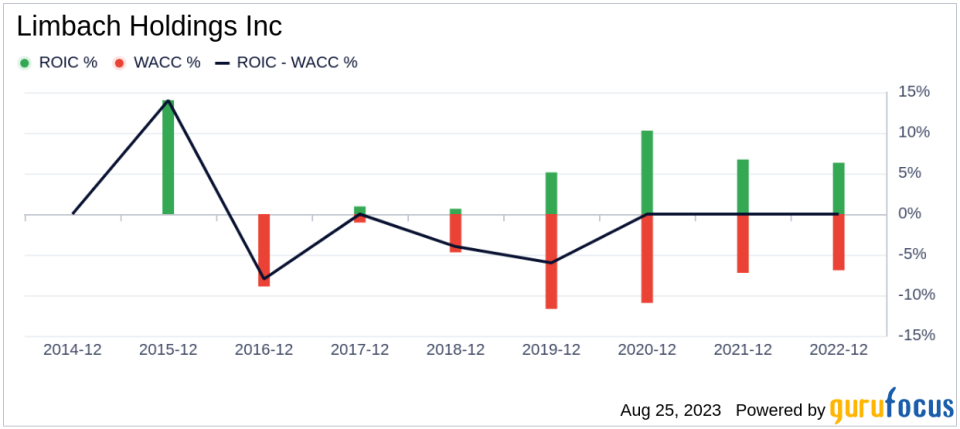

ROIC vs WACC

Comparing a company's Return on Invested Capital (ROIC) to its Weighted Average Cost of Capital (WACC) can provide insights into its profitability. Over the past 12 months, Limbach Holdings's ROIC was 11.87, while its WACC came in at 8.5, indicating the company is creating value for shareholders.

Conclusion

In conclusion, Limbach Holdings (NASDAQ:LMB) appears to be significantly overvalued. Despite its strong financial condition and fair profitability, its growth ranks worse than 58.13% of 1316 companies in the Construction industry. For more details about Limbach Holdings stock, you can check out its 30-Year Financials here.

For high-quality companies that may deliver above-average returns, please check out GuruFocus High Quality Low Capex Screener.

This article first appeared on GuruFocus.