Limbach (LMB) Acquires ACME, Boosts Presence in Chattanooga

Limbach Holdings, Inc. LMB acquired the Chattanooga, TN-based specialty industrial contractor — ACME Industrial Piping, LLC — for an enterprise value of $5 million in cash.

About ACME & Transaction Synergies

ACME specializes in performing industrial maintenance, capital project work and emergency services for specialty chemical and manufacturing clients. Also, it is a leading mechanical solutions provider for hydroelectric producers. It serves industrial customers in the greater Chattanooga market and hydroelectric customers throughout the United States, especially in the Southeast region. ACME is recognized nationally as "The EMTs of the Industrial Market."

ACME’s business model will fortify Limbach’s Owner Direct Relationships ("ODR") segment. ACME expects to contribute $10 million in revenues and more than $1 million in EBITDA annually.

Limbach’s management believes that ACME is a perfect fit with the company’s dynamic mechanical solutions platform, both operationally and culturally. The ODR segment mainly focuses on performing mission-critical work for customers that value immediate access to a trusted partner to help manage and optimize their facility assets. ACME’s niche as a market leader in maintaining and servicing hydroelectric infrastructure will benefit Limbach.

The transaction is likely to close in mid-2023 and is expected to be immaterial on 2023 revenues and earnings. Moreover, the company believes that its immediate focus on integration and driving revenue synergies will yield results in 2024 and beyond.

Stock Performance

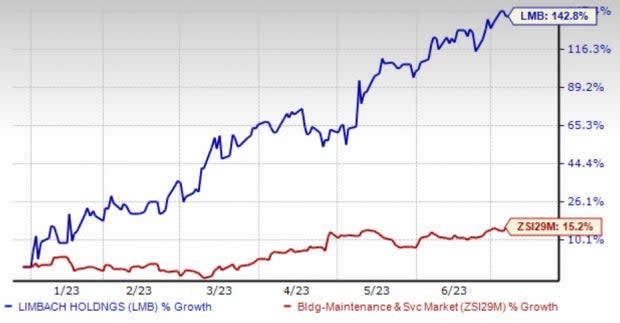

Shares of LMB have gained 142.8% so far this year compared with the Zacks Building Products - Maintenance Service industry’s 47.8% growth.

Image Source: Zacks Investment Research

This Zacks Rank #3 (Hold) company has been banking on solid execution in both its operating segments: ODR and General Contractor Relationships (“GCR”). Also, market conditions remain favorable as businesses in various primary end markets continue to invest in their building assets, such as data centers, hospitals and manufacturing facilities. Additionally, solid cost control measures and tightness in industrial supply chains, aiding ODR by driving demand for service and repair work necessary for customers until new equipment replacement is available, bode well.

For 2023, the company expects revenues within $490-$520 million and adjusted EBITDA in the $33-$37 million range. The Zacks consensus estimates for 2023 revenues of $497.01 million reflect slight growth from a year ago level. Earnings of $1.12 per share reflect 75% growth year over year.

Stocks to Consider

Investors interested in the Zacks Business Services sector can consider the following stocks:

Green Dot GDOT: For second-quarter 2023, the Zacks Consensus Estimate for Green Dot’s revenues suggests a decline of 4.8% year over year to $338.2 million and the same for earnings indicates a 59.5% plunge to 30 cents per share. The company has an impressive earnings surprise history, beating the consensus mark in all the trailing four quarters, the average surprise being 37.3%.

GDOT has a Value Score of A and a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Maximus MMS: For second-quarter 2023, the Zacks Consensus Estimate for Maximus’ revenues suggests an increase of 6.9% year over year to $1.2 billion and the same for earnings indicates a 46.2% rise to $1.14 per share. The company has an impressive earnings surprise history, beating the consensus mark in three instances and missing once, the average surprise being 9.6%.

MMS has a VGM Score of B and sports a Zacks Rank #1.

Rollins ROL: For second-quarter 2023, the Zacks Consensus Estimate for Rollins’ revenues suggests growth of 12.6% year over year to $803.6 million and the same for earnings indicates a 15% increase to 23 cents per share. The company has an impressive earnings surprise history, beating the consensus mark in three of the trailing four quarters and missing once, the average surprise being 5.53%.

ROL currently carries a Zacks Rank #2 and a Growth Score of A.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Green Dot Corporation (GDOT) : Free Stock Analysis Report

Rollins, Inc. (ROL) : Free Stock Analysis Report

Maximus, Inc. (MMS) : Free Stock Analysis Report

Limbach Holdings, Inc. (LMB) : Free Stock Analysis Report