Limbach's (LMB) Stock Skyrockets 32% in 3 Months: Here's How

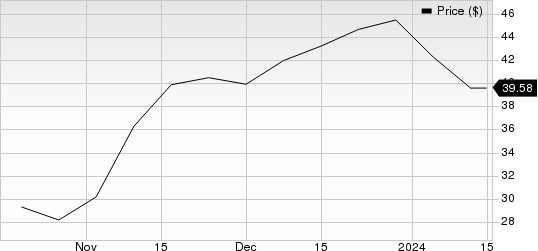

Limbach Holdings, Inc. LMB has had an impressive run over the past three months. The stock has gained 32.2%, outperforming the 16.9% growth of the industry it belongs to and the 8.8% rise of the Zacks S&P 500 composite.

ODR Strength, Acquisition, Strong Liquidity Supporting the Rally

Limbach delivered better-than-expected earnings performance in the past four quarters, driven by the company’s continuous focus on value-added services and solutions.

Limbach Holdings, Inc. Price

This integrated building systems solutions company is benefiting from the strong performance of the Owner Direct Relationships (ODR) segment, offsetting continued softness in the General Contractor Relationships (GCR). ODR revenues in the quarter are being driven by the company’s continued focus on increasing the segment’s contribution to the business. ODR revenues increased 10.3% year over year in the third quarter of 2023. GCR revenues stayed flat.

The recent acquisition of Industrial Air, LLC is expected to significantly strengthen Limbach’s ODR segment, allowing the company to efficiently provide critical solutions to sophisticated manufacturing and process facilities.

Limbach’s current ratio (a measure of liquidity) at the end of third-quarter 2023 was pegged at 1.57, higher than the current ratio of 1.43 reported in the prior-year quarter. The improvement in the current ratio is a welcome development as it implies that the company has enough cash to meet its short-term obligations. A current ratio of more than 1 often indicates that the company will be easily paying off its short-term obligations.

Zacks Rank and Stocks to Consider

Limbach currently carries a Zacks Rank #3 (Hold).

Investors interested in the Zacks Business Services sector can consider the following better-ranked stocks:

Gartner IT: The Zacks Consensus Estimate for Gartner’s 2023 revenues indicates 7.9% growth from the year-ago figure. Its earnings are expected to decline 1.9% year over year. The company beat the consensus estimate in each of the four quarters, with the average surprise being 34.4%.

IT carries a Zacks Rank of 1 (Strong Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Broadridge Financial Solutions BR: The Zacks Consensus Estimate for Broadridge’s fiscal 2024 revenues indicates 7.7% growth from the year-ago figure. Its earnings are expected to grow 10.1% year over year. The company beat the consensus estimate in three of the past four quarters and matched once, with the average surprise being 5.4%.

BR currently carries a Zacks Rank of 2 (Buy).

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Broadridge Financial Solutions, Inc. (BR) : Free Stock Analysis Report

Gartner, Inc. (IT) : Free Stock Analysis Report

Limbach Holdings, Inc. (LMB) : Free Stock Analysis Report