Liminal (LMNL) Up 40% on Buyout Offer From Majority Shareholder

Shares of Liminal BioSciences LMNL surged 40% on Wednesday, after management announced that the company entered into a definitive arrangement agreement with its largest shareholder, Structured Alpha LP ("SALP"), a fund managed by Thomvest Asset Management Ltd.

Per the terms of agreement, SALP will acquire the outstanding shares of Liminal BioSciences’ minority shareholders at $8.50 per share. This $8.50 per share offer ishigher than the first offer of $7.50 received by the company in April. At the time LMNL received this initial offer, SALP owned 64.03% of Liminal’s outstanding common shares.

Following this buyout, the company will go private and delist its common stock from the Canadian and United States stock exchanges. The transaction, which is subject to customary closing conditions and clearance from the regulatory authorities, is expected to be completed by third-quarter 2023.

The board of directors of Liminal BioSciences have given their approval to thistransaction. To ensure that the SALP’s proposal was in the best interest of the company, the directors established a special committee comprising independent directors to evaluate SALP’s proposal and other strategic alternatives. It was after this special committee’s unanimous recommendation to approve SALP’s proposal, Liminal BioSciences entered into an agreement with SALP for the buyout.

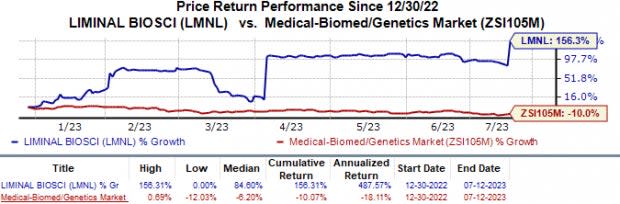

Year to date, shares of Liminal have skyrocketed 156.3% against the industry’s 10.0% decline.

Image Source: Zacks Investment Research

Liminal BioSciencesdoes not have any pipeline candidate in clinical development. Earlier at the onset of this year, management announced that it is seeking opportunities to divest remaining non-core assets to reduce costs, which would enable the company to extend its cash runway beyond early 2024.

The most advanced candidate inLiminal BioSciences’ pipeline is LMNL6511, a GPR84 antagonist, which is expected to enter early-stage clinical development before this year’s end to treat metabolic diseases. Apart from LMNL6511, the company is also developing an OXER1 antagonist as well as a GPR40 antagonist to treat respiratory, skin disease and diabetic conditions

Last year, Liminal BioSciences suffered a major setback when it decided to discontinue the development of its then lead pipeline candidate, fezagepras, which was being developed as a potential nitrogen scavenger. Although there were no safety concerns reported in the study participants administered fezagepras, data from a phase Ia study showed that fezagepras was inferior compared with Sodium Phenylbutyrate as a nitrogen scavenger.

A nitrogen scavenger drug, also called ammonia scavenger drug, helps to remove ammonia from the bloodstream and has been effective in treating urea cycle disorders (UCD).

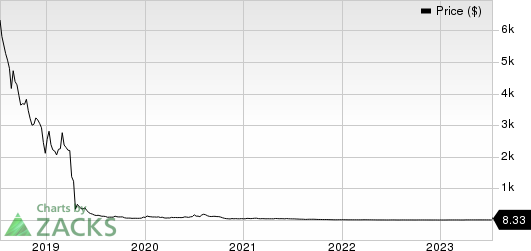

Liminal BioSciences Inc. Price

Liminal BioSciences Inc. price | Liminal BioSciences Inc. Quote

Zacks Rank & Stocks to Consider

Liminal BioSciences currently carries a Zacks Rank #3 (Hold). Some better-ranked stocks in the overall healthcare sector include Adaptimmune Therapeutics ADAP, Alkermes ALKS and Axsome Therapeutics AXSM, each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Estimates for Adaptimmune Therapeutics’ 2023 earnings have narrowed from 63 cents to 48 cents in the past 60 days.

Earnings of Adaptimmune Therapeutics beat estimates in three of the last four quarters and met the mark on one occasion, the average surprise being 36.89%. In the last reported quarter, Adaptimmune delivered a positive earnings surprise of 105.26%.

Estimates for Alkermes’ 2023 earnings have increased from 20 cents to 79 cents in the past 60 days. The earnings estimates for 2024 have also increased from $1.73 to $2.07 in the past 60 days. Shares of Alkermes have risen 14.7% in the year-to-date period.

Earnings of Alkermes beat estimates in three of the last four quarters and met the mark on the one occasion, the average surprise being 90.83%. In the last reported quarter, Alkermes delivered an earnings surprise of 133.33%.

Estimates for Axsome Therapeutics’ 2024 earnings have narrowed from $1.65 to $1.63 in the past 60 days.

Earnings of Axsome Therapeutics beat estimates in three of the last four quarters and missed the mark on one occasion, the average surprise being 22.34%. In the last reported quarter, Axsome delivered an earnings surprise of 80.53%.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Alkermes plc (ALKS) : Free Stock Analysis Report

Adaptimmune Therapeutics PLC (ADAP) : Free Stock Analysis Report

Axsome Therapeutics, Inc. (AXSM) : Free Stock Analysis Report

Liminal BioSciences Inc. (LMNL) : Free Stock Analysis Report