Limoneira Co (LMNR) Reports Modest Revenue Growth Amid Strategic Shift in Q1 FY2024

Revenue Growth: Limoneira Co (NASDAQ:LMNR) reported a 5% increase in net revenues to $39.7 million in Q1 FY2024.

Strategic Business Model Shift: The company's move towards an "asset-lighter" business model resulted in a notable 84% improvement in agribusiness operating loss.

Cost Reduction: Agribusiness costs and expenses decreased by 5%, reflecting the company's cost management efforts.

Real Estate Development: Limoneira Co continues to progress with its Harvest at Limoneira project, with expectations to increase the total number of residential units.

Balance Sheet Strength: Long-term debt stood at $51.4 million as of January 31, 2024, with the company maintaining a net debt position of $51.6 million.

Guidance: The company reiterated its lemon and avocado volume guidance for FY2024, expecting strong organic growth in the coming years.

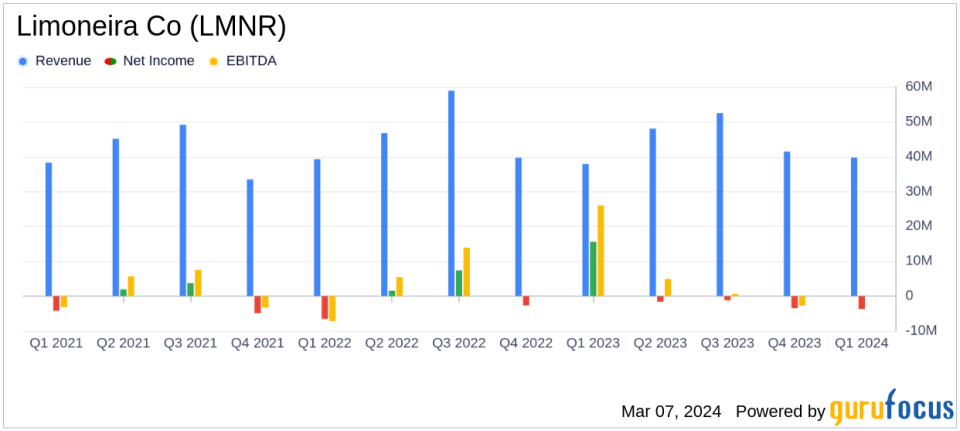

On March 7, 2024, Limoneira Co (NASDAQ:LMNR), a leading agribusiness and real estate development company, released its 8-K filing, detailing financial results for the first quarter of fiscal year 2024. The company, known for its fresh lemons, lemon packing, avocados, and other agribusiness operations, saw a modest increase in net revenues, which rose to $39.7 million, a 5% increase compared to the same period in the previous fiscal year.

Performance and Strategic Shift

Limoneira's strategic shift towards a more "asset-lighter" business model is beginning to bear fruit, as evidenced by the significant improvement in agribusiness operating loss, which improved by 84%. This shift is also reflected in the 5% decrease in agribusiness costs and expenses. The company's President and CEO, Harold Edwards, expressed optimism about the impact of this new model on future operating results.

Despite the positive trend in revenue and cost management, the company faced challenges due to increased rainfall in California, which delayed lemon picking from the first to the second quarter. However, this is not expected to affect the overall harvest or the quality of the fruit. The company also anticipates the avocado harvest to begin in the second quarter, with favorable market conditions due to reduced import pressure.

Financial Achievements and Metrics

Limoneira's financial achievements in the first quarter include an increase in brokered lemons and other lemon sales to $2.9 million and farm management revenue of $2.0 million. These figures are particularly important for a company in the Consumer Packaged Goods industry, as they indicate a diversification of revenue streams and an ability to leverage its agribusiness expertise.

Key financial metrics from the income statement show a net loss applicable to common stock of $3.7 million, or $0.21 per diluted share, compared to a net income of $15.5 million, or $0.84 per diluted share in the first quarter of the previous fiscal year. This decline is primarily due to the gain on the sale of the Northern Properties in the prior year. Adjusted EBITDA improved to a loss of $4.8 million compared to a loss of $7.9 million in the same period of fiscal year 2023.

"We are very encouraged to see the Companys strategic shift towards an 'asset-lighter' business model reflected in our results," said Harold Edwards, President and CEO of Limoneira.

Balance Sheet and Liquidity

Limoneira's balance sheet shows a net cash used in operating activities of $10.3 million, an improvement from $21.2 million in the prior year. The company's long-term debt increased slightly to $51.4 million, up from $40.6 million at the end of fiscal year 2023. The sale of the Northern Properties in the previous year significantly strengthened the company's liquidity position.

Real Estate Development and Guidance

The company's real estate development project, Harvest at Limoneira, is expected to yield approximately 1,500 residential units, with negotiations underway to increase this number to 2,050 units. For fiscal year 2024, Limoneira expects fresh lemon volumes to be in the range of 5.0 million to 5.5 million cartons and avocado volumes to be between 7.0 million to 8.0 million pounds.

Limoneira's first quarter results reflect a company in transition, with a strategic shift towards a more efficient business model that is beginning to show in its financials. While there are challenges ahead, the company's diversified operations and real estate development projects position it for potential growth in the coming years.

For more detailed information and analysis, investors are encouraged to review the full 8-K filing and listen to the conference call scheduled for March 7, 2024.

Explore the complete 8-K earnings release (here) from Limoneira Co for further details.

This article first appeared on GuruFocus.