Lincoln Educational's (NASDAQ:LINC) Q4: Beats On Revenue, Guides For Strong Full-Year Sales

Education company Lincoln Educational (NASDAQ:LINC) reported Q4 FY2023 results beating Wall Street analysts' expectations , with revenue up 11.7% year on year to $102.5 million. The company's full-year revenue guidance of $415 million at the midpoint also came in 8.4% above analysts' estimates. It made a GAAP profit of $0.22 per share, down from its profit of $0.32 per share in the same quarter last year.

Is now the time to buy Lincoln Educational? Find out by accessing our full research report, it's free.

Lincoln Educational (LINC) Q4 FY2023 Highlights:

Revenue: $102.5 million vs analyst estimates of $96.2 million (6.6% beat)

EPS: $0.22 vs analyst expectations of $0.28 (20% miss)

Management's revenue guidance for the upcoming financial year 2024 is $415 million at the midpoint, beating analyst estimates by 8.4% and implying 9.8% growth (vs 8.5% in FY2023)

Gross Margin (GAAP): 60%, up from 57.6% in the same quarter last year

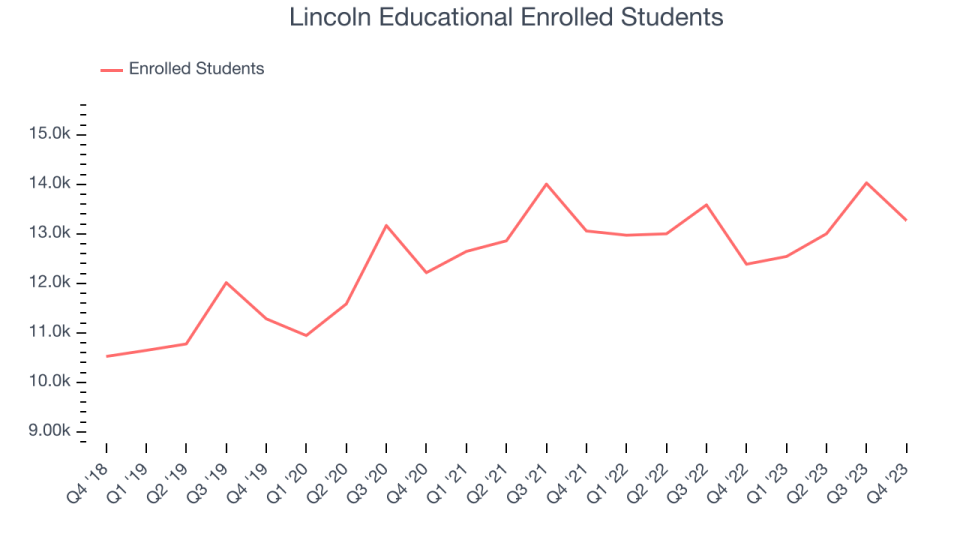

Enrolled Students: 13,270

Market Capitalization: $305.4 million

“Our team is successfully executing our transformative growth strategies, which has led to increased student starts, retention, graduation and placement rates, and allowed us to exceed all of our 2023 guidance metrics,” said Scott Shaw, President & CEO.

Established in 1946, Lincoln Educational (NASDAQ:LINC) is a provider of specialized technical training in the United States, offering career-oriented programs to provide practical skills required in the workforce.

Education Services

A whole industry has emerged to address the problem of rising education costs, offering consumers alternatives to traditional education paths such as four-year colleges. These alternative paths, which may include online courses or flexible schedules, make education more accessible to those with work or child-rearing obligations. However, some have run into issues around the value of the degrees and certifications they provide and whether customers are getting a good deal. Those who don’t prove their value could struggle to retain students, or even worse, invite the heavy hand of regulation.

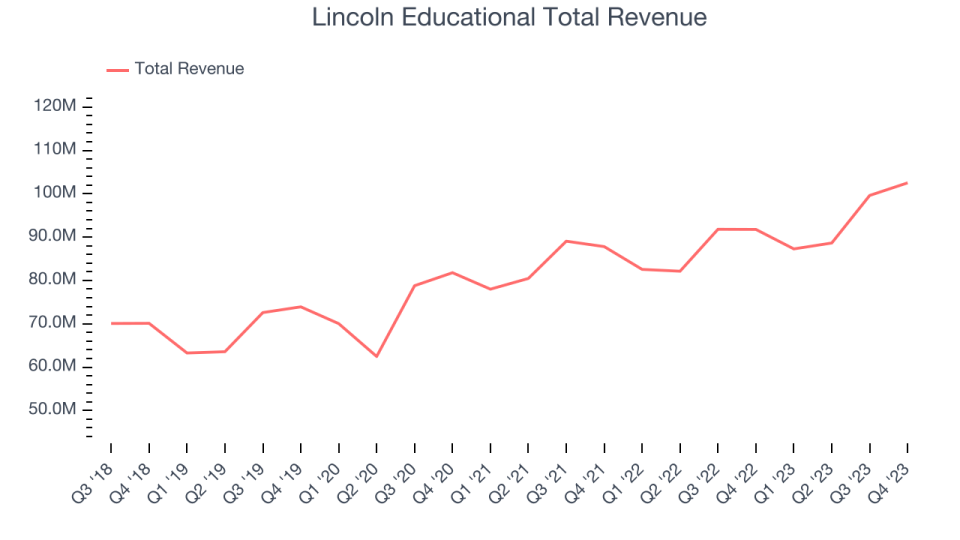

Sales Growth

A company's long-term performance can indicate its business quality. Any business can enjoy short-lived success, but best-in-class ones sustain growth over many years. Lincoln Educational's annualized revenue growth rate of 7.5% over the last five years was weak for a consumer discretionary business.

Within consumer discretionary, product cycles are short and revenue can be hit-driven due to rapidly changing trends. That's why we also follow short-term performance. Lincoln Educational's recent history shows the business has slowed as its annualized revenue growth of 6.2% over the last two years is below its five-year trend.

We can dig even further into the company's revenue dynamics by analyzing its number of enrolled students, which reached 13,270 in the latest quarter. Over the last two years, Lincoln Educational's enrolled students were flat. Because this number is lower than its revenue growth during the same period, we can see the company's average selling price has risen.

This quarter, Lincoln Educational reported robust year-on-year revenue growth of 11.7%, and its $102.5 million of revenue exceeded Wall Street's estimates by 6.6%. Looking ahead, Wall Street expects sales to grow 1.1% over the next 12 months, a deceleration from this quarter.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefitting from the rise of AI, available to you FREE via this link.

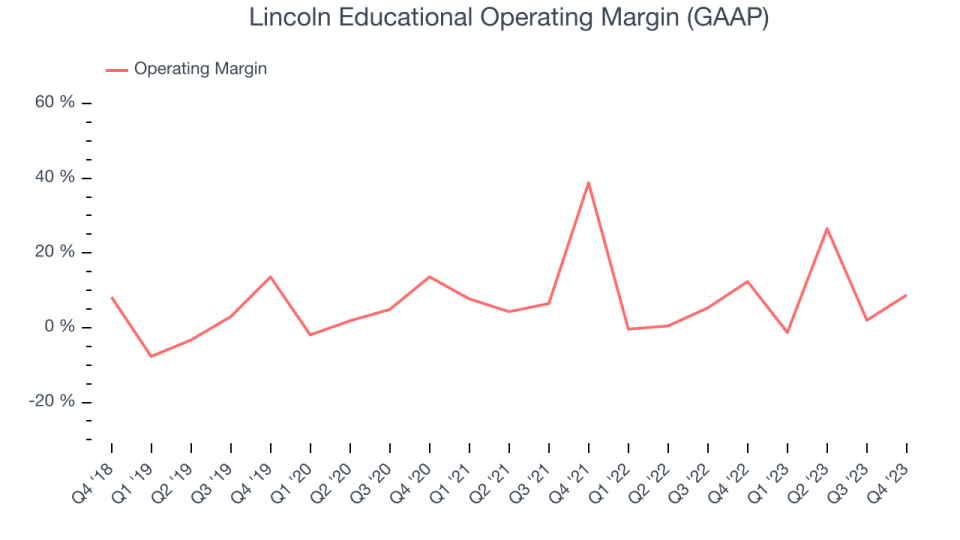

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income–the bottom line–excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Lincoln Educational was profitable over the last eight quarters but held back by its large expense base. It's demonstrated subpar profitability for a consumer discretionary business, producing an average operating margin of 6.8%.

In Q4, Lincoln Educational generated an operating profit margin of 8.7%, down 3.6 percentage points year on year.

Over the next 12 months, Wall Street expects Lincoln Educational to become less profitable. Analysts are expecting the company’s LTM operating margin of 8.8% to decline to 4.6%.

Key Takeaways from Lincoln Educational's Q4 Results

We were impressed by Lincoln Educational's optimistic full-year revenue and EBITDA guidance, which blew past analysts' expectations. We were also excited this quarter's revenue outperformed Wall Street's estimates as its new student starts increased by 16.0%. On the other hand, its EPS unfortunately missed.

During the quarter, the company relocated two campuses, opened a new campus in Houston, Texas, and added Hyundai Genesis to its list of OEM partners. Students have also begun enrolling in its new East Point, Georgia campus with classes expected to commence in March 2024.

Overall, this quarter's results still seemed fairly positive and shareholders should feel optimistic. The stock is up 2.7% after reporting and currently trades at $10 per share.

Lincoln Educational may have had a good quarter, but does that mean you should invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.