Lincoln Electric (LECO) Rallies 54% in a Year: More Room to Run?

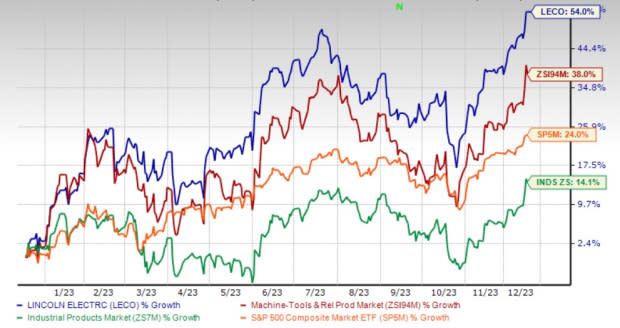

Lincoln Electric Holdings, Inc. LECO has rallied 54% in a year, faring way better than the industry’s 38% growth. The Industrial Products sector has risen 14.1%, while the Zacks S&P 500 composite has moved up 24% in the same time frame.

LECO has a market capitalization of $12.4 billion. The average volume of shares traded in the last three months was 315.2k.

Lincoln Electric currently carries a Zacks Rank #3 (Hold).

Image Source: Zacks Investment Research

Solid Order Levels Bode Well

Lincoln Electric has delivered year-over-year improvement in its top and bottom lines in the last 11 quarters. This performance is impressive considering the inflationary headwinds and supply-chain issues witnessed by the industry at large. LECO has witnessed improving order rates across all end-market sectors, regions and products. The company is witnessing strong quoting activity and record backlogs for equipment systems and automation solutions.

LECO has also been effectively managing to counter raw material inflation through pricing actions and improved productivity. Solid backlog and acquisitions have been aiding the company’s performance as well.

Upbeat Growth Projections

The Zacks Consensus Estimate for the company’s fiscal 2023 earnings per share is currently pegged at $9.17 and suggests year-over-year growth of 11%. The same for 2024 is $9.55 which indicates year-over-year growth of 4%.

The company has a long-term estimated earnings growth rate of 15%.

Focus on Innovation

Lincoln Electric is focused on product development and using digital platforms to engage with customers. The company’s product launches in the automation solutions market are likely to aid growth.

LECO is focused on its new additive services business, which will position it as a manufacturer of large-scale 3D-printed metal spell parts, prototypes and tooling for industrial customers. This is likely to be a growth opportunity for Lincoln Electric. The company has been expanding its geographic and channel reach into attractive areas, such as automation, in sync with its strategy initiatives. It has a robust pipeline of additional product launches and acquisitions.

Strategic Acquisitions

Lincoln Electric is benefiting from several acquisitions. In April 2021, Lincoln Electric acquired Zeman Group’s unit, ZemanBauelemente Produktionsgesellschaftm.b.H., to drive automation growth in structural steel applications and support the company’s Higher Standard 2025 Strategy. The acquisition of Fabricated Tube Products and Shoals positions the Harris Products Group to capitalize on the attractive HVAC growth opportunity as part of its Higher Standard 2025 Strategy.

The company also acquired Sao Paulo-based Kestra, thus expanding its specialty alloy capabilities in South America. Lincoln Electric’s acquisition of Fori Automation is expected to increase its annualized automation portfolio revenues to more than $850 million.

The company is well-poised for growth on the back of a strong product development pipeline, industry-leading position in automation, investments in new technologies like additive, and a solid balance sheet that will support acquisitions.

Strong Balance Sheet to Aid Growth

Lincoln Electric had cash and cash equivalents of around $343 million at the end of the third quarter of 2023 compared with $197 million at 2022 end. The company generated a record $223 million in cash flow from operations in the quarter under review, up 71% year over year. Its total debt-to-total capital ratio was 0.48 as of Sep 30, 2023. The times interest earned ratio was 15.1 as of Sep 30, 2023.

Lincoln Electric has a balanced capital-allocation strategy, prioritizing growth investment while returning cash to shareholders. The company returned approximately $82 million to its shareholders in the third quarter of 2023 through dividends and share repurchases.

Few Headwinds Remain

Lincoln Electric is witnessing inflationary headwinds stemming from escalating labor, freight and raw material costs, which impact its margins. The Harris Products Group’s revenues have been bearing the brunt of lower volumes for the past four quarters, reflecting weak demand. Continued weakness in the retail channel also affected the segment’s margin. There has been an improvement in the retail channel sales in the third quarter on improving -year-ago comparisons and some restocking activity.

Stocks to Consider

Some better-ranked stocks from the Industrial Products sector are Crane Company CR, Applied Industrial Technologies AIT and A. O. Smith Corporation AOS.

CR currently sports a Zacks Rank #1 (Strong Buy), and AIT and AOS each carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Crane Company’s 2023 earnings per share is pegged at $4.18. The consensus estimate for 2023 earnings has been unchanged in the past 60 days. The company has a trailing four-quarter average earnings surprise of 29.8%. CR shares have rallied 40% in a year.

Applied Industrial has an average trailing four-quarter earnings surprise of 15%. The Zacks Consensus Estimate for AIT’s 2023 earnings is pinned at $9.43 per share, which indicates year-over-year growth of 7.8%. Estimates have moved up 4% in the past 60 days. The company’s shares have gained 40% in a year’s time.

The Zacks Consensus Estimate for A. O. Smith’s 2023 earnings is pegged at $3.77 per share. The consensus estimate for 2023 earnings has moved 5% north in the past 60 days and suggests year-over-year growth of 20.1%. The company has a trailing four-quarter average earnings surprise of 14%. AOS shares have gained 41% in the past year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Lincoln Electric Holdings, Inc. (LECO) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Crane Company (CR) : Free Stock Analysis Report