Lincoln (LINC) to Open Second Campus in Atlanta, Aids Expansion

Lincoln Educational Services Corporation’s LINC stock jumped 2.5% after it announced its intention to open a second campus in the metropolitan Atlanta area. Located near Interstate 85, the new campus will be built in a 55,000-square foot area. It will be able to cater to approximately 700 students with training programs in Auto Technology, Electrical & Electronic Systems Technology, Welding, and Heating, Ventilation & Air Conditioning (HVAC).

The new campus, which is likely to open in third-quarter 2023 (subject to obtaining necessary regulatory approvals and timely build-out), will complement Lincoln’s existing Marietta, GA campus.

Lincoln’s hybrid education delivery model will offer greater flexibility for students and faculty. The new campus will likely add a combined 84,000 jobs across Georgia by 2028. Also, it projects that the new campus will generate approximately $20 million in revenue and $5 million in EBITDA within four years of opening.

Scott Shaw, Lincoln’s president and chief executive officer, stated, “As a result of our in-depth market analysis, we’re confident that this market represents a tremendous growth opportunity for Lincoln, area students, and the employers who will seek to hire them upon graduation to ensure their organizations continue to grow. We believe successfully executing our five-year expansion plan will demonstrate our commitment to helping students gain the skills required to achieve rewarding careers and to close the nation’s skills gap.”

He also noted that the United States has been facing a severe shortage of middle-skilled workers. The recent move will help it identify and enter significant markets of opportunity to expand its footprint and grow its business.

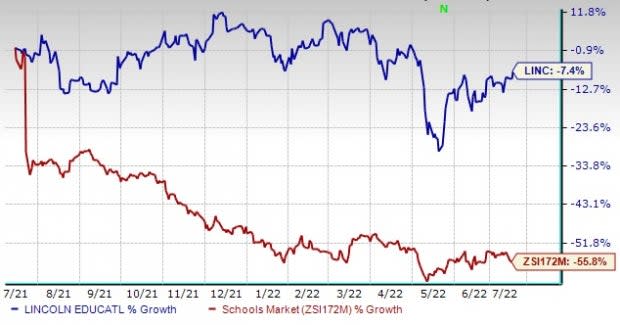

Image Source: Zacks Investment Research

Shares of this Zacks Rank #3 (Hold) company have declined 7.4% compared with the Zacks Schools industry’s 55.8% fall in the past year.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Stocks to Consider

Some better-ranked stocks in the Zacks Consumer Discretionary sector are G-III Apparel Group, Ltd. GIII, Caleres, Inc. CAL and Hilton Worldwide Holdings Inc. HLT.

G-III Apparel sports a Zacks Rank #1. GIII has a trailing four-quarter earnings surprise of 97.5%, on average. The stock has declined 34.9% in the past year.

The Zacks Consensus Estimate for GIII’s current financial year sales and earnings per share (EPS) indicates growth of 12.9% and 10.4%, respectively, from the year-ago period’s reported levels.

Caleres sports a Zacks Rank #1. CAL has a trailing four-quarter earnings surprise of 62.9%, on average. Shares of the company have increased 5.3% in the past year.

The Zacks Consensus Estimate for CAL’s current financial year sales and EPS suggests growth of 4.8% and 0.7%, respectively, from the year-ago period’s levels.

Hilton sports a Zacks Rank #1. HLT has a trailing four-quarter earnings surprise of 20.5%, on average. Shares of the company have declined 9.1% in the past year.

The Zacks Consensus Estimate for HLT’s current financial year sales and EPS suggests growth of 41.1% and 93.3%, respectively, from the year-ago period’s reported levels.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lincoln Educational Services Corporation (LINC) : Free Stock Analysis Report

GIII Apparel Group, LTD. (GIII) : Free Stock Analysis Report

Hilton Worldwide Holdings Inc. (HLT) : Free Stock Analysis Report

Caleres, Inc. (CAL) : Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research