Lincoln National (LNC) Arm Closes Fortitude Re Reinsurance Deal

Lincoln National Corporation’s LNC subsidiary, The Lincoln National Life Insurance Company, has successfully closed a $28 billion reinsurance deal with Fortitude Reinsurance Company, a global multi-line reinsurer.

Lincoln National has reinsured a substantial portion of its universal life insurance and fixed annuity business with Fortitude Re, consistent with their agreement earlier. The company will persist in servicing and administering the reinsured policies, aligning with the terms outlined in the deal struck between the two entities in May 2023.

The reinsurance agreement is anticipated to alleviate pressure on its Life Insurance business, which faced a surge in mortality and morbidity claims due to the COVID-19 pandemic. Elevated spread pressure and reinsurance costs pose additional concerns for the company.

Earlier this month, regulatory authorities granted approval to Lincoln National for the transaction. The deal is expected to decrease its exposure to life insurance in-force long-term assumption risks and decrease invested asset leverage.

The reinsurance deal is poised to enhance the company's risk-based capital ratio and augment annual free cash flow, pivotal for advancing the company's objective of improving financial flexibility. Over the past 12 months, its free cash flow witnessed a substantial 89.3% decline, dwindling to $433 million. This strategic move is expected to reverse this trend in the long run, fortifying its financial position in the coming days.

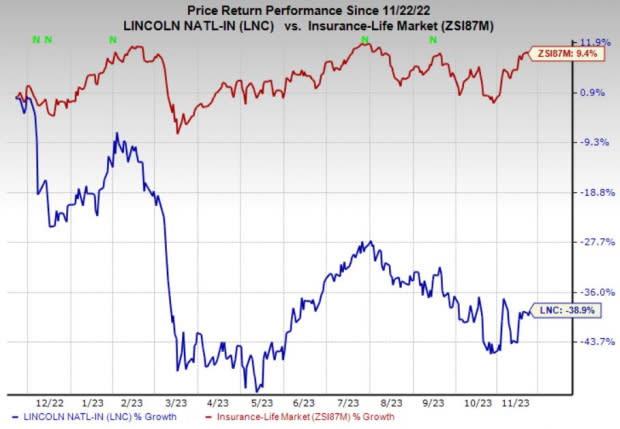

Price Performance

Lincoln National’s shares have plunged 38.9% in the past year against a 9.4% rise in the industry it belongs to.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Lincoln National currently has a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the broader Finance space are Brown & Brown, Inc. BRO, Employers Holdings, Inc. EIG andAssurant, Inc. AIZ, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

The Zacks Consensus Estimate for Brown & Brown’s current-year earnings is pegged at $2.75 per share, which indicates 20.6% year-over-year growth. It has witnessed four upward estimate revisions against none in the opposite direction during the past month. BRO beat earnings estimates in each of the past four quarters, with an average surprise of 12.3%.

The consensus mark for Employers Holdings’ current-year earnings indicates a 17.8% year-over-year increase. It beat earnings estimates in all the past four quarters, with an average surprise of 26.5%. Furthermore, the consensus estimate for EIG’s 2023 revenues suggests 17.5% year-over-year growth.

The Zacks Consensus Estimate for Assurant’s current-year earnings indicates a 27.5% year-over-year increase. It beat earnings estimates in all the past four quarters, with an average surprise of 42.4%. Also, the consensus mark for AIZ’s 2023 revenues suggests 5.4% year-over-year growth.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lincoln National Corporation (LNC) : Free Stock Analysis Report

Assurant, Inc. (AIZ) : Free Stock Analysis Report

Brown & Brown, Inc. (BRO) : Free Stock Analysis Report

Employers Holdings Inc (EIG) : Free Stock Analysis Report