Lincoln National's (LNC) Marketplace to Lower Student Loan Debt

Lincoln National Corporation’s LNC Workplace Solutions unit recently introduced a financial wellness marketplace that will be integrated within WellnessPATH (LNC’s financial wellness tool) from 2023. The marketplace, developed in collaboration with the well-known student debt management platform – Candidly, is meant to provide student debt solutions and add strength to the financial wellness program of Lincoln National.

The newly launched marketplace, available to LNC’s Workplace Solutions clients, will form a part of its benefit and protection product suite. It provides third-party solutions and resources that will provide financial relief to Americans and their families by reducing student loan debt.

The latest move marks yet another investment in financial wellness resources on the part of Lincoln National. Through such investments, it joins forces with nationwide employers to enhance employees’ financial management skills revolving around investing, saving and budgeting. A stable financial future awaits employees who are able to track their financial priorities.

Candidly seems to be the apt partner for LNC in launching a marketplace to bring down student debt and prepare Americans to address future costs. The reason can be attributed to Candidly’s wide array of lucrative services in the form of federal student loan forgiveness programs and applications.

The recent launch seems to be a well-timed move of Lincoln National as a mounting student loan burden has been a problem for Americans for quite some time. According to LNC research, eight in ten workers suffer from some kind of debt, which can be a credit card, mortgage or student loan. Thereby, most of the surveyed employees reported of a favorable impact consequent to using financial wellness resources, with 42% addressing the impact as significant. This highlights the timeliness of the financial wellness marketplace launch.

The Group Protection segment of Lincoln National, through which it distributes non-medical insurance products via employee-paid and employer-paid plans, is expected to receive an impetus as a result of its latest initiative.

Several product launches and upgrades have resulted in a well-diversified product portfolio for LNC. The life insurer remains on a spree to add more components within the workplace benefits offered by employers to employees. This month itself, Lincoln National integrated three benefits related to newborn care, birth center and affiliated facility benefits within the Hospital Indemnity solution to address the unexpected hospitalization expense problem of Americans.

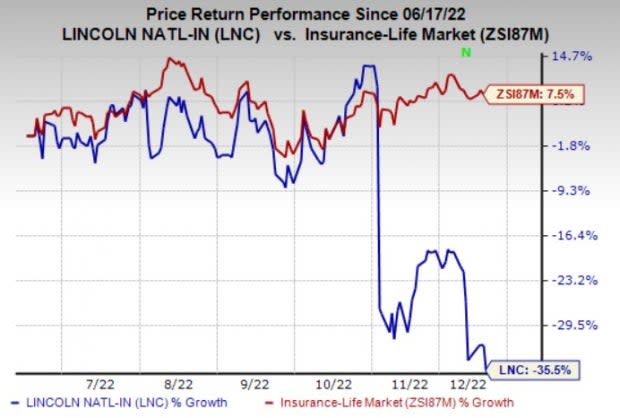

Shares of Lincoln National have lost 35.5% in the past six months against the industry’s 7.5% growth.

Image Source: Zacks Investment Research

Zacks Rank & Key Picks

Lincoln National currently has a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the insurance space are Employers Holdings, Inc. EIG, Reinsurance Group of America, Incorporated RGA and MGIC Investment Corporation MTG. While Employers Holdings sports a Zacks Rank #1 (Strong Buy), Reinsurance Group and MGIC Investment carry a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

Employers Holdings’ earnings surpassed estimates in three of the last four quarters and missed the mark once, the average being 25.31%. The Zacks Consensus Estimate for EIG’s 2022 earnings suggests an improvement of 3.4%, while the same for revenues suggests growth of 7.3% from the respective year-ago reported figures. The consensus mark for EIG’s 2022 earnings has moved 14% north in the past 30 days.

The bottom line of Reinsurance Group outpaced estimates in three of the trailing four quarters and missed the mark once, the average being 49.74%. The Zacks Consensus Estimate for RGA’s 2022 earnings is pegged at $14.97 per share, which indicates a more than 13-fold increase from the prior-year quarter reported number. The same for revenues suggests an improvement of 3.8% from the year-ago reported number. The consensus mark for RGA’s 2022 earnings has moved 4.8% north in the past 30 days.

MGIC Investment’s earnings surpassed estimates in each of the trailing four quarters, the average being 36.34%. The Zacks Consensus Estimate for MTG’s 2022 earnings indicates a rise of 49.7%, while the same for revenues suggests an improvement of 3.8% from the comparable prior-year actuals. The consensus mark for MTG’s 2022 earnings has moved 5.9% up in the past 30 days.

Shares of Employers Holdings, Reinsurance Group and MGIC Investment have gained 5.8%, 23.3% and 10.7%, respectively, in the past six months.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lincoln National Corporation (LNC) : Free Stock Analysis Report

MGIC Investment Corporation (MTG) : Free Stock Analysis Report

Reinsurance Group of America, Incorporated (RGA) : Free Stock Analysis Report

Employers Holdings Inc (EIG) : Free Stock Analysis Report