Linde PLC (LIN) Reports Robust Full-Year and Q4 2023 Results

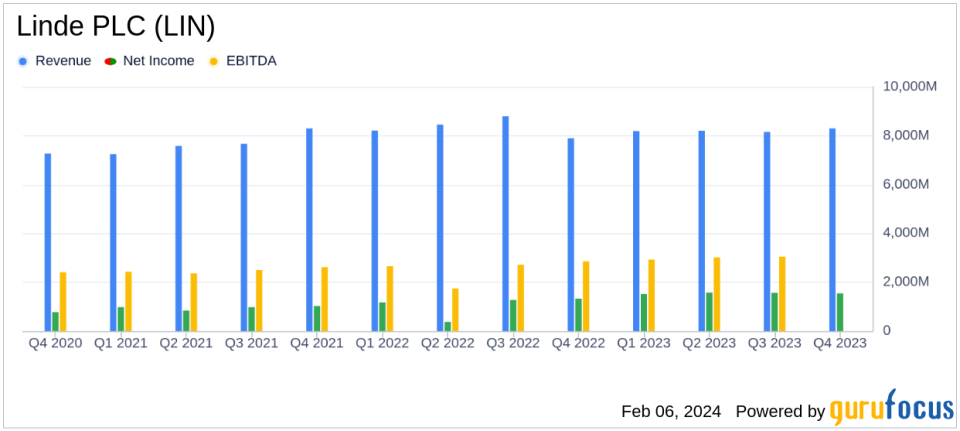

Full-Year Revenue: $32.9 billion with an underlying sales increase of 5%.

Adjusted Operating Profit: $9.1 billion, up 15% from the previous year.

Adjusted EPS: $14.20, a 16% increase year-over-year.

Q4 Sales: $8.3 billion, up 5% year-over-year with underlying sales up 4%.

Q4 Adjusted Operating Profit: $2.3 billion, a 14% increase from the prior year.

2024 Guidance: Adjusted EPS expected to be $15.25 - $15.65, indicating 8%-11% growth excluding FX impacts.

Shareholder Returns: $6.4 billion returned through dividends and share repurchases in 2023.

On February 6, 2024, Linde PLC (NASDAQ:LIN), the world's largest industrial gas supplier, released its 8-K filing, detailing its financial performance for the full year and fourth quarter of 2023. Despite a slight decline in annual sales, the company's underlying sales grew, and it achieved significant gains in operating profit and earnings per share (EPS), both on a reported and adjusted basis.

Linde's operations span over 100 countries, providing atmospheric and process gases, as well as related equipment, to diverse industries such as chemicals, healthcare, and manufacturing. In 2022, Linde generated approximately $33 billion in revenue and a GAAP operating profit of $5.4 billion.

Financial Performance and Challenges

The company faced a challenging environment in 2023, with geopolitical uncertainties and macroeconomic factors impacting the global market. Despite these challenges, Linde's strategic pricing initiatives and productivity measures led to a 5% increase in underlying sales and a significant improvement in operating margins. The adjusted operating profit margin expanded by 390 basis points to 27.6%, reflecting the company's ability to manage costs effectively and improve profitability.

However, the reported 2% decline in full-year sales to $32.9 billion indicates that volume growth has been a challenge, partially offset by a 6% price attainment. This underscores the importance of Linde's continued focus on operational efficiency and strategic pricing in a competitive and uncertain market.

Financial Achievements and Industry Significance

Linde's financial achievements, particularly the 15% increase in adjusted operating profit to $9.1 billion and the 16% rise in adjusted EPS to $14.20, are significant in the chemicals industry. These metrics demonstrate the company's strong pricing power and operational excellence, which are critical for maintaining profitability in the capital-intensive industrial gases sector. Additionally, the total project backlog of $8.5 billion positions Linde for sustained earnings growth, highlighting the company's robust pipeline and future potential.

Key Financial Metrics

The following are key takeaways from Linde's financial statements:

Operating cash flow for the fourth quarter increased by 30% to $2.7 billion, driven by higher earnings and improved working capital management.

Free cash flow after capital expenditures amounted to $1.6 billion for the quarter.

The company's strong balance sheet was further solidified by returning $6.4 billion to shareholders in 2023 through dividends and stock repurchases.

These metrics are crucial as they reflect Linde's ability to generate cash, invest in growth, and return value to shareholders, which are key considerations for value investors.

"Despite the challenging environment in 2023, the Linde team once again delivered industry-leading results including a 25.4% ROC, 27.6% operating margin and EPS growth rate of 16%. In addition, we closed the year with a strong balance sheet and a high-quality project backlog of $8.5 billion which will contribute earnings growth for years to come," said Chief Executive Officer Sanjiv Lamba.

Analysis of Company's Performance

Linde's performance in 2023 was marked by resilience and strategic agility. The company's ability to navigate a complex global landscape while delivering strong financial results is a testament to its operational efficiency and market leadership. The increase in adjusted operating profit and EPS, despite flat volumes, indicates a successful focus on pricing and cost control. The projected growth for 2024, with adjusted EPS guidance indicating further increases, suggests confidence in the company's ability to continue delivering value amidst ongoing uncertainties.

For value investors, Linde's consistent performance, strong cash flow generation, and commitment to shareholder returns make it a compelling investment opportunity. The company's strategic investments and robust project backlog are expected to drive future growth, reinforcing its position as a leader in the industrial gases sector.

For more detailed insights and financial analysis, investors are encouraged to review Linde's full earnings report and join the earnings call or access the webcast through the provided links.

For further information about Linde and its products and services, please visit www.linde.com.

Explore the complete 8-K earnings release (here) from Linde PLC for further details.

This article first appeared on GuruFocus.