Linde's (LIN) Q2 Earnings Beat Estimates on Higher Prices

Linde plc LIN reported second-quarter 2023 adjusted earnings of $3.57 per share, surpassing the Zacks Consensus Estimate of $3.47. The bottom line improved from the year-ago quarter’s profit of $3.10.

Total quarterly revenues of $8,204 million missed the Zacks Consensus Estimate of $8,639 million and declined from the year-ago quarter’s $8,457 million.

Strong quarterly earnings were driven by higher pricing from the Americas segment. Lower volumes from the EMEA business unit offset the positives partially.

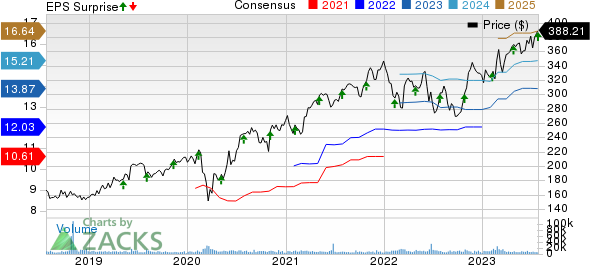

Linde PLC Price, Consensus and EPS Surprise

Linde PLC price-consensus-eps-surprise-chart | Linde PLC Quote

Segmental Highlights

The operating profit of Linde in the Americas segment was up 17.6% year over year to $1,070 million and met the Zacks Consensus Estimate on increased pricing.

Linde’s profit in the EMEA segment increased 17.5% year over year to $630 million and beat the Zacks Consensus Estimate of $608 million due to an uptick in pricing, partially nullified by a decrease in volumes.

Profit in the APAC segment increased 10.8% year over year to $472 million and beat the Zacks Consensus Estimate of $449 million on an uptick in prices and volumes, primarily in the chemicals, electronics and energy end markets, comprising project start-ups.

Operating profit in the Engineering segment increased to $107 million from the prior year’s $105 million and surpassed the Zacks Consensus Estimate of $92 million.

Backlogs

At the end of the second quarter, the company’s high-quality backlog was $7.8 billion, comprising a sale-of-gas backlog of $4.4 billion.

Capital Investment & Balance Sheet

Linde reported capital expenditure of $859 million for the June quarter. The company ended the quarter with cash and cash equivalents of $3.4 billion. Linde’s long-term debt was $13.5 billion.

Guidance

For the September-end quarter, Linde projects adjusted earnings per share between $3.48 and $3.58. For 2023, it projects adjusted earnings per share of $13.80-$14.00.

The company expects capital expenditure of $3.5-$4 billion for the year.

Zacks Rank & Key Picks

Currently, Linde carries a Zacks Rank #3 (Hold). Better-ranked players in the basic material space include ATI ATI, Golden Minerals Company AUMN and Avino Silver & Gold Mines Ltd. ASM. All the stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

ATI is a leading producer of excellent quality materials for the aerospace and defense markets across the globe. In the past 30 days, ATI has witnessed upward earnings estimate revisions for 2023.

Golden Minerals is a leading producer of gold and silver. In 2023, AUMN is likely to see bottom-line growth of 99.3%.

Avino Silver & Gold is a leading producer of silver and focuses on profitable organic growth projects to create long-term value for shareholders.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

ATI Inc. (ATI) : Free Stock Analysis Report

Golden Minerals Company (AUMN) : Free Stock Analysis Report

Linde PLC (LIN) : Free Stock Analysis Report

Avino Silver (ASM) : Free Stock Analysis Report