Lindsay (LNN) Q1 Earnings Beat Estimates, Revenues Miss

Lindsay Corporation LNN delivered earnings per share of $1.36 in first-quarter fiscal 2024 (ended Nov 30, 2023), beating the Zacks Consensus Estimate of $1.26. The bottom line, however, declined 17.6% year over year.

Lindsay generated revenues of $161.4 million, down 8.4% from the $176 million reported in the year-ago quarter. The top line missed the Zacks Consensus Estimate of $162.6 million.

The company’s backlog as of Nov 30, 2023, was around $87 million compared with roughly $130 million as of Nov 30, 2022. Our model predicted the backlog to be $96 million for the quarter.

Lindsay Corporation Price, Consensus and EPS Surprise

Lindsay Corporation price-consensus-eps-surprise-chart | Lindsay Corporation Quote

Operational Update

The cost of operating revenues decreased 9.5% year over year to around $111 million. The gross profit decreased 5.9% to roughly $50 million from the year-earlier quarter. The gross margin was 30.9% compared with the year-ago quarter’s 30.1%.

Operating expenses were around $29 million in the fiscal first quarter, up 1.4% year over year. Operating income was roughly $21 million, down from the prior-year quarter’s around $25 million.

Segmental Results

The Irrigation segment’s revenues fell 7.8% year over year to around $140 million in the fiscal first quarter. We projected revenues of $143 million for the quarter. North America irrigation revenues improved 6.5% from the year-ago quarter to roughly $89 million due to higher unit sales volume. The International irrigation segment’s revenues fell 25.5% year over year to around $51 million.

The irrigation segment’s operating income fell 11.6% year over year to $25.3 million. Our estimate for the segment’s operating income was $24.2 million.

The Infrastructure segment’s revenues decreased 12% year over year to roughly $21 million. The downside was driven by lower Road Zipper System sales, offset by higher Road Zipper System lease revenues and increased sales of road safety products. Our model predicted the segment’s revenues to be $20.7 million in the quarter. The segment reported an operating income of $3.6 million, up 7.3% year over year. We expected an operating income of $2.4 million.

Financial Position

Lindsay had cash and cash equivalents of roughly $159 million at the end of the first quarter of fiscal 2024 compared with $99 million as of Nov 30, 2022. The company’s long-term debt stood at around $115 million as of Nov 30, 2023, flat with that reported on Nov 30, 2022.

Outlook

The company anticipates sales volume levels in established international markets, particularly Brazil, to improve throughout the remainder of the year. The company's infrastructure business is beginning to benefit from rising infrastructure spending in the United States, particularly in Road Zipper System leasing and sales of road safety equipment. It also continues to actively manage projects through the Road Zipper System project sales funnel, but project implementation timing remains difficult to estimate.

LNN continues to see project potential in the developing markets, boosted by global concerns about food security and grain supplies.

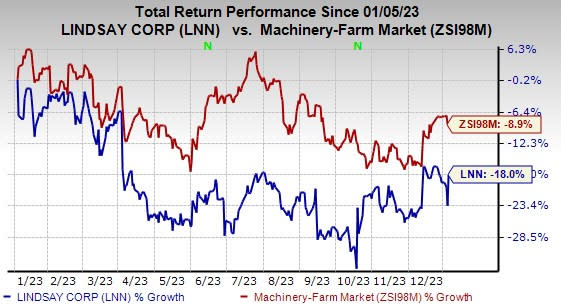

Price Performance

Lindsay’s shares have lost 18% in the past year compared with the industry’s fall of 8.9%.

Image Source: Zacks Investment Research

Zacks Rank & Stocks to Consider

LNN currently carries a Zacks Rank #4 (Sell).

Some better-ranked stocks from the Industrial Products sector are Alamo Group Inc. ALG, Applied Industrial Technologies AIT and A. O. Smith Corporation AOS. ALG currently sports a Zacks Rank #1 (Strong Buy), and AIT and AOS carry a Zacks Rank #2 (Buy). You can see the complete list of today's Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for Alamo Group’s 2023 earnings per share is pegged at $11.59. The consensus estimate for 2023 earnings has moved north by 5% in the past 60 days. The company has a trailing four-quarter average earnings surprise of 19.8%. ALG shares have rallied 47.6% year to date.

Applied Industrial has an average trailing four-quarter earnings surprise of 13.9%. The Zacks Consensus Estimate for AIT’s 2023 earnings is pinned at $9.43 per share, which indicates year-over-year growth of 7.8%. Estimates have moved up 2% in the past 60 days. The company’s shares have gained 37.7% in a year.

The Zacks Consensus Estimate for A. O. Smith’s 2023 earnings is pegged at $3.77 per share. The consensus estimate for 2023 earnings has moved 1% north in the past 60 days and suggests year-over-year growth of 20.4%. The company has a trailing four-quarter average earnings surprise of 14%. AOS shares have gained 40.8% in a year.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

Lindsay Corporation (LNN) : Free Stock Analysis Report

A. O. Smith Corporation (AOS) : Free Stock Analysis Report

Applied Industrial Technologies, Inc. (AIT) : Free Stock Analysis Report

Alamo Group, Inc. (ALG) : Free Stock Analysis Report