Lineage Cell Therapeutics Inc. Reports Q4 and Full Year 2023 Financial Results

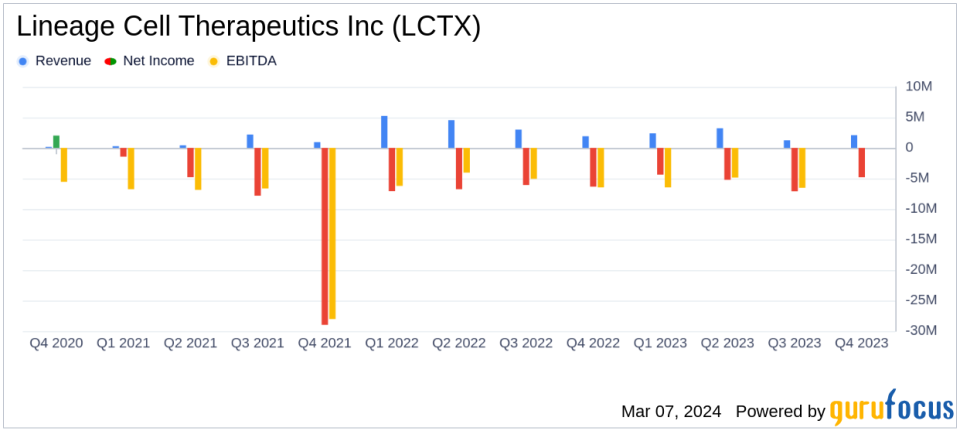

Revenue: Q4 revenues increased to $2.1 million, up from $1.9 million in the same period last year.

Operating Expenses: Q4 operating expenses decreased to $8.2 million, down from $8.5 million in Q4 2022.

Net Loss: Q4 net loss improved to $4.8 million, or $0.03 per share, compared to a net loss of $6.4 million, or $0.03 per share, in the prior year.

Cash Position: Cash, cash equivalents, and marketable securities totaled $35.5 million as of December 31, 2023.

Full Year Revenue: Full year revenues were $8.9 million, a decrease from $14.7 million in the previous year.

Full Year Net Loss: Full year net loss was $21.5 million, or $0.12 per share, an improvement from a net loss of $26.3 million, or $0.15 per share, in 2022.

On March 7, 2024, Lineage Cell Therapeutics Inc (LCTX) released its 8-K filing, detailing the financial results for the fourth quarter and full year of 2023, along with a comprehensive business update. The clinical-stage biotechnology company, known for its innovative cell therapies for degenerative diseases, has reported a mix of financial achievements and challenges in the past year.

Financial Performance and Business Highlights

Lineage Cell Therapeutics Inc. has seen a slight increase in its Q4 revenues, which rose to approximately $2.1 million, compared to $1.9 million in the same period of the previous year. This increase is primarily attributed to collaboration revenues and royalties. However, the company's full year revenues saw a significant decrease, primarily due to lower collaboration and licensing revenue recognized from deferred revenues under the collaboration and license agreement with Roche.

Operating expenses for Q4 showed a marginal decrease to $8.2 million from $8.5 million in the same quarter of the previous year. This was a result of reduced research and development costs, particularly in the OpRegen program and other research and development expense programs. The company's net loss for the quarter improved to $4.8 million, or $0.03 per share, compared to a net loss of $6.4 million, or $0.03 per share, for the same period in 2022. For the full year, the net loss was $21.5 million, or $0.12 per share, an improvement from the previous year's net loss of $26.3 million, or $0.15 per share.

Strategic Developments and Future Outlook

Throughout 2023, Lineage Cell Therapeutics Inc. has made significant strides in advancing its clinical and preclinical pipeline. The company's CEO, Brian M. Culley, highlighted the importance of their partnership with Roche and Genentech in supporting the ongoing Phase 2a clinical study of OpRegen in patients with geographic atrophy secondary to age-related macular degeneration (AMD). The company also reported the clearance of an Investigational New Drug Amendment for OPC1, which will allow the initiation of a new clinical trial for spinal cord injury patients.

The company's balance sheet remains robust, with cash, cash equivalents, and marketable securities totaling $35.5 million as of December 31, 2023. The recent financing activities, including a $14 million registered direct offering, are expected to support operations into the third quarter of 2025.

Lineage Cell Therapeutics Inc. is poised to continue its mission of developing novel cell therapies for unmet medical needs. The company's inclusion in the Russell 3000 Index and the establishment of the 1st Annual Spinal Cord Injury Investor Symposium are indicative of its growing presence in the biotechnology industry.

Investors and stakeholders are encouraged to join the conference call hosted by Lineage Cell Therapeutics Inc. to discuss these results and receive further business updates.

Conclusion

Lineage Cell Therapeutics Inc. has demonstrated a commitment to advancing its cell therapy programs and maintaining a solid financial position. While the company faces the typical challenges of clinical-stage biotech companies, such as the need for continued funding and successful clinical trial outcomes, its strategic collaborations and recent financial achievements provide a foundation for future growth and development.

For detailed financial tables and further information, interested parties can refer to the full 8-K filing linked above.

Explore the complete 8-K earnings release (here) from Lineage Cell Therapeutics Inc for further details.

This article first appeared on GuruFocus.