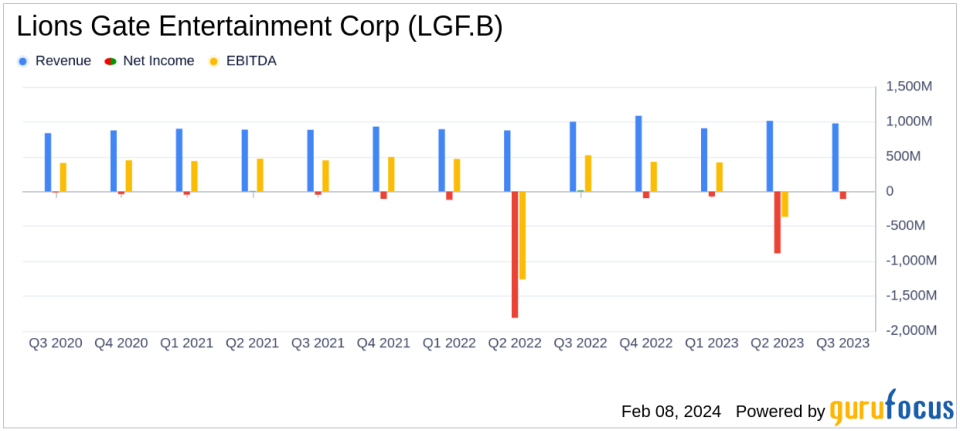

Lions Gate Entertainment Corp (LGF.B) Faces Operating Loss Despite Revenue of $975. ...

Revenue: Reported at $975.1 million for the quarter.

Operating Loss: Recorded an operating loss of $43.5 million.

Net Loss: Net loss attributable to Lionsgate shareholders was $106.6 million.

Adjusted Net Income: Stood at $65.0 million, showcasing a more positive aspect of the earnings.

Adjusted OIBDA: Achieved $150.9 million, indicating underlying business strength.

Subscriber Growth: STARZ gained 700K North American OTT subscribers sequentially during the quarter.

Strategic Investments: The acquisition of eOne and expansion with 3 Arts are expected to bolster future growth.

Lions Gate Entertainment Corp (NYSE:LGF.B) released its 8-K filing on February 8, 2024, revealing a mixed financial picture for the third quarter of fiscal year 2024. The company, which operates in the entertainment industry with a focus on Motion Picture, Television Production, and Media Networks, reported a substantial revenue of $975.1 million. However, it faced an operating loss of $43.5 million and a net loss attributable to shareholders of $106.6 million, or $0.45 diluted net loss per share. Despite these challenges, adjusted net income stood at $65.0 million, or $0.27 adjusted diluted earnings per share, and adjusted OIBDA was reported at $150.9 million.

The company's Television Production segment, which generates the maximum revenue, saw a decrease in both revenue and segment profit due to the impact of strikes on episodic deliveries and the comparison with the prior year's licensing of 'Schitts Creek'. Conversely, the Motion Picture segment experienced a 53% revenue increase to $443.2 million and a 31% increase in segment profit to $100.4 million, driven by strong box office performances and ancillary market strength.

Media Networks segment revenue increased by 10% year-over-year to $417.2 million, with segment profit growing by 73% to $85.5 million. This growth was attributed to the increase in domestic streaming revenue and LIONSGATE+ revenue, despite a decline in domestic linear revenue.

Lionsgate CEO Jon Feltheimer commented on the quarter's results, stating:

"Were pleased to report another strong financial quarter in which the performance of our diversified businesses gives us confidence that we can continue to deliver the growth our investors expect."

The company's strategic investments, including the acquisition of eOne and the expansion of its partnership with 3 Arts, are expected to enhance the strength of its businesses moving forward. Additionally, the plan to launch Lionsgate Studios as an independent, publicly-traded pure play content company is anticipated to contribute to future growth.

Lions Gate Entertainment Corp (NYSE:LGF.B) ended the quarter with $283 million in unrestricted cash and a studio backlog from the Motion Picture and Television Production segments of $1.6 billion. The company's financial achievements, such as the adjusted OIBDA and subscriber growth, are crucial for its stability and growth in the competitive Media - Diversified industry.

Investors and analysts will continue to monitor Lions Gate Entertainment Corp (NYSE:LGF.B)'s performance closely, especially in light of the operating loss and net loss reported this quarter. The company's ability to convert strategic investments and subscriber growth into sustained profitability will be key to its success moving forward.

Explore the complete 8-K earnings release (here) from Lions Gate Entertainment Corp for further details.

This article first appeared on GuruFocus.