Lionsgate (LGF.A) Q4 Earnings Beat Estimates, Revenues Rise

Lionsgate (LGF.A) reported adjusted earnings of 21 cents per share for the fourth quarter of fiscal 2023, surpassing the Zacks Consensus Estimate of 1 cent per share. The company reported earnings of 6 cents in the year-ago quarter.

Revenues increased 17% year over year to $1.1 billion and beat the consensus mark by 11.37%.

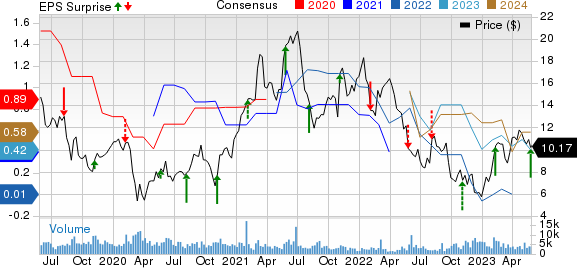

Lions Gate Entertainment Corp. Price, Consensus and EPS Surprise

Lions Gate Entertainment Corp. price-consensus-eps-surprise-chart | Lions Gate Entertainment Corp. Quote

Segment Details

Motion Picture (48.3% of revenues) revenues increased 85% year over year to $532.1 million. The segment generated a profit of $93.8 million, up 89% year over year.

Television Production (26.5% of revenues) revenues decreased 21.2% year over year to $291.5 million. Segmental profit was $28.8 million, down 12.9% year over year.

The Media Networks segment (35% of revenues) reported revenues of $389 million, up 2.3% year over year. Segmental profit increased 122% to $73.3 million.

Starz Networks’ revenues decreased 0.7% year over year to $347.1 million.

LIONSGATE+ revenues in the quarter rose 37.3% year over year to $41.9 million.

Total global subscribers, including STARZPLAY Arabia (a non-consolidated equity method investee), decreased sequentially to 30.3 million, primarily due to linear and OTT pressures domestically.

Excluding the international subscribers in the seven markets that LIONSGATE+ is exiting, total global subscribers were up 3.4% year over year but down sequentially to 29.7 million.

Operating Details

Lionsgate’s adjusted OIBDA increased 67% year over year to $138 million in the reported quarter.

Direct operating expenses, as a percentage of revenues, contracted 850 basis points (bps) to 53.6%.

Distribution and marketing expenses, as a percentage of revenues, contracted 280 bps to 21.6%.

Moreover, general & administrative expenses, as a percentage of revenues, expanded 450 bps year over year to 17.6%.

The company reported an operating loss of $49.6 million in the reported quarter, up 1.5% from the year-ago quarter.

Balance Sheet & Cash Flow

As of Mar 31, 2023, Lionsgate had cash and cash equivalents of $272.1 million compared with $425.4 million as of Dec 31, 2022.

Net cash flow provided by operating activities was $13.6 million at the end of the fiscal fourth quarter compared with $11.4 million of cash flow used at the end of the previous quarter.

Adjusted free cash flow was negative $36.7 million against a free cash flow of $30 million in the previous quarter.

Zacks Rank & Stocks to Consider

Lionsgate currently carries a Zacks Rank #5 (Strong Sell).

Some better-ranked stocks in the Consumer Discretionary sector are Reservoir Media RSVR and H World Group Ltd HTHT, each carrying a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Reservoir Media and H World Group Ltd are scheduled to report quarterly results on May 31 and May 29, respectively.

The Zacks Consensus Estimate for RSVR’s first-quarter 2023 earnings is pegged at 6 cents per share, which has remained unchanged over the past 30 days.

The Zacks Consensus Estimate for HTHT’s first-quarter 2023 earnings is pegged at 12 cents per share, up by 2 cents over the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

H World Group Ltd (HTHT) : Free Stock Analysis Report

Lions Gate Entertainment Corp. (LGF.A) : Free Stock Analysis Report

Reservoir Media, Inc. (RSVR) : Free Stock Analysis Report