Liquidia Corp (LQDA) Reports Full Year 2023 Financial Results

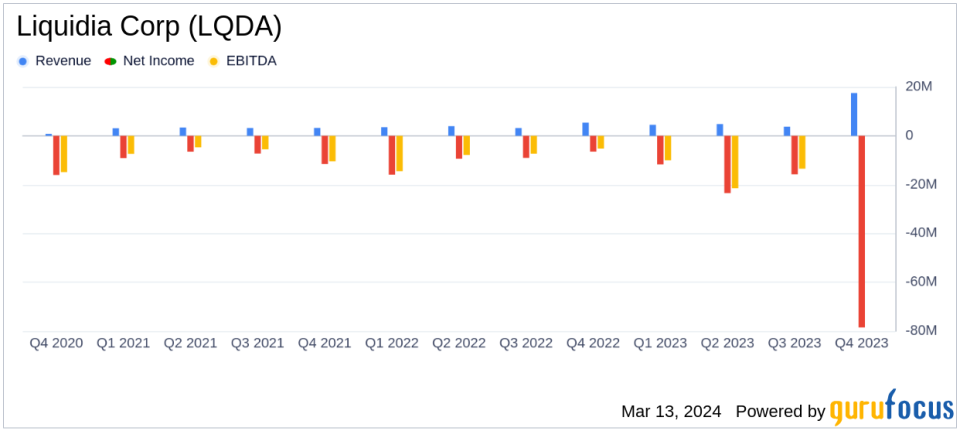

Revenue: Increased to $17.5 million for the year ended December 31, 2023, up from $15.9 million in the previous year.

Net Loss: Widened to $78.5 million, or $1.21 per share, compared to a net loss of $41.0 million, or $0.67 per share, in the previous year.

Cash Position: Cash and cash equivalents stood at $83.7 million as of December 31, 2023.

Research and Development Expenses: Increased significantly to $43.2 million, driven by upfront license fee payment and increased manufacturing activities.

General and Administrative Expenses: Rose to $44.7 million, reflecting preparations for the potential commercialization of YUTREPIA.

Corporate Updates: Awaiting final FDA approval of YUTREPIA for PAH and PH-ILD, with favorable court decisions supporting the company's position.

Liquidia Corp (NASDAQ:LQDA) released its 8-K filing on March 13, 2024, detailing its financial performance for the full year ended December 31, 2023, and providing a corporate update. The company, a leader in the biopharmaceutical industry, is focused on developing and commercializing products for pulmonary hypertension (PH) and leveraging its proprietary PRINT technology.

Fiscal Summary and Performance Insights

The year 2023 saw Liquidia Corp (NASDAQ:LQDA) increase its revenue to $17.5 million, a modest rise from the previous year's $15.9 million. This growth was primarily attributed to favorable adjustments in gross-to-net chargebacks, rebates, and managed care, despite a decrease in sales quantities. However, the company's net loss expanded significantly to $78.5 million, or $1.21 per share, from a net loss of $41.0 million, or $0.67 per share, in the previous year. This increase in net loss was largely due to a substantial rise in research and development expenses, which jumped to $43.2 million from $19.4 million, driven by a $10.0 million upfront license fee for L606 and increased activities related to YUTREPIA.

General and administrative expenses also saw a significant uptick, reaching $44.7 million, up from $32.4 million in the prior year. This increase was primarily due to higher personnel and consulting expenses, including stock-based compensation, and heightened commercial expenses in anticipation of YUTREPIA's potential market launch.

Balance Sheet and Cash Flow Considerations

Liquidia's cash and cash equivalents totaled $83.7 million as of December 31, 2023. The company's total assets were reported at $118.3 million, with total liabilities at $71.0 million, and an accumulated deficit of $429.1 million. The balance sheet reflects the company's strategic financial initiatives, including a private placement of common stock and an amendment to the Revenue Interest Financing Agreement (RIFA) with HealthCare Royalty Partners, bringing in an additional $100 million of gross proceeds.

Strategic Corporate Developments

CEO Roger Jeffs commented on the company's readiness to launch YUTREPIA following favorable court decisions and the expiration of Tyvaso's market exclusivity. Jeffs expressed confidence in YUTREPIA's potential as a best-in-class inhaled product for the treatment of PAH and PH-ILD. The company is also advancing its portfolio with the ASCENT study for YUTREPIA and preparing for a Phase 3 efficacy trial for L606.

Based on our success last year, we are preparing to become a full-scale commercial entity in 2024 and initiate meaningful change to the lives of patients diagnosed with PAH and PH-ILD," said Roger Jeffs, Liquidias Chief Executive Officer.

The company's strategic focus and the anticipation of YUTREPIA's approval underscore the importance of its financial achievements and the potential impact on the biotechnology industry. With a robust pipeline and strategic partnerships, Liquidia Corp (NASDAQ:LQDA) is poised to make significant strides in addressing unmet patient needs in pulmonary hypertension.

For more detailed information on Liquidia Corp's financial results and corporate updates, investors and interested parties are encouraged to review the full 8-K filing.

Investors and media inquiries can be directed to Jason Adair, Chief Business Officer, at jason.adair@liquidia.com, or through the company's media inquiries channel at media@liquidia.com.

Explore the complete 8-K earnings release (here) from Liquidia Corp for further details.

This article first appeared on GuruFocus.