Liquidity Services Inc Reports Mixed Q1 Fiscal 2024 Results Amidst Growth and Challenges

Gross Merchandise Volume (GMV): Increased by 13% to $305.9 million.

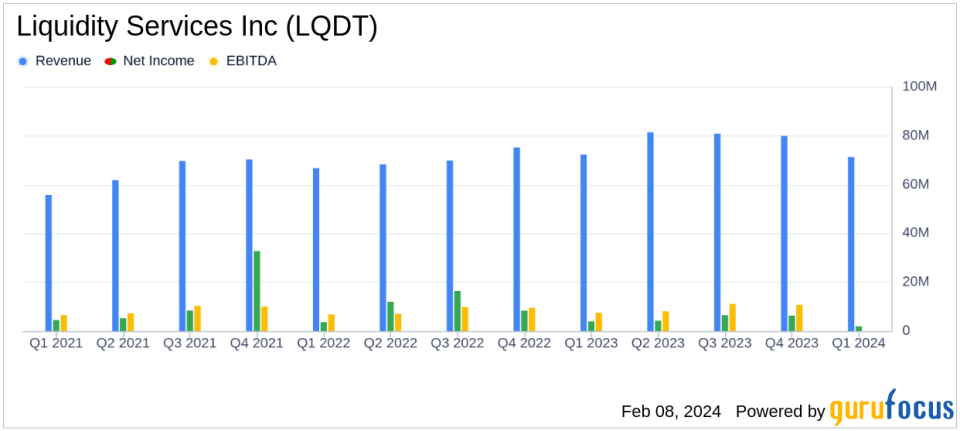

Revenue: Slight decrease of 1% to $71.3 million.

GAAP Net Income: Decreased to $1.9 million, down $2.1 million from the previous year.

GAAP Diluted Earnings Per Share (EPS): Dropped to $0.06, a decrease of $0.06.

Non-GAAP Adjusted EBITDA: Fell by $2.6 million to $7.3 million.

Cash Position: Strong with $107.0 million in cash balances and zero financial debt.

Market Capitalization: Not disclosed in the summary provided.

Liquidity Services Inc (NASDAQ:LQDT), a leader in the online auction marketplace for business and government surplus, released its 8-K filing on February 8, 2024, detailing its financial results for the first quarter of fiscal year 2024. The company reported a 13% increase in GMV, driven by strong bidder engagement and subscriber growth, particularly in its GovDeals and Machinio segments. However, revenue saw a slight decrease of 1% to $71.3 million, and profitability metrics such as GAAP Net Income and Non-GAAP Adjusted EBITDA experienced declines compared to the same quarter in the previous year.

Company Overview

Liquidity Services Inc operates a network of e-commerce marketplaces that facilitate transactions between buyers and sellers in an efficient, automated environment. The company's segments include GovDeals, Capital Assets Group (CAG), Retail Supply Chain Group (RSCG), and Machinio. The RSCG segment, which deals with the sale of overstocked consumer goods, generates the majority of the company's revenue, primarily in the United States.

Performance and Challenges

The company's GMV growth was led by the GovDeals segment, which benefited from strong bidder engagement on the updated GovDeals.com platform. The Machinio segment also recorded strong subscriber growth due to the Machinio System dealer management software solutions. However, growth and profitability in the RSCG and CAG segments were affected by an inferior product mix and delays in selected international sales events, respectively. Despite these challenges, Liquidity Services expects an improvement in the RSCG product mix and the closure of delayed projects in the CAG segment in the fiscal second quarter.

Financial Achievements and Importance

The company's strong cash position, with $107.0 million in cash balances and no financial debt, is a significant achievement, especially for a company in the Retail - Cyclical industry where cash flow management is crucial for operations and investment in growth opportunities. This solid financial footing is important for sustaining operations and pursuing strategic acquisitions, such as the recent acquisition of Sierra Auction, which is expected to strengthen Liquidity Services' position in the market.

Key Financial Details

The financial results for the first quarter of fiscal year 2024 included a GMV of $305.9 million, a 13% increase from the previous year. Revenue was slightly down at $71.3 million, a 1% decrease. GAAP Net Income was reported at $1.9 million, or $0.06 per share, a decrease from the previous year's $4.0 million, or $0.12 per share. Non-GAAP Adjusted Net Income was $4.3 million, or $0.14 per share, a decrease from $6.4 million, or $0.19 per share. Non-GAAP Adjusted EBITDA was $7.3 million, a decrease from $9.8 million in the same quarter last year.

Commentary from CEO

"We remain the trusted provider of choice for commercial and government clients in the circular economy and continue to deliver outstanding value for our customers. We look to capitalize on our strong buyer base and business pipeline across our business to deliver improved growth and profitability in our fiscal second quarter, said Bill Angrick, Liquidity Services, CEO.

Analysis of Performance

Liquidity Services' performance in the first quarter of fiscal year 2024 reflects a mixed outcome with robust growth in GMV, yet a slight decline in revenue and profitability. The company's strategic acquisitions and investments in technology are poised to enhance its market position and drive future growth. The challenges faced in the RSCG and CAG segments are expected to be temporary, with management anticipating a recovery in the coming quarters.

The company's focus on expanding its market share and the acquisition of Sierra Auction underscore its commitment to long-term growth strategies. The attention garnered by RSCG's AllSurplus Deals location from major media outlets also highlights the company's growing influence in the retail returns and overstock goods market.

For value investors and potential GuruFocus.com members, Liquidity Services Inc's strong cash position, absence of financial debt, and strategic initiatives to enhance its platform and services present a company with solid fundamentals and potential for future growth.

For further details and insights, investors are encouraged to review the full earnings report and consider the company's prospects in light of the current financial results and strategic direction.

Contact information for investor relations at Liquidity Services Inc is available for those seeking more in-depth analysis and information.

Explore the complete 8-K earnings release (here) from Liquidity Services Inc for further details.

This article first appeared on GuruFocus.