Lithia (LAD) Q4 Earnings Surpass Estimates, Decrease Y/Y

Lithia Motors LAD reported fourth-quarter 2023 adjusted earnings of $8.24 per share, which declined from the prior-year quarter’s $9.05 but beat the Zacks Consensus Estimate of $8.11.

Total revenues jumped 10% year over year to $7.74 billion. The top line outpaced the Zacks Consensus Estimate of $7.67 billion.

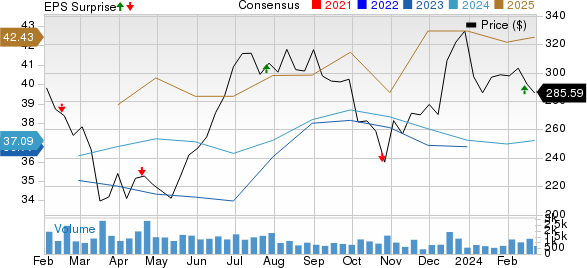

Lithia Motors, Inc. Price, Consensus and EPS Surprise

Lithia Motors, Inc. price-consensus-eps-surprise-chart | Lithia Motors, Inc. Quote

Segmental Performance

New vehicle retail revenues increased 21.4% year over year to $3.97 billion, surpassing our estimate of $3.79 billion due to an increase in the number of units sold.

New vehicle units sold rose 18.2% from the prior-year quarter’s levels to 80,596 units, beating our estimate of 79,527 units.

The average selling price (ASP) of new-vehicle retail increased to $49,318 from $48,051 reported in the prior-year quarter, surpassing our estimate of $47,682. However, the gross margin in this segment contracted 320 basis points (bps) to 7.9% amid the high cost of sales, which flared up 25.8% year over year to $3.7 billion and beat our projection of $3.39 billion.

Used-vehicle retail revenues rose 1.8% year over year to $2.27 billion but missed our estimate of $2.34 billion. Lower-than-anticipated number of units sold resulted in the underperformance.

The used-vehicle retail units sold rose 3.4% from the year-ago quarter to 78,424 units, lagging our expectation of 82,195 units. The ASP of used-vehicle retail was $28,913, dropping 1.6% year over year but outpacing our projection of $28,440.8. The gross margin in the segment declined 50 bps to 6.8%.

Revenues from used-vehicle wholesale fell 17.3% to $242.9 million and missed our estimate of $370.5 million.

Revenues from service, body and parts were up 14.3% from the prior-year period’s levels to $818.3 million, outpacing our estimate of $756.4 million. The gross margin in the segment increased 110 bps to 55%.

The company’s finance and insurance revenues rose 7.5% to $331.5 million and exceeded our estimate of $300.7 million.

Revenues from fleet and others were $39.4 million, which plunged 68.5% year over year and missed our expectation of $98 million.

Same-store new-vehicle revenues increased 10.1% year over year and same-store used-vehicle retail sales declined 10.8%.

The same-store revenues from finance and insurance rose 1.5%, while that of the service, body and parts unit grew 2.7%.

Financial Tidbits

Cost of sales jumped 11.8% year over year in fourth-quarter 2023. SG&A expenses were $836.8 million, up 11.1% from $753.4 million in the year-ago quarter. Adjusted SG&A as a percentage of gross profit was 65.2%. Pretax and net profit margins declined from the year-ago levels.

The company approved a dividend of 50 cents per share, to be paid on Mar 22, 2024, to shareholders of record as of Mar 9, 2024. The company repurchased more than 142,700 shares at an average price of $240.81. As of Dec 31, 2023, Lithia had approximately $467 million shares remaining under its buyback authorization.

Lithia had cash/cash equivalents/restricted cash of $941.4 million as of Dec 31, 2023, up from $246.7 million as of Dec 31, 2022. Long-term debt was $5.5 billion as of Dec 31, 2023, up from $5.1 billion as of Dec 31, 2022.

Zacks Rank & Key Picks

LAD currently carries a Zacks Rank #3 (Hold).

Some better-ranked players in the auto space are Modine Manufacturing Company MOD, General Motors Company GM and Oshkosh Corporation OSK. MOD & GM sport a Zacks Rank #1 (Strong Buy) each, while OSK carries a Zacks Rank #2 (Buy) at present. You can see the complete list of today’s Zacks #1 Rank stocks here.

The Zacks Consensus Estimate for MOD’s 2024 sales and earnings indicates growth of 4% and 67.2%, respectively, year over year. The EPS estimates for 2024 and 2025 have improved 22 cents each in the past 30 days.

The Zacks Consensus Estimate for GM’s 2024 sales and earnings implies growth of 1.8% and 17.2%, respectively, year over year. The EPS estimates for 2024 and 2025 have improved $1.27 and $1.70, respectively, in the past 30 days.

The Zacks Consensus Estimate for OSK’s 2024 sales and earnings indicates growth of 6.7% and 4%, respectively, year over year. The EPS estimates for 2024 and 2025 have improved 8 cents and 30 cents, respectively, in the past 30 days.

Want the latest recommendations from Zacks Investment Research? Today, you can download 7 Best Stocks for the Next 30 Days. Click to get this free report

General Motors Company (GM) : Free Stock Analysis Report

Lithia Motors, Inc. (LAD) : Free Stock Analysis Report

Oshkosh Corporation (OSK) : Free Stock Analysis Report

Modine Manufacturing Company (MOD) : Free Stock Analysis Report