Lithia Motors Inc (LAD) Reports Record Q4 Revenue Amidst Earnings Dip

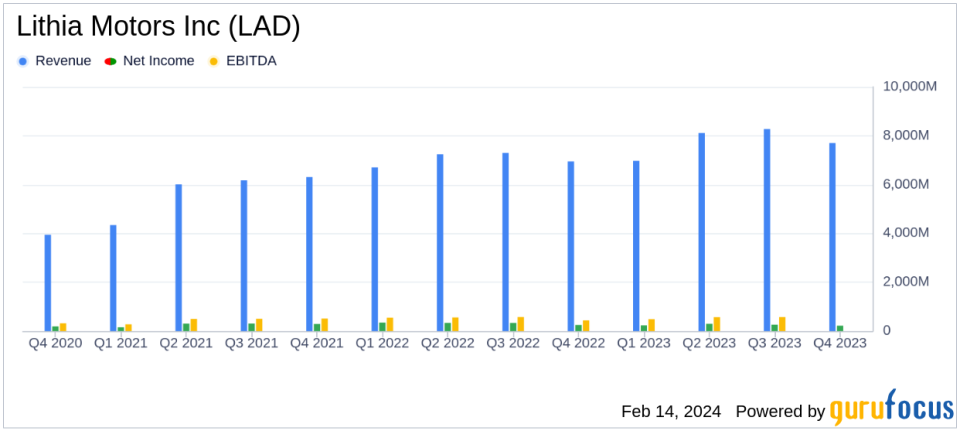

Revenue Growth: Record fourth-quarter revenue of $7.7 billion, a 10% increase year-over-year.

Net Income: Fourth-quarter net income decreased by 13% to $216 million year-over-year.

Earnings Per Share: Q4 diluted EPS fell by 14% to $7.74, with adjusted EPS down 9% at $8.24.

Dividend: Announced a dividend of $0.50 per share for Q4 2023.

Strategic Expansion: No new acquisitions in Q4, but over $3.8 billion in annualized revenues acquired year-to-date.

Liquidity: Approximately $1.7 billion in cash and credit availability, with potential additional liquidity from unfinanced real estate.

Share Repurchases: Over 142,700 shares repurchased in Q4 at an average price of $240.81.

Lithia Motors Inc (NYSE:LAD) released its 8-K filing on February 14, 2024, announcing a record-breaking fourth quarter with a 10% increase in revenue to $7.7 billion compared to the same period last year. Despite the revenue surge, the company experienced a decline in net income and earnings per share (EPS). The diluted EPS for Q4 2023 was $7.74, a 14% decrease from the $9.00 reported in Q4 2022. Adjusted for non-core items, the EPS stood at $8.24, marking a 9% decrease year-over-year.

Lithia Motors, a leading automotive retailer, operates approximately 350 stores globally and has recently expanded into the UK market. The company's strategy focuses on growth through acquisitions and diversification of services. Despite the record revenue, Lithia Motors faced challenges, including a decrease in net income attributable to LAD, which fell by 20% to $1.0 billion for the full year of 2023. This decline is significant as net income is a critical measure of a company's profitability.

Financial Performance and Challenges

The company's financial achievements in 2023 include a 10% increase in full-year revenue, reaching $31.0 billion. However, the full-year net income and adjusted net income both saw significant decreases of 20% and 19%, respectively. These declines are attributed to various non-core charges, including investment losses and acquisition expenses. The challenges faced by Lithia Motors, such as the decrease in total vehicle gross profit per unit and the decline in F&I per unit, may lead to problems if not addressed, as they directly impact the company's bottom line and competitive positioning in the Vehicles & Parts industry.

Key Financial Metrics

Important metrics from Lithia Motors' financial statements include a 14% increase in service, body, and parts revenues, and a 66.4% SG&A as a percentage of gross profit, which adjusts to 65.2% when excluding non-core items. These metrics are crucial as they reflect the company's efficiency and profitability. The SG&A ratio, in particular, is an indicator of how well the company manages its overhead costs in relation to its gross profit.

"2023 completes another successful year of tremendous growth and building strategic diversification. My team and I are excited to turn our efforts to even higher levels of execution in 2024, as we now have all the key components of our long-term growth strategy in place," said Bryan DeBoer, President and CEO.

DeBoer's commentary underscores the company's focus on strategic growth and operational execution. Despite the mixed financial results, Lithia Motors remains committed to its long-term strategy and shareholder value creation.

Analysis and Outlook

Lithia Motors' record revenue in Q4 2023 demonstrates the company's robust sales performance and market presence. However, the decline in earnings highlights the challenges of margin compression and increased expenses, which are areas that require strategic attention. The automotive industry is highly competitive, and Lithia Motors' ability to maintain profitability while expanding its footprint will be critical for its future success.

For value investors, Lithia Motors' strategic acquisitions and diversified revenue streams present opportunities, but the earnings decline may warrant a cautious approach. The company's balance sheet strength, with significant cash and credit availability, provides a solid foundation for future growth and resilience in a dynamic industry landscape.

For more detailed insights and analysis, visit GuruFocus.com to stay informed on Lithia Motors Inc (NYSE:LAD) and other investment opportunities.

Explore the complete 8-K earnings release (here) from Lithia Motors Inc for further details.

This article first appeared on GuruFocus.