Lithia (NYSE:LAD) Misses Q4 Sales Targets

Automotive retailer Lithia Motors (NYSE:LAD) missed analysts' expectations in Q4 FY2023, with revenue up 9.8% year on year to $7.67 billion. It made a non-GAAP profit of $8.24 per share, down from its profit of $9.05 per share in the same quarter last year.

Is now the time to buy Lithia? Find out by accessing our full research report, it's free.

Lithia (LAD) Q4 FY2023 Highlights:

Revenue: $7.67 billion vs analyst estimates of $7.95 billion (3.5% miss)

EPS (non-GAAP): $8.24 vs analyst estimates of $8.22 (small beat)

Free Cash Flow was -$361.7 million compared to -$185.9 million in the same quarter last year

Gross Margin (GAAP): 16.4%, down from 17.9% in the same quarter last year

Same-Store Sales were down 2% year on year

Market Capitalization: $8.21 billion

"2023 completes another successful year of tremendous growth and building strategic diversification. My team and I are excited to turn our efforts to even higher levels of execution in 2024, as we now have all the key components of our long-term growth strategy in place," said Bryan DeBoer, President and CEO.

With a strong presence in the Western US, Lithia Motors (NYSE:LAD) sells a wide range of vehicles, including new and used cars, trucks, SUVs, and luxury vehicles from various manufacturers.

Vehicle Retailer

Buying a vehicle is a big decision and usually the second-largest purchase behind a home for many people, so retailers that sell new and used cars try to offer selection, convenience, and customer service to shoppers. While there is online competition, especially for research and discovery, the vehicle sales market is still very fragmented and localized given the magnitude of the purchase and the logistical costs associated with moving cars over long distances. At the end of the day, a large swath of the population relies on cars to get from point A to point B, and vehicle sellers are acutely aware of this need.

Sales Growth

Lithia is one of the larger companies in the consumer retail industry and benefits from economies of scale, enabling it to gain more leverage on fixed costs and offer consumers lower prices.

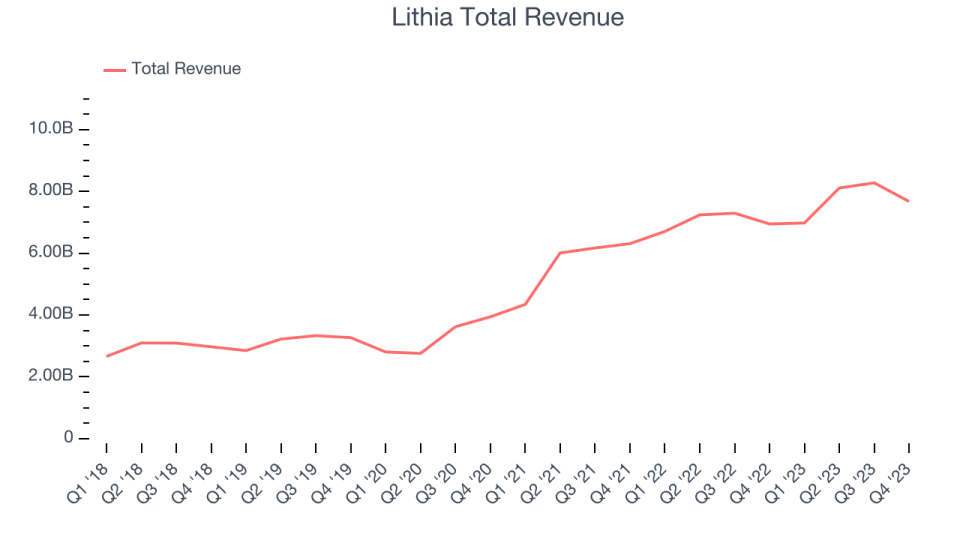

As you can see below, the company's annualized revenue growth rate of 25.1% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was incredible .

This quarter, Lithia's revenue grew 9.8% year on year to $7.67 billion, missing Wall Street's expectations. Looking ahead, Wall Street expects sales to grow 17.8% over the next 12 months, an acceleration from this quarter.

Today’s young investors likely haven’t read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Same-Store Sales

A company's same-store sales growth shows the year-on-year change in sales for its brick-and-mortar stores that have been open for at least a year, give or take, and e-commerce platform. This is a key performance indicator for retailers because it measures organic growth and demand.

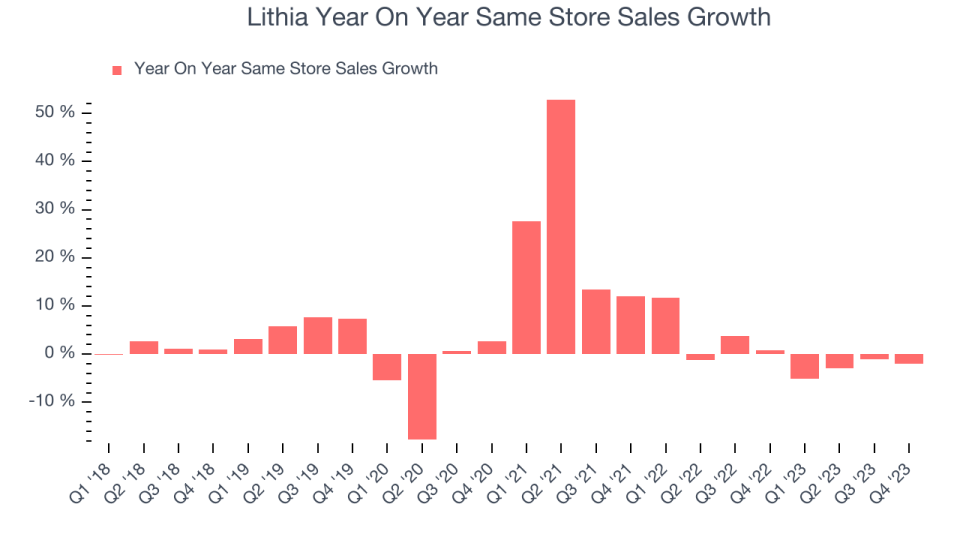

Lithia's demand within its existing stores has barely increased over the last eight quarters. On average, the company's same-store sales growth has been flat.

In the latest quarter, Lithia's same-store sales fell 2% year on year. This decline was a reversal from the 0.8% year-on-year increase it posted 12 months ago. We'll be keeping a close eye on the company to see if this turns into a longer-term trend.

Key Takeaways from Lithia's Q4 Results

It was good to see Lithia beat analysts' gross margin expectations this quarter. That stood out as a positive in these results. On the other hand, its revenue unfortunately missed analysts' expectations and same store sales fell. Overall, this was a mediocre quarter for Lithia. The company is down 1.2% on the results and currently trades at $295.35 per share.

Lithia may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.