Lithia (NYSE:LAD) Q3: Beats On Revenue

Automotive retailer Lithia Motors (NYSE:LAD) announced better-than-expected results in Q3 FY2023, with revenue up 13.5% year on year to $8.28 billion. Turning to EPS, Lithia made a non-GAAP profit of $9.25 per share, down from its profit of $11.08 per share in the same quarter last year.

Is now the time to buy Lithia? Find out by accessing our full research report, it's free.

Lithia (LAD) Q3 FY2023 Highlights:

Revenue: $8.28 billion vs analyst estimates of $8.17 billion (1.3% beat)

EPS (non-GAAP): $9.25 vs analyst expectations of $10.07 (8.15% miss)

Free Cash Flow of $54.9 million is up from -$328 million in the same quarter last year

Gross Margin (GAAP): 16.6%, down from 18% in the same quarter last year

Same-Store Sales were down 1.1% year on year (beat vs. expectations of down roughly 3% year on year)

"We continued to make steady progress executing our plan in the third quarter. Our omni-channel solution provides a set of affordable and convenient options for our customers. The experience is convenient, affordable and transparent. This also helped drive the growth of our complementary adjacencies," said Bryan DeBoer, Lithia & Driveway, President and CEO.

With a strong presence in the Western US, Lithia Motors (NYSE:LAD) sells a wide range of vehicles, including new and used cars, trucks, SUVs, and luxury vehicles from various manufacturers.

Vehicle Retailer

Buying a vehicle is a big decision and usually the second-largest purchase behind a home for many people, so retailers that sell new and used cars try to offer selection, convenience, and customer service to shoppers. While there is online competition, especially for research and discovery, the vehicle sales market is still very fragmented and localized given the magnitude of the purchase and the logistical costs associated with moving cars over long distances. At the end of the day, a large swath of the population relies on cars to get from point A to point B, and vehicle sellers are acutely aware of this need.

Sales Growth

Lithia is one of the larger companies in the consumer retail industry and benefits from economies of scale, enabling it to gain more leverage on fixed costs and offer consumers lower prices.

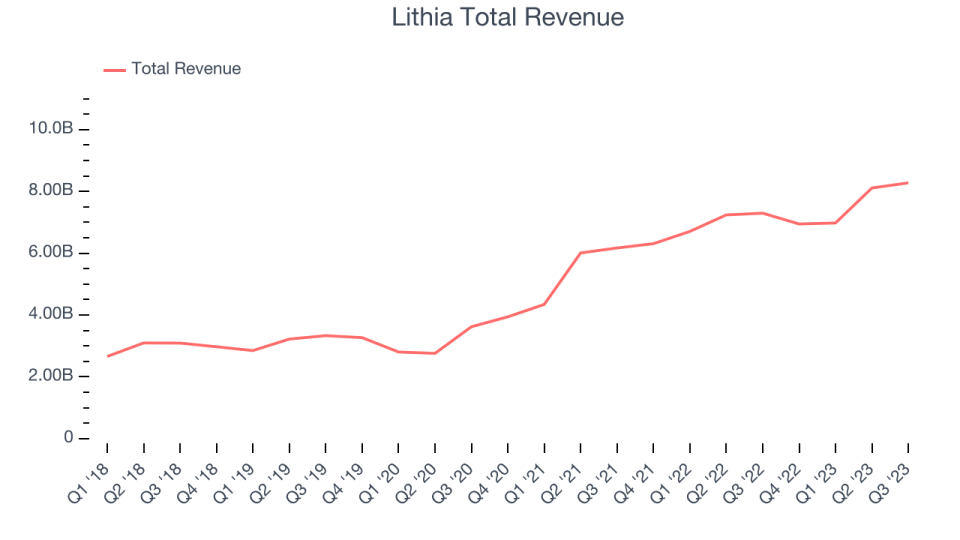

As you can see below, the company's annualized revenue growth rate of 25.1% over the last four years (we compare to 2019 to normalize for COVID-19 impacts) was exceptional .

This quarter, Lithia reported robust year-on-year revenue growth of 13.5% and its revenue of $8.28 billion exceeded analysts' estimates by 1.3%. Looking ahead, the analysts covering the company expect sales to grow 8.11% over the next 12 months.

Our recent pick has been a big winner, and the stock is up more than 2,000% since the IPO a decade ago. If you didn’t buy then, you have another chance today. The business is much less risky now than it was in the years after going public. The company is a clear market leader in a huge, growing $200 billion market. Its $7 billion of revenue only scratches the surface. Its products are mission critical. Virtually no customers ever left the company. You can find it on our platform for free.

Same-Store Sales

Same-store sales growth is a key performance indicator used to measure organic growth and demand for retailers.

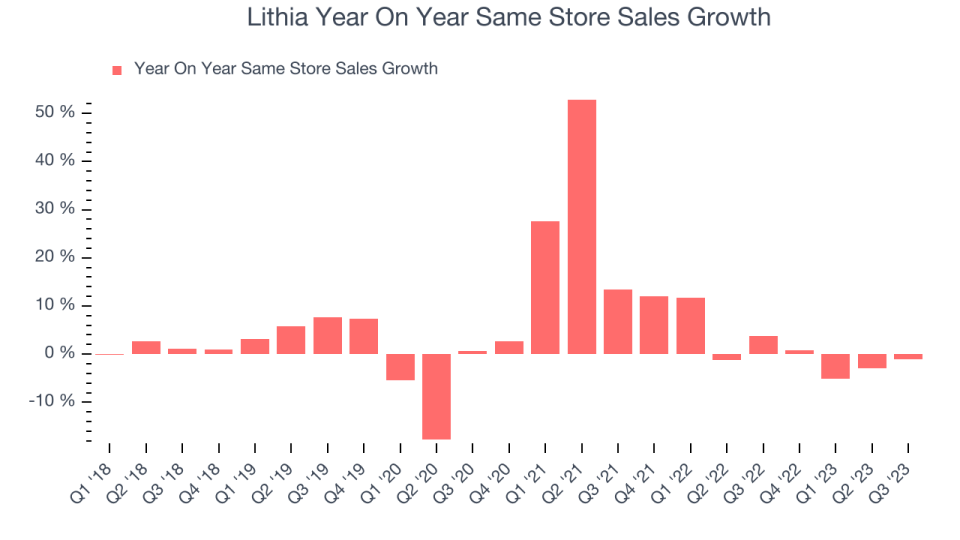

Lithia's demand within its existing stores has been relatively stable over the last eight quarters but fallen behind the broader consumer retail sector. On average, the company's same-store sales have grown by 2.24% year on year.

In the latest quarter, Lithia's same-store sales fell 1.1% year on year. This decline was a reversal from the 3.7% year-on-year increase it posted 12 months ago. A one quarter hiccup isn't material for the long-term prospects of a business, but we'll keep a close eye on the company.

Operating Margin

Operating margin is an important measure of profitability for retailers as it accounts for all expenses keeping the lights on, including wages, rent, advertising, and other administrative costs.

This quarter, Lithia generated an operating profit margin of 5.62%, down 1.6 percentage points year on year. We can infer Lithia was less efficient with its expenses or had lower leverage on its fixed costs because its operating margin decreased more than its gross margin.

Zooming out, Lithia was profitable over the last two years but held back by its large expense base. It's demonstrated mediocre profitability for a consumer retail business, producing an average operating margin of 6.58%. On top of that, Lithia's margin has slightly declined, on average, by 1.8 percentage points year on year. This shows Lithia has faced some speed bumps.

Key Takeaways from Lithia's Q3 Results

With a market capitalization of $6.88 billion, Lithia is among smaller companies, but its more than $256.2 million in cash on hand and near break-even free cash flow margins puts it in a stable financial position.

It was good to see Lithia beat analysts' revenue expectations this quarter on stronger-than-expected same store sales growth. On the other hand, its gross margin missed analysts' expectations, leading to an EPS miss. In the earnings release, the company's CEO mentioned "changing market conditions", which suggests that demand today is perhaps not as strong as recent history. Overall, this was a mixed quarter for Lithia. The company is down 6.48% on the results and currently trades at $233.53 per share.

Lithia may have had a tough quarter, but does that actually create an opportunity to invest right now? When making that decision, it's important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it's free.

One way to find opportunities in the market is to watch for generational shifts in the economy. Almost every company is slowly finding itself becoming a technology company and facing cybersecurity risks and as a result, the demand for cloud-native cybersecurity is skyrocketing. This company is leading a massive technological shift in the industry and with revenue growth of 50% year on year and best-in-class SaaS metrics it should definitely be on your radar.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.

The author has no position in any of the stocks mentioned in this report.