LivaNova PLC (LIVN) Posts Double-Digit Revenue Growth in Q4 and Full-Year 2023

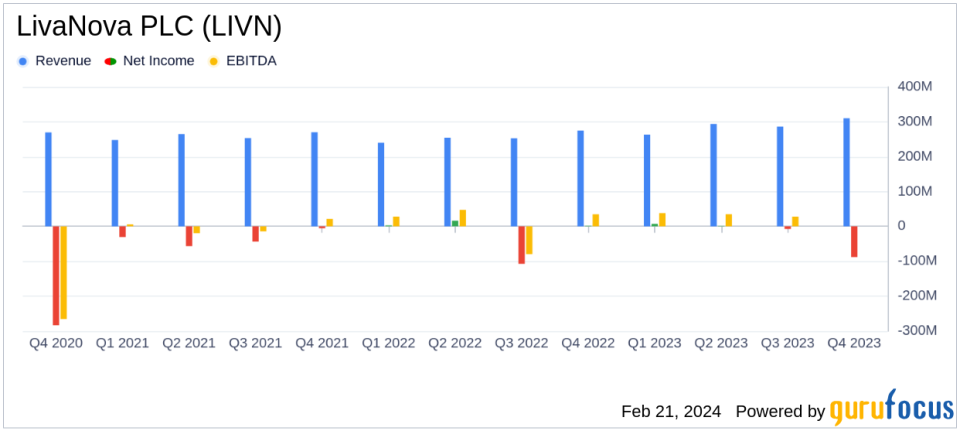

Quarterly Revenue: Q4 revenue rose to $310.1 million, a 12.8% increase year-over-year.

Annual Revenue: Full-year revenue reached $1.15 billion, marking a 12.9% growth from the previous year.

Earnings Per Share: Q4 adjusted diluted EPS was $0.87, up from $0.81 in the prior-year period.

Annual Earnings Per Share: Full-year adjusted diluted EPS increased to $2.80 from $2.39 year-over-year.

Strategic Shifts: LivaNova plans to wind down the Advanced Circulatory Support segment to focus on core segments.

Leadership Transition: Vladimir A. Makatsaria appointed as CEO effective March 1, 2024.

2024 Guidance: Revenue growth projected between 4 and 5 percent on a constant-currency basis, excluding ACS segment wind down.

On February 21, 2024, LivaNova PLC (NASDAQ:LIVN), a leader in medical technology, announced its financial results for the fourth quarter and full year ended December 31, 2023. The company unveiled a significant uptick in revenue and earnings per share, underscoring its robust performance in the medical devices and instruments industry. LivaNova's 8-K filing details these financial achievements and outlines the company's strategic direction for the coming year.

Company Overview

U.K.-based LivaNova PLC was formed from the merger of Cyberonics in the U.S. and Sorin in Italy, focusing on cardiovascular and cardiopulmonary solutions, as well as neuromodulation devices. The company has since divested its cardiac rhythm management and heart valve businesses to sharpen its strategic focus. With approximately half of its revenue generated from the U.S. market, another 21% from Europe, and the rest from various global markets, LivaNova is a significant player in the medical technology landscape.

Financial Performance and Strategic Developments

LivaNova's revenue for the fourth quarter stood at $310.1 million, a 12.8% increase on a reported basis and an 11.9% increase on a constant-currency basis compared to the same period in the previous year. The full-year revenue saw a similar trend, with a 12.9% increase on a reported basis and a 13.3% increase on a constant-currency basis, totaling $1.15 billion. This growth was driven by strong sales across all regions, particularly in the Cardiopulmonary and Neuromodulation segments.

Adjusted operating income for the fourth quarter was $48.0 million, up from $46.8 million in the prior-year period. For the full year, adjusted operating income rose to $169.3 million from $145.1 million in 2022. The company also reported a significant improvement in adjusted diluted earnings per share, with a 17% increase year-over-year.

Bill Kozy, Interim CEO and Board Chair, commented on the company's performance, stating,

We delivered strong revenue growth in both the fourth quarter and full year. Our 2023 performance reflects double-digit revenue growth across all regions, an improvement in adjusted operating margin and a 17% increase in adjusted diluted earnings per share."

Kozy also expressed confidence in the incoming CEO, Vladimir A. Makatsaria, to continue building on these results.

In January 2024, LivaNova initiated a wind down of the Advanced Circulatory Support segment to concentrate on its core business areas. This strategic move is expected to positively impact adjusted operating income in 2024.

Looking Ahead to 2024

For the full year 2024, LivaNova anticipates revenue growth between 4 and 5 percent on a constant-currency basis, excluding the impact of the ACS segment wind down. Adjusted diluted earnings per share are expected to range between $2.95 and $3.05. The company also estimates adjusted free cash flow to be between $95 and $115 million.

LivaNova's financial strength and strategic focus position it well for continued success in the medical technology industry. The company's commitment to innovation and patient care, combined with sound financial management, make it a noteworthy entity for value investors and stakeholders alike.

For more detailed information on LivaNova's financial results and future outlook, interested parties can access the live audiocast of the company's conference call on their website.

Explore the complete 8-K earnings release (here) from LivaNova PLC for further details.

This article first appeared on GuruFocus.