Today's news: TSX rises almost 300 points, U.S. stock markets also rally

Today’s top headlines

Trudeau calls on major grocers to create plan to stabilize food prices or face consequences

5:09 p.m.

Prime Minister Justin Trudeau is calling on grocery executives to come up with a plan to stabilize food prices or face consequences.

He says the government will be asking the five largest grocery companies including Loblaw Cos. Ltd., Metro Inc., Empire Co. Ltd., Walmart Inc. and Costco Wholesale Corp. to come up with a plan by Thanksgiving.

“If their plan doesn’t provide real relief for the middle class and people working hard to join it, then we will take further action and we are not ruling anything out including tax measures.”

The Canadian Press

Market close: TSX rises almost 300 points, U.S. stock markets also rally

4:25 p.m.

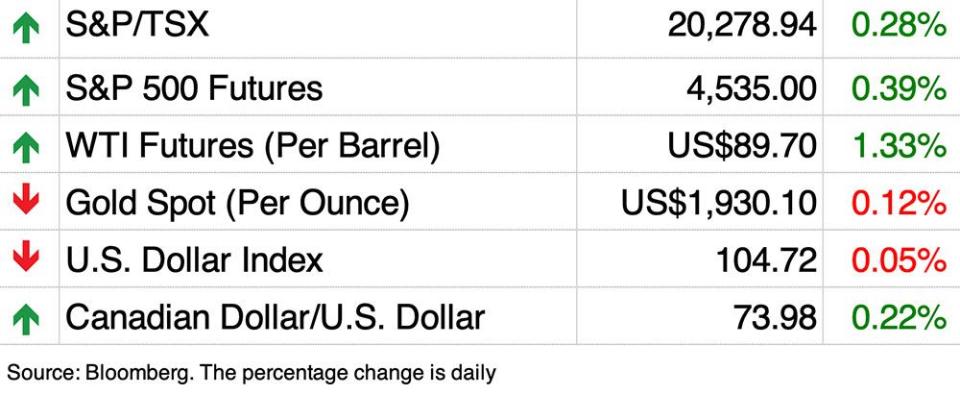

Canada’s main stock index gained almost 30 points on a broad-based rally led by base metal stocks as the price of oil reached US$90 per barrel, while U.S. stock markets also rose.

The S&P/TSX composite index closed up 288.90 points at 20,567.84.

In New York, the Dow Jones industrial average was up 331.58 points at 34,907.11. The S&P 500 index was up 37.66 points at 4,505.10, while the Nasdaq composite was up 112.47 points at 13,926.05.

The Canadian Press

1:36 p.m.

Dye & Durham’s stock plunges on struggling real estate market

Dye & Durham Ltd.’s share price is the latest victim of the slowdown in Canada’s struggling property market, as the real estate software maker’s stock sustained its biggest one-day plunge ever on Thursday.

The Toronto-based company fell as much as 21 per cent, the most on record, after posting a larger-than-expected net loss for its fiscal fourth quarter. The stock slipped below the $1-billion market capitalization threshold, making it one of the smallest companies by value in Canada’s benchmark S&P/TSX Composite Index.

Real estate transactions account for more than half of Dye & Durham’s revenues, and chief executive Matthew Proud said on an earnings call Sept. 13 the company’s goal is to diversify its “exposure to real estate transactions to less than 33 per cent.” Globally, that figure stood at 58 per cent in the most recent quarter, down from 68 per cent in the same period a year earlier.

Home sales in Canada dropped in July after the Bank of Canada resumed raising interest rates. Yet analysts believe the company’s shares and earnings have the potential to recover as real estate transactions pick up.

“We believe the stock is undervalued given DND’s current EBITDA profile during a challenging point in the cycle, and the strong operating leverage we’d anticipate as property transaction volumes start to recover,” BMO Capital Markets analyst Thanos Moschopoulos wrote in a note Sept. 14.

He said Dye & Durham’s EBITDA in the current quarter “might be a touch light.”

Bloomberg.com

12:30 p.m.

Montreal billionaire, accused of paying minors for sex, to sell Future Electronics for $5 billion

Montreal billionaire Robert Miller, who faces a class-action lawsuit alleging he paid underage girls for sex, is selling his company Future Electronics Inc. for more than $5 billion to a Taiwanese semiconductor distributor.

WT Microelectronics Co. says it has signed an agreement to acquire 100 per cent of the company’s shares for more than $5 billion in an all-cash deal expected to close in the first half of 2024.

Future Electronics, which Quebec’s business registry lists as wholly owned by Miller, is a global distributor of electronics components that employs 5,200 workers across 47 countries.

Co-founded by Miller in 1968, the Montreal-based corporation says it generated US$2.9 billion in revenue and US$184 million in profits in the first half of 2023.

A class-action lawsuit against Miller and Future Electronics saw around 30 women come forward this year alleging he gave them money and gifts in exchange for sex when they were underage.

Miller has denied all accusations, which have not been proven in court. In February he stepped down as chairman and CEO of Future Electronics amid the allegations.

The encounters allegedly took place at downtown Montreal hotels and two residences in the wealthy Westmount neighbourhood between 1992 and 2012.

The class-action lawsuit, filed in February by the Consumer Law Group, has yet to be authorized by a judge.

The Canadian Press

12 p.m.

Midday markets: TSX up more than 200 points

Canada’s main stock index is up more than 200 points as strength in base metal stocks helped lead in a broad-based rally and the price of oil reached US$90 per barrel, while U.S. stock markets also pushed higher.

The S&P/TSX composite index was up 216.96 points to 20,495.90 at noon.

In New York, the Dow Jones industrial average was up 269.03 points at 34,844.56. The S&P 500 index was up 32.29 points at 4,499.73, while the Nasdaq composite was up 107.14 points at 13,920.72.

11:34 a.m.

Ottawa to remove GST on new rental builds, source says

Prime Minister Justin Trudeau will announce Sept. 14 that Ottawa is removing the GST on construction of new rental apartment buildings, according to a senior government source.

The source spoke on the condition of anonymity to discuss matters that were not yet public.

The change would lower the cost of labour and materials for homebuilders, and is one of the components of an affordability announcement Trudeau was set to make in the afternoon, the source said.

Finance Minister Chrystia Freeland, Housing Minister Sean Fraser and Industry Minister Francois-Philippe Champagne are also to be at the announcement in London, Ont.

The Canadian Press

10:50 a.m.

Crude surges to $90 for first time in almost a year

U.S. crude oil hit US$90 a barrel for the first time since November, the latest milestone in a surge driven by output cuts from Saudi Arabia and Russia amid record global consumption.

This week, the International Energy Agency warned that continued supply cuts by the two OPEC+ leaders are likely to create a “significant supply shortfall” and threaten further price volatility. That report came a day after OPEC said the market is facing a deficit of more than 3 million barrels a day next quarter, potentially the biggest in more than a decade.

With prices soaring more than 30 per cent since late June, traders are bracing for a potential pullback as technical gauges such as the relative strength index show futures near overbought territory. West Texas Intermediate is now seeing near-term resistance at US$90.04 a barrel, wrote Dennis Kissler, senior vice president for trading at BOK Financial Securities.

Demand in the U.S. and China — the top two consumers — remains robust while OPEC+ leaders Saudi Arabia and Russia constrict supplies.

The rally is a boost to the economies of oil-producing nations, but is raising fresh questions over whether crude prices will derail efforts by central banks across the globe to quash inflation.

10:30 a.m.

Canopy Growth seeks creditor protection for sports drink business BioSteel

Canopy Growth Corp. says it has obtained creditor protection for its BioSteel Sports Nutrition Inc. division and intends to seek permission to sell the business.

The Smiths Falls, Ont., cannabis company says it pursued creditor protection from the Ontario Superior Court of Justice because its sports drink business BioSteel no longer has access to funding.

Canopy described BioSteel as a “significant drag” on its profitability and cash flow, saying about 60 per cent of the company’s adjusted EBITDA loss was attributable to BioSteel.

Canopy says BioSteel having creditor protection will limit its further funding obligations and help the company focus on its core cannabis operations.

The Canadian Press

10 a.m.

Morning trade

Stocks are ticking higher after traders shrugged off data that bolstered the case for the Federal Reserve to keep rates higher for longer.

Earlier futures pared gains when retail sales and producer prices both topped estimates.

The S&P 500 was up 0.5 per cent in early trading. The Dow rose 148 points and the Nasdaq composite added 0.4 per cent. The TSX was up 0.75 per cent or 151 points.

9:15 a.m.

Air Transat soars past expectations

Transat A.T. Inc. reported record net income and adjusted earnings for the third quarter, the first time it has turned a profit since the end of 2019.

Buoyed by strong demand for leisure travel, the airline reported adjusted earnings before interest, taxes, depreciation and amortization of $114.8 million, a nearly 85 per cent jump from 2019 levels. This was well beyond analyst expectations of $68 million.

It also recorded a $746.3 million revenue in the three months ended July 31, almost seven per cent above pre-pandemic levels despite 14 per cent less capacity.

8:15 a.m.

European Central Bank raises rate to all-time high

The European Central Bank has raised interest rates to an all-time high in a bid to cool consumer prices, despite faltering growth in the eurozone.

The ECB’s knife-edge decision to lift its deposit rate for the 10th consecutive time, by 25 basis points to 4 per cent, made at a meeting of its governing council in Frankfurt today, came as officials cut their growth forecasts for the eurozone economy.

The Financial Times

8 a.m.

Grocer Empire’s profit beats expectations

Canadian grocer Empire Co. Ltd. says it earned $261.0 million in its latest quarter, up from $187.5 million in the same quarter last year, boosted by the sale of its 56 gas stations in Western Canada to Shell Canada.

The grocer, which owns Sobeys and Safeway and other banners, says the profit amounted to $1.03 per share for the quarter ended Aug. 5, up from a profit of 71 cents per share a year earlier.

Sales in what was Empire’s first quarter totalled $8.08 billion, up from $7.94 billion in the same quarter last year.

Same-store sales were up 3.0 per cent, while same-store sales, excluding fuel, were up 4.1 per cent.

On an adjusted basis, Empire says it earned 78 cents per share in its latest quarter, up from an adjusted profit of 71 cents per share a year earlier.

The average analyst estimate had been for an adjusted profit of 75 cents per share, based on estimates compiled by financial markets data firm Refinitiv.

The Canadian Press

7:41 a.m.

Laurentian Bank ends review without deal to sell

Laurentian Bank has completed its review of strategic options without a deal to sell the bank.

The Montreal-based bank said Thursday it has decided that its best path forward to drive shareholder value is an accelerated evolution of its current plan with an increased focus on efficiency and simplification.

A strategic review is often seen by investors as a prelude to a sale by a company. However, Laurentian said it will work on simplifying its organizational structure and focusing on allocating capital and resources to its highest grossing businesses and specialized products.

“Having now completed this review of our strategic options, we are more confident than ever in Laurentian Bank’s strong positioning in the market and unique offering for our customers,” Laurentian chief executive Rania Llewellyn said in a statement.

“As we continue to evolve our bank, our executive management team and all employees will build on our proven track record of executing against our plan and delivering meaningful results for our customers, shareholders, and stakeholders.”

Laurentian announced its strategic review in July, prompting speculation the bank could be acquired.

The bank said Thursday it considered a variety of options, including an acquisition of the whole bank, sale of certain businesses, as well as accelerating its current strategic plan.

As part of its path forward, the bank said Eric Provost, currently head of commercial banking, will assume the leadership of personal banking as group head of personal and commercial banking.

Sebastien Belair will also become the bank’s chief administrative officer, assuming responsibility for the bank’s operations in addition to his current role as chief human resources officer.

Laurentian said it will share more information when it reports its fourth-quarter results on Dec. 7 and will unveil a renewed strategic plan at an investor day early in 2024.

The bank has been working through a three-year strategic plan it launched in late 2021 to modernize operations, including with the rollout of its first mobile banking app.

The Canadian Press

7:30 a.m.

Credit card debt in Canada just hit an all-time high

Credit card balances hit an all-time high of $107.4 billion in the second quarter of 2023, in a sign financial stress continued to build in the face of inflation and rising interest rates.

Equifax Canada says total Canadian consumer debt reached $2.4 trillion during the second quarter.

Vice-president of advanced analytics Rebecca Oakes says non-mortgage debt growth was largely due to substantial growth in credit card balances and a notable increase in debt among subprime and deep subprime consumers.

The report by Equifax Canada said average non-mortgage debt per credit-active consumer edged up to $21,131.

Oakes says despite mounting credit card debt, credit card delinquencies aren’t rising as fast as expected, in part because of an influx of new credit card users which also contributed to the growth in overall non-mortgage debt.

The Canadian Press

Before the bell

European stocks are mixed and U.S. futures are steady as investors wait for the European Central Bank’s interest-rate decision.

Markets are now pricing in a two-thirds chance the ECB hikes its rate by 25 basis points, a shift from earlier this month when bets were for a hold.

Oil prices are fanning inflationary fears, with West Texas Intermediate trading near US$89 a barrel and Brent above US$92 this morning, after the International Energy Agency’s prediction yesterday that demand would exceed supply.

What to watch today

Shares of Arm Holdings Plc are due to start trading today on the Nasdaq Global Select Market in the largest listing of the year

On deck for data are Canada’s wholesale trade numbers for July. In the United States, we get the numbers on retail sales, producer price index and business inventories

Earnings: Empire Co, Transat AT, Reitmans Canada, Adobe

Additional reporting by The Canadian Press, Associated Press and Bloomberg