LKQ Corp (LKQ) Reports Solid Organic Growth Amidst Macroeconomic Challenges in Q4 and Full Year 2023

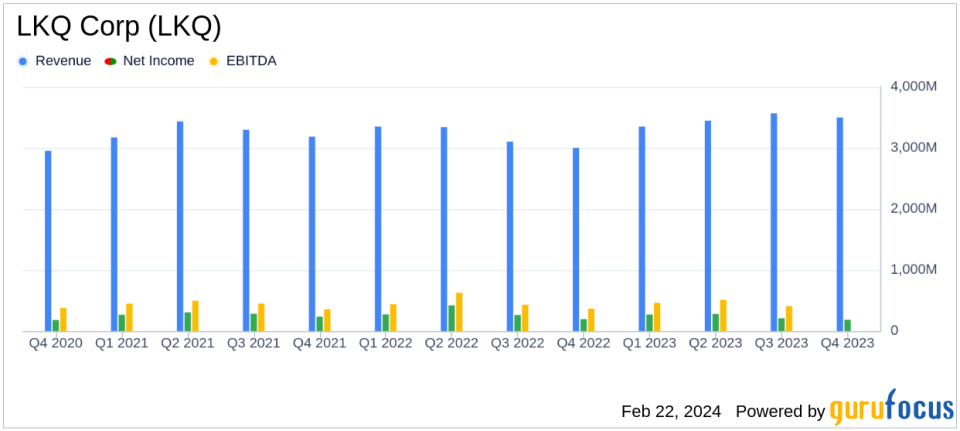

Revenue Growth: Q4 revenue up 16.6% year-over-year; full-year increase of 8.4%.

Organic Growth: Parts and services organic revenue grew 2.8% in Q4 and 4.7% annually.

Earnings Per Share: Q4 diluted EPS at $0.69; adjusted diluted EPS at $0.84.

Annual Performance: Full-year diluted EPS down 14.6%; adjusted diluted EPS nearly steady with a slight 0.5% decrease.

Cash Flow: Operating cash flow reached $1.4 billion; free cash flow at $1.0 billion for the year.

Dividend: Board approves $0.30 per share to be paid in Q1 2024.

2024 Outlook: Management anticipates organic revenue growth and margin enhancements.

On February 22, 2024, LKQ Corp (NASDAQ:LKQ), a global distributor of non-OEM automotive parts, released its 8-K filing, announcing financial results for the fourth quarter and full year of 2023. The company, known for its extensive network of facilities and its ability to provide a broad range of products and services, faced a challenging macroeconomic environment, including persistent inflation and declining commodity prices. Despite these headwinds, LKQ reported significant revenue growth and solid organic growth in parts and services.

Financial Performance Highlights

LKQ's revenue for Q4 2023 reached $3.5 billion, marking a 16.6% increase from the same period in 2022. The full-year revenue stood at $13.9 billion, an 8.4% rise compared to the previous year. The parts and services sector saw organic growth of 2.8% in Q4 and 4.7% for the year. However, other revenue streams experienced a decline, primarily due to weaker commodity prices.

Net income for Q4 was $184 million, a slight decrease from $193 million in the prior year. The diluted earnings per share (EPS) for the quarter was $0.69, down from $0.72 in Q4 2022. Adjusted net income, however, increased by 7.9% to $226 million, with adjusted diluted EPS rising by 8.0% to $0.84.

For the full year, net income decreased by 14.6% to $0.94 billion, with diluted EPS falling to $3.51 from $4.11 in 2022. Adjusted figures showed a more stable picture, with a slight decrease of 4.0% in net income and a marginal 0.5% dip in adjusted diluted EPS.

Operational and Strategic Developments

LKQ's cash flow remained robust, with $1.4 billion from operations and $1.0 billion in free cash flow. The company's balance sheet showed total debt of $4.3 billion, with leverage at 2.3x EBITDA. LKQ continued its stock repurchase program, investing $35 million to buy back 0.8 million shares over the year.

The company also declared a quarterly cash dividend of $0.30 per share, reinforcing its commitment to shareholder returns. Strategic moves included the sale of GSF Car Parts Limited and the ongoing integration of Uni-Select, with significant synergy savings expected.

Looking ahead to 2024, LKQ's management anticipates organic revenue growth across all operating segments and aims to enhance margins, including a return to double-digit Europe Segment EBITDA margins.

Value Investor Considerations

For value investors, LKQ's ability to generate strong cash flow and maintain a disciplined approach to capital allocation, despite market fluctuations, is noteworthy. The company's focus on operational excellence and margin improvement initiatives, coupled with a positive outlook for 2024, may present a compelling case for long-term investment potential.

As LKQ navigates the evolving automotive parts landscape, its strategic divestitures and acquisitions, along with its commitment to returning value to shareholders through dividends and share repurchases, underscore its resilience and adaptability in a competitive industry.

Investors are encouraged to review LKQ's full earnings report and consider the company's performance in the context of their investment strategies. LKQ's solid foundation and strategic vision suggest it is well-positioned to continue delivering value in the dynamic automotive parts sector.

Explore the complete 8-K earnings release (here) from LKQ Corp for further details.

This article first appeared on GuruFocus.