‘Load Up,’ Says Raymond James About These 2 ‘Strong Buy’ Stocks

As summer travel remains solid and consumer spending appears robust, plenty of analysts now believe a recession will not materialize. However, that is not the view of Raymond James’ CIO, Larry Adam. Adam is of the mind that a recession is all but inevitable and will kick off by this year’s fourth quarter.

That said, the good news is that it will be a mild recession, one where the U.S. economy will shrink in a far less acute manner than during other recessions (0.6% vs. the average 2.5%), won’t last as long (6 months vs. the usual 10 months), and during which only 500,000 jobs will be lost compared to the 3.5 million jobs typically shed during a recession. “In fact,” Adam goes on to say, “this will likely be the second mildest recession we’ve seen in the post-World War II era.”

As for the markets, Adam sees S&P 500 earnings falling by just 1%, far below the typical 25% drop observed in a normal recession. And that is why he also does not foresee a big decline in equity prices. “The bottom line is that while we do expect a mild recession to unfold, that does not deter us from our more favorable outlook for both the equity and fixed income market,” Adam summed up.

For investors, of course, the main question remains: which equities are best positioned to thrive against this backdrop? Raymond James analysts have an idea about that and have tagged two names as ‘Strong Buys’ right now. And they are not alone, according to TipRanks’ database, both are also rated as ‘Strong Buy’s by the analyst consensus. Let’s see why they are drawing plaudits across the board.

Coastal Financial Corp (CCB)

The first Raymond James-endorsed name takes us to the banking sector, where we find Coastal Financial, a bank holding company headquartered in Everett, Washington.

The company offers conventional lending and deposit services to both businesses and individuals through its subsidiary, Coastal Community Bank. Additionally, Coastal Financial provides Banking-as-a-Service (BaaS) to digital financial services companies and broker dealers through its CCBX segment. With assets totaling over $3.5 billion, Coastal Financial operates 14 branches throughout the greater Seattle-MSA region, making these services readily available. The company proudly touts its credentials as the largest community bank based on deposit market share.

In the recently reported Q2 earnings, Coastal Financial demonstrated sequential deposit growth, increasing by $67.3 million, or 2.2% compared to 1Q23. Moreover, the company showcased substantial top-line growth, with revenues soaring by 85% from the same quarter last year, reaching $120.95 million. However, the figure missed Street estimates by $3.11 million. On the bottom-line, Coastal Financial’s EPS rose from $0.76 to $0.95 year-over-year, but it fell slightly short of the $0.97 forecast. It’s a rare instance of the bottom-line figure falling short, given Coastal almost always posts beats on the profitability end.

In any case, those figures are of little concern to Raymond James analyst David Feaster, who points out to investors why this community bank represents a solid play in the current environment.

“We see 2Q results as continuing to demonstrate the growth potential and accelerating earnings power of CCB. As such, given the strong growth outlook with defensive characteristics ahead of a potential credit cycle, we view the risk/reward favorably and do not believe current valuation contemplates the meaningful potential earnings power from its BaaS segment (CCBX). As it continues to validate the business model through the cycle, we anticipate significant potential for multiple expansion given its highly profitable business model (+20% ROATCE) with de minimis credit risk,” Feaster opined.

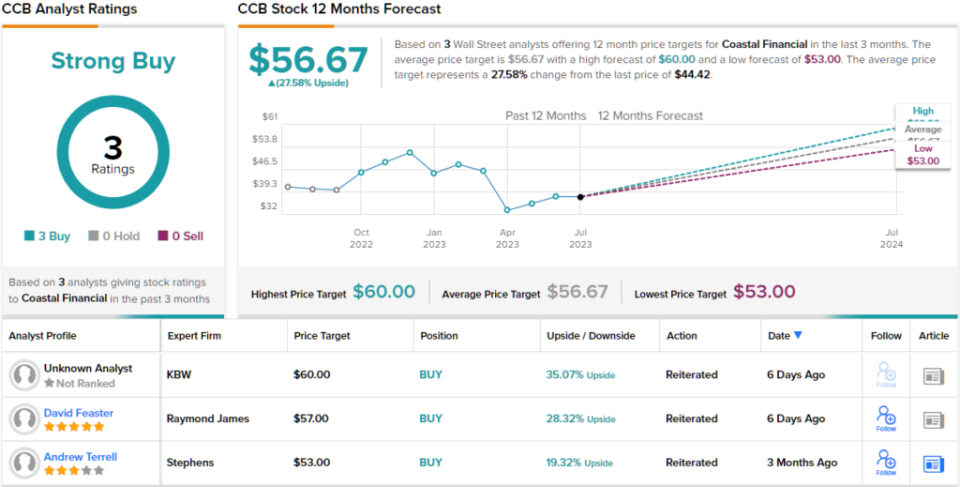

These comments underpin Feaster’s Strong Buy rating and $57 price target on Coastal Financial shares. Should the figure be met, investors will be pocketing returns of 28% a year from now. (To watch Feaster’s track record, click here)

Looking at the consensus breakdown, other analysts are on the same page. With 3 Buys and no Holds or Sells, the word on the Street is that CCB is a Strong Buy. The $56.67 average target is almost identical to Feaster’s objective. (See CCB stock forecast)

ConnectOne Bancorp (CNOB)

We’ll stay in the finance industry for our next Raymond James-endorsed stock. Based in Englewood Cliffs, New Jersey, ConnectOne Bancorp is a $10 billion asset bank that conducts its operations primarily through two subsidiaries: ConnectOne Bank and BoeFly.

ConnectOne Bank caters to small to middle-market businesses, offering a comprehensive range of banking and lending products and services. On the other hand, BoeFly functions as a fintech marketplace, connecting borrowers in the franchise industry with various funding options provided by partner banks.

The bank has seen its net interest margin (NIM) compress in recent times and although that was the case again in the recently reported Q2 print, the company thinks the worst of that is behind now. NIM compressed sequentially by 19 basis points, but bottomed out in April, stabilized and expanded throughout the rest of the quarter.

And while revenue dropped by 14.8% year-over-year to $68.28 million, the figure beat the consensus estimate by $4.28 million. There was a beat at the other end of the scale too, as EPS of $0.51 came in ahead of the $0.48 expected by the analysts.

The company also repurchased 270,000 shares of common stock during the quarter, which means that under the current Board approved repurchase program there are roughly 1.3 million shares left authorized for repurchase.

Scanning the print, Raymond James analyst Daniel Tamayo has an interesting take. While he has now lowered his 2023 EPS estimate by $0.04 to $2.12 and the 2024 forecast by $0.23 to $1.88, there are other reasons why the rating is pushed up, from Market Perform (i.e., Neutral) to Strong Buy.

Explaining his stance, Tamayo writes, “Modest NIM contraction remains as incremental funding pressures materialize while balance sheet growth remains unlikely, ultimately fueling the downward revision to our estimates. However, with NIM compression largely realized, we believe further downward revision to estimates remains unlikely while we forecast liquidity and credit quality remain solid through-the-cycle. Net, we believe shares should close the P/TBV discount to peers and CNOB historically, with potential upside to EPS if rate cuts materialize in 2024.”

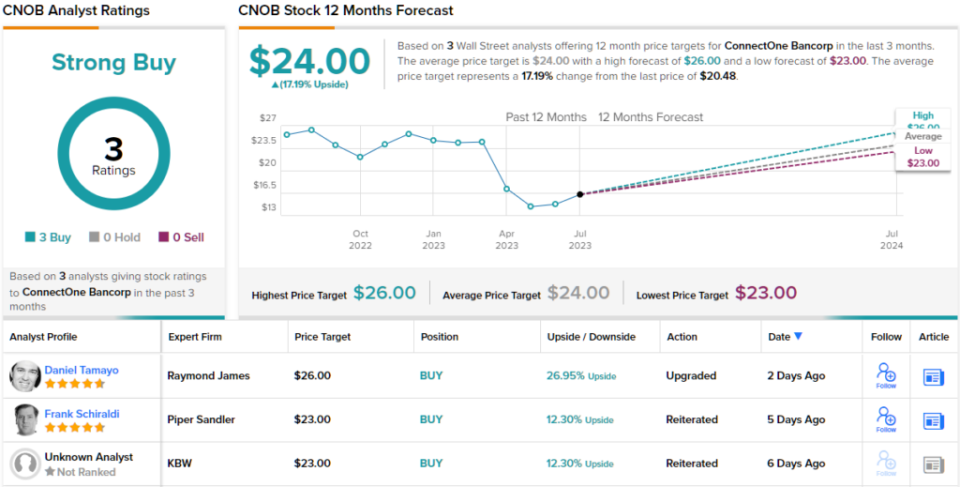

Along with the Strong Buy rating, Tamayo’s $26 price target implies shares will climb ~27% higher over the coming months. (To watch Tamayo’s track record, click here)

Like Tamayo, other analysts also take a bullish approach. CNOB’s Strong Buy consensus rating breaks down into 3 Buys and no Holds or Sells. The stock is selling for $20.48, and its average price target of $24 suggests ~17% gain on the one-year horizon. (See CNOB stock forecast)

To find good ideas for stocks trading at attractive valuations, visit TipRanks’ Best Stocks to Buy, a newly launched tool that unites all of TipRanks’ equity insights.

Disclaimer: The opinions expressed in this article are solely those of the featured analysts. The content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment.