Loaded and Rolling: The plight of the owner-operator

The plight of the owner-operator

The freight recession’s impact on small fleets and owner-operators gained mainstream media attention on Monday with an article by Shannon Pettypiece, a senior policy reporter for NBC News. The article related the story of Arnesha Barron, a 39-year-old driver who in 2021 became an owner-operator after working at a trucking company for six years. Barron’s journey from COVID boom to bust highlights the plight of many drivers who were lured into the pandemic-fueled freight market by sky-high rates.

The article said in 2021 Barron took a loan of $175,000 for a new truck and was part of a flood of new entrants looking to capitalize on record rates, fueled by stories of riches from social media influencers from YouTube to TikTok. When the market turned and trucking capacity outstripped demand, many carriers shut down.

A major reason was revenue no longer kept up with expenses. Pettypiece wrote, “Barron said she went from making $20,000 a month in profits in March 2022 to just over $3,300 a few months later in July after fuel prices surged and demand slowed. That wasn’t enough money to keep up with her family’s expenses back home, which included $2,600 in rent, along with a $1,400-a-month loan payment for her truck. In August, she surrendered her truck to the lender, losing her $4,000 down payment and having to pay a $7,000 penalty for returning the vehicle.”

MIT research evaluates government progress on driver issues

FreightWaves’ Washington correspondent John Gallagher interviewed David Correll, a research scientist and lecturer at the Massachusetts Institute of Technology’s Center for Transportation and Logistics, about his assessment of how Congress is dealing with driver issues. Correll gave testimony before the House Transportation and Infrastructure Committee back in November 2021 from research by MIT that analyzed ELD data to determine on average, American long-haul over-the-road drivers spent an average of 6.5 hours of their 11 hours of available drive time actually driving.

Correll noted in his testimony that the implications from this research suggest that 40% of American truckload capacity is not being utilized and the current situation with trucking is not a driver shortage but an endemic utilization shortage that undervalues drivers’ time.

During the interview with Gallagher, Correll gave his thoughts on various driver initiatives by the Biden administration and the FMCSA. One big challenge Correll highlighted was the lack of public visibility in how shippers and receivers are evaluated. “One of the things I think the government could do that would really help would be to organize information about all the nodes in American supply chains — starting with pickup and delivery points — and give them an A to D health rating similar to what the department of sanitation does with sanitation grades to restaurants,” Correll said.

Market update: LMI June inventory data hits new lows

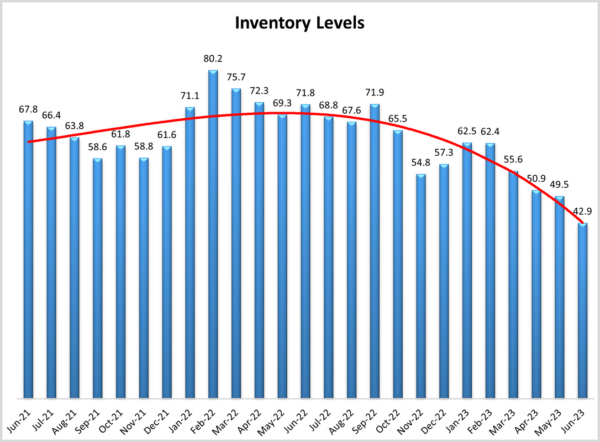

Data released on Wednesday by the Logistics Managers’ Index (LMI) for June indicated further contraction with overall supply chain activity falling in June to 45.6. This is 1.7 points lower than May’s reading of 47.3. Inventory levels led the way, falling 6.5 points to 42.9, the second-fastest decline in the history of the index. Any reading above 50 indicates expansion, while a reading below 50 signals a contraction.

The report said, “Seasonality would suggest that this value should come up soon, but there are some signals that that might not happen. Traditionally we see consumers move from bulkier goods that may require financing (i.e. lawn furniture) in the summer towards smaller goods (i.e. back-to-school items, clothing, and toys) during the back half of the year.”

The concern, according to the report, is that while small goods have continued to move faster throughout the year, there currently does not appear to be a large glut of holiday inventory on the way, based on Chinese manufacturing PMI data that registered a 49 in June. The report added that the resumption of student loan repayments has retailers nervous about restocking, as $430 billion owed by 16 million people will resume before the holiday shopping season.

FreightWaves SONAR spotlight: Average length of haul up 5% year over year

Commentary courtesy of the Daily Watch, a newsletter for SONAR subscribers

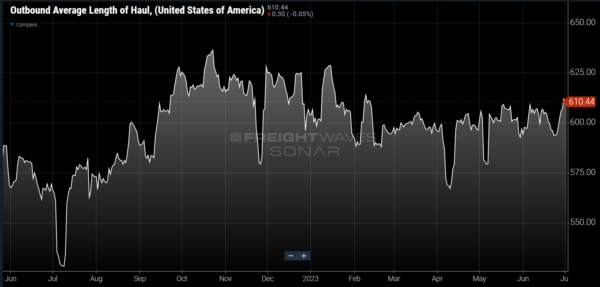

Summary: The average length of haul from FreightWaves’ tender data set is up roughly 5% compared to last summer. One of the driving reasons for this is the drop in short-haul demand in relation to longer-haul freight. Tender volumes for freight moving less than 250 miles have fallen about 20% over the past year while demand for loads moving more than 800 miles has only fallen 6%. Long-haul freight is more closely tied to inventory replenishment, something many retailers have cut back on after a period of over-ordering left their warehouses crammed with more goods than they could sell. Shorter-haul loads are tied to upstream warehouse repositioning that occurs earlier in the order cycle. With short-haul demand slowing at a faster pace than long haul, it could be a sign that inventories are getting back into alignment with company expectations. This has two implications for transportation providers: We could be getting back to more predictable freight patterns and the West Coast could be getting more active this fall.

The Routing Guide: Links from around the web

NHTSA rejects call to make AV test reporting mandatory (FreightWaves)

Benchmark diesel price down again as broader oil market continues decline (FreightWaves)

Knight-Swift lowers Q2 expectations, closes on U.S. Xpress deal (FreightWaves)

No freight market fireworks in 2023 (FreightWaves)

Billions of US trucking hours being spent in unladen trucks every year (The Loadstar)

Women of Trucking Advisory Board makes suggestions for driver recruitment and retention (Land Line)

Like the content? Subscribe to the newsletter here.

The post Loaded and Rolling: The plight of the owner-operator appeared first on FreightWaves.