loanDepot Inc (LDI) Reports Significant Reduction in Annual Net Loss and Strong Liquidity in 2023

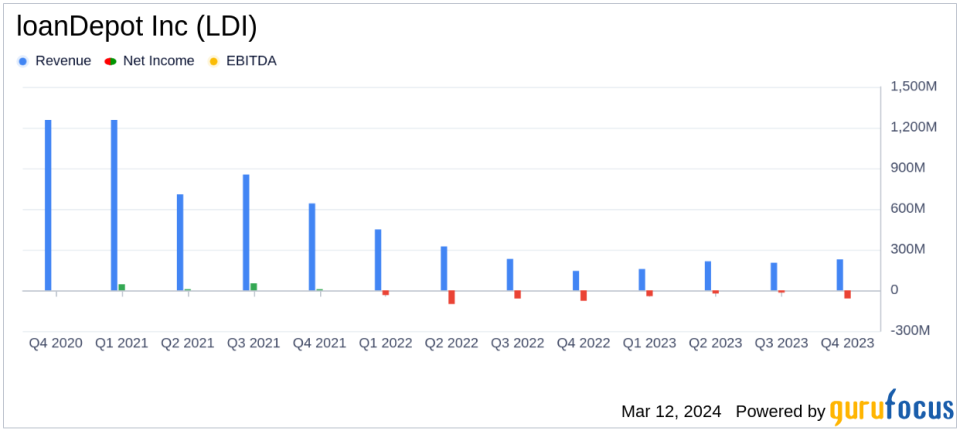

Annual Revenue: Decreased by 22% to $974 million in 2023, primarily due to lower market volume.

Expense Reduction: Total expenses dropped by 36% to $1.25 billion, reflecting cost productivity improvements.

Net Loss: Annual net loss narrowed by 61% to $236 million, showing significant progress in cost restructuring.

Adjusted Net Loss: Improved by 69% to $142 million, indicating effective management of non-operational costs.

Liquidity: Maintained a strong cash balance of $661 million, ensuring robust liquidity.

Q4 Performance: Q4 saw a 35% year-over-year revenue increase to $229 million, with a net loss decrease from $158 million to $60 million.

On March 12, 2024, loanDepot Inc (NYSE:LDI), a leading nonbank consumer lending solutions provider in the United States, released its 8-K filing, announcing its financial results for the fourth quarter and year-end 2023. The company reported a significant reduction in its annual net loss and a strong liquidity position, despite a challenging market environment.

loanDepot Inc provides a range of lending solutions, including personal, residential home, home refinancing, mortgage, and home equity loans. It operates through various distribution channels across the United States and competes with commercial banks and other financial institutions. The company's adherence to governmental laws and regulations is a critical aspect of its operations.

The company's strategic initiatives, dubbed "Vision 2025," have led to productivity improvements that more than offset the revenue decline caused by market-driven factors. This resulted in a 61% reduction in the annual net loss, demonstrating the effectiveness of loanDepot's cost management and operational efficiency.

loanDepot's financial achievements in 2023, particularly the reduction in expenses and the narrowing of net loss, are crucial for the company's sustainability and future growth. These improvements reflect the company's ability to adapt to market conditions and optimize its cost structure, which is particularly important in the competitive banking and financial services industry.

The company's performance metrics, such as the decrease in annual revenue and the reduction in total expenses, are vital indicators of its financial health. loanDepot's management has focused on diversifying revenue streams, such as growing servicing income and HELOC revenue, and improving gain on sale margin, which partially offset the impact of decreased loan volumes.

loanDepot's President and CEO, Frank Martell, commented on the company's progress, stating:

"loanDepot made substantial progress in 2023, significantly resetting its cost structure and making critical investments in our technology platforms and business processes, which we believe position us to capture the benefits of the eventual rebound in mortgage volumes."

Chief Financial Officer David Hayes added:

"During the course of 2023, we reduced our cost structure by $693 million. We expect significant additional benefits from our previously announced $120 million annualized cost reduction program during 2024."

The company's balance sheet highlights include a cash and cash equivalents balance of $660.7 million as of December 31, 2023, a decrease from the previous quarter but still indicative of a strong liquidity profile. Total assets stood at $6.15 billion, with total liabilities at $5.45 billion, and total equity at $704.5 million.

Looking ahead to the first quarter of 2024, loanDepot anticipates origination volume between $3.5 billion and $5.5 billion, with a pull-through weighted gain on sale margin of between 270 and 300 basis points.

loanDepot's focus on automation and productivity, along with its multi-channel origination business and servicing platform, positions the company to potentially benefit from a recovery in the housing and mortgage markets. The company's disciplined approach to cost management and investment in technology and business processes underpin its strategy to become a trusted partner in homeownership.

For more detailed financial information and future updates, investors and interested parties are encouraged to visit loanDepot's Investor Relations website.

loanDepot's commitment to simplifying the complex transaction of homeownership through its lending and real estate services continues to drive its mission of making homeownership more accessible and achievable for all, especially the increasingly diverse communities of first-time homebuyers.

For further inquiries, loanDepot's Investor Relations and Media contacts are available to provide additional information and insights into the company's financial performance and strategic direction.

Explore the complete 8-K earnings release (here) from loanDepot Inc for further details.

This article first appeared on GuruFocus.